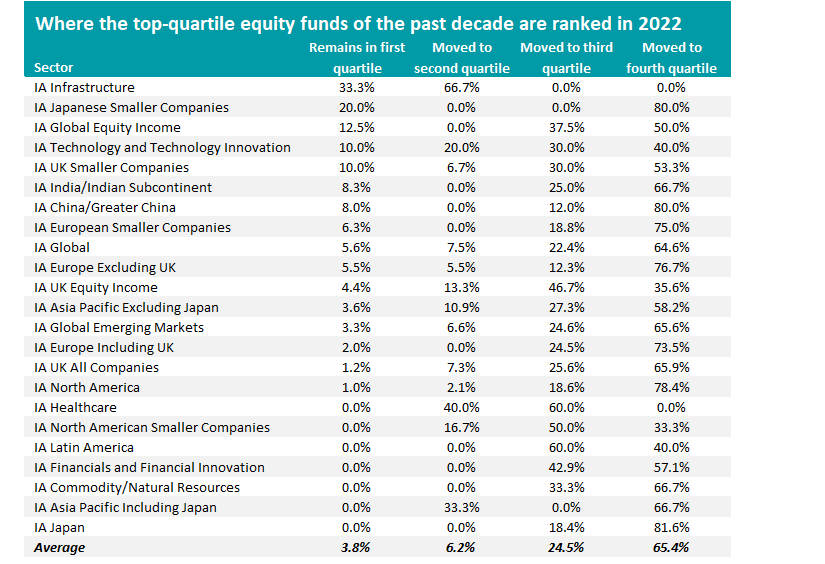

Fewer than 4% of equity funds that topped their sector over the past decade have managed to hold onto that position in 2022’s turbulent opening half, with most falling into the bottom quartile of their peers.

These results from new Trustnet analysis might not come as a surprise, given the challenges that the stock market has endured in 2022. High inflation and rising interest rates, paired with geopolitical and global health concerns, have shaken up the investment landscape and shifted investors’ focus from equities to less risky assets.

Trustnet found out which long-term outperformers the Investment Association’s equity sectors have weathered the perfect storm of 2022 so far. The question was: which of the funds that delivered first-quartile returns over 10 years retained their top position year-to-date?

There are 929 equity funds with a first-quartile ranking over 10 years. Just 35 of these – or 3.8% – remain in the first quartile for 2022; in contrast, 608 – or 65.4% - are currently in the bottom quartile.

But let us start at the bottom of the list and dive into the sectors whose constituent funds fell the most – from first to bottom quartile.

Of the 23 IA equity sectors we looked at, there were five where not one long-term outperformer has been able to stay in the top quartile over 2022 so far.

Source: FE Analytics. Total return in sterling, covering 1 Jan 2012 to 31 Dec 2021 and 1 Jan 2022 to 27 Jul 2022.

Suffering the most were IA Japan, IA Japanese Smaller Companies and IA China/Greater China. Investors in these sectors had a 80% chance that their top funds over 10 years ended up in the bottom quartile year-to-date.

The IA North America, IA Europe Excluding UK, IA European Smaller Companies and IA Europe Including UK sectors also witnessed a significant rotation in the ranking of funds over the two periods examined. IBOSS’ Chris Metcalfe recently told Trustnet why his Europe exposure is at an all-time low.

The Global and the Global Emerging Markets sectors are both very close to the industry average, with 90% of formerly leading funds plunging into the bottom two quartiles this year.

IA UK All Companies scored not too far, with 65.9% hard fallers and 1.2% remainers.

Sinking the hardest were SVM UK Growth, ASI UK Mid Cap Equity and ASI UK Opportunities Equity, which have all fallen more than 30% in 2022.

Conversely, Schroder Recovery and Thesis Stonehage Fleming Opportunities are the only two IA UK All Companies that are top quartile this year and over the past decade.

Performance of top and bottom UK All Companies funds year-to-date against sector

Source: FE Analytics

As we get closer to the podium, the IA Technology and Technology Innovation and IA UK Smaller Companies sectors saw 10% of their long-term top performers stay in the first quartile this year.

In both these sectors, the best performers were Fidelity funds: Fidelity Global Technology and Fidelity UK Smaller Companies, which are both were down more than 8% year-to-date.

Snatching the third position on the podium was the Global Equity Income sector, with 12.5% of funds having in the first quartile over 10 years and year-to-date. Top-contributors were Guinness Global Equity Income and JPM Global Equity Income.

Claiming the silver medal, although 80% of its funds capitulated from first to bottom quartile, is the IA Japanese Smaller Companies sector, where 20% of funds remained clawed to the top.

Given the smallness of the peer group, that’s just one fund: M&G Japan Smaller Companies, which has kept its 2022 losses to just 1.5% compared with double-digit losses from most of its peers.

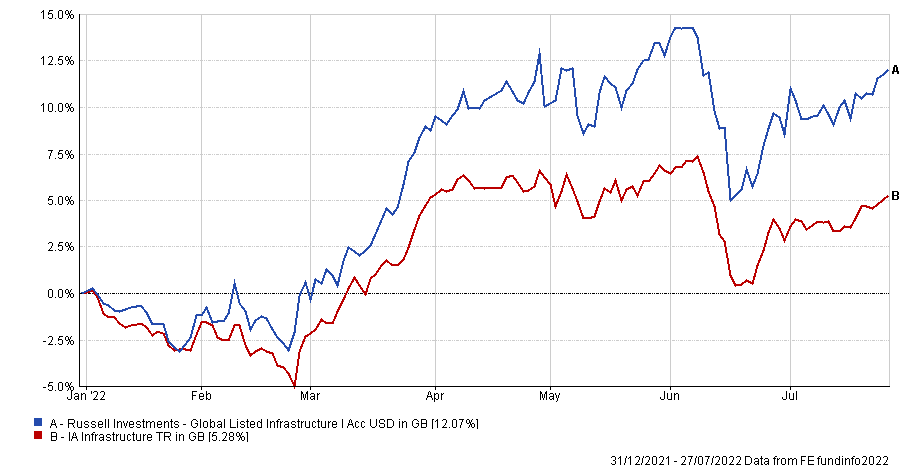

Sitting the top is IA Infrastructure, with 33.3% of long-term winners still in the first quartile and the remaining 66.7% smoothly gliding into the second quartile.

Performance of fund year-to-date against its sector

Source: FE Analytics

Here, Russell Investments Global Listed Infrastructure stood out, distancing its peers by seven percentage points, as shown in the graph above.