Investors should keep an eye on consumer cyclical stocks this earnings season, as a lack of movement in their share prices following major profit warnings is one of the signs that all the bad news may be priced in, according to Rathbone UK Opportunities manager Alexandra Jackson.

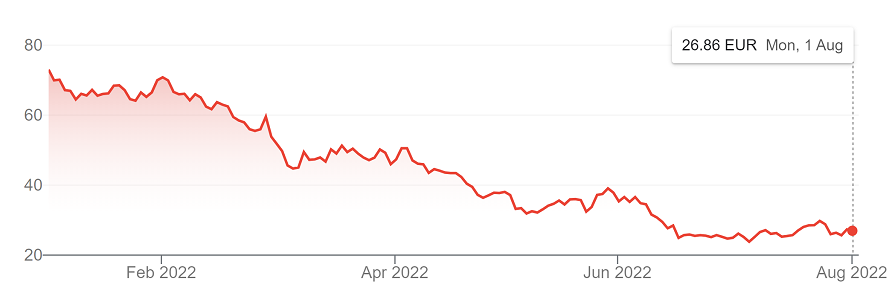

For example, German online fashion retailer Zalando released an update in June warning that revenue and earnings would fall well short of expectations in Q2. However, Jackson pointed out that its share price barely budged on the news, as by that point in the year the stock had already fallen by about two-thirds from its starting level.

Performance of Zalando stock in 2022

Source: Google Finance

While the manager said one of these events was not enough on its own to signal the bottom of the market, it may be a sign of peak negativity when it is a prevailing trend – especially when forecasts are overly pessimistic, as they are today.

“We're in results season now and they have been extremely strong on the whole, but the real point is the outlook statement,” Jackson claimed.

“Most companies tend to be saying, ‘okay, we've had a great first half, it’s been in line or a little bit above our expectations and we can't see anything bad coming down the pipe. But we know that fears are out there, so we're not going to upgrade our numbers at this stage.’

“There are no prizes for being a hero right now.”

Jackson has been disappointed in her performance this year – Rathbone UK Opportunities has fallen into the fourth quartile of the IA UK All Companies sector in 2022 so far, after recording top-quartile gains in 2020 and 2021. However, she is keeping turnover low and resisting the urge to trade, pointing out the operating performance of the businesses she holds has been solid overall.

Performance of stock in 2022

Source: FE Analytics

“Nothing's changed dramatically for the worse in the companies we invest in,” she said. “Normally when I see fourth-quartile performance, I think we must have had loads of profits warnings and I must have really messed up with stock selection.

“This time we have only had one or two, like Fevertree – that's been a real dog. But generally it's been style and that mid cap over large cap thing.”

Despite the strong underlying performance of her portfolio holdings – and the fact that flows into her fund have held up surprisingly well – Jackson said she doesn’t want to be “one of those fund managers who doesn’t listen”.

As a result, she uses market corrections as a chance to test “the weakest links” in her portfolio, selling the 10% of stocks with the weakest prospects and replacing them with high-quality names that may have been too expensive for her to buy when the market was rallying.

One of the names the manager sold recently was housebuilder MJ Gleeson.

On paper, the housebuilders sound like the sort of companies she would usually be interested in – they offer strong margins, a high return on capital, and are now well capitalised.

“The problem is they trade so tightly with sterling, and with the always delightful newsflow out of the government, it's not great for a stockpicker,” she said.

“Because I don't have a yield requirement, I don't see the need for a mid-cap fund like mine to buy those large-cap names.”

Although she bypassed the housebuilders on the whole, she was intrigued by MJ Gleeson’s business model.

The company builds houses on regenerated brownfield land, predominantly in the north-east of England, and sells them at an affordable price, typically around the £150,000 mark. This means a couple each earning the minimum wage could afford to pay a mortgage on an MJ Gleeson home, and the company sells a significant proportion of its stock to key workers.

However, a major headwind is building for the company in terms of new environmental regulations, including a planned ban on gas boilers in newbuild homes from 2025.

“You have to put an air heater in instead which costs £7,000. On a £150,00 house, that could potentially cause a big margin squeeze coming down the path,” Jackson explained.

“And Help to Buy is coming off as well. That's a big component, so we reluctantly sold it and it hasn't done that well.”

Not all of Rathbone UK Opportunities’ stocks have suffered from the introduction of new environmental regulations. The fund has smaller positions in what Jackson referred to as “concept-type stocks” which are a “bit more juicy”, and don’t trade on conventional valuation metrics. One of these is Ceres Power.

“It was up 9% on pretty average numbers last week, because the Chips Act they passed in the US should be very beneficial for renewable energy,” the manager added. “You have to be more cute around price with these stocks and trade a bit more.”