So far, 2022 has been characterised by disruption and uncertainty. In ever-changing market conditions caused by persisting Covid restrictions in Asia, the war in Ukraine and rising interest rates, growing and protecting capital has become even more arduous, and investors have been relocating their money into safer and cheaper options.

In a recent article, Trustnet explored which long-term equity outperformers are still at the top of their sector this year. To further inspire investors, we asked four experts for their best funds of the year so far and were pointed towards cheap global equity, data-driven UK equity, small- and mid-caps and insurance.

To start with a broad horizon, Downing multi-manager Simon Evan-Cook selected two global highlights from his portfolios: Kennox Strategic Value and Sephira GEM Long Only.

As shown in the graph below, Kennox Strategic Value has outperformed its peer group by 16 percentage points year to date.

The £61.7m fund looks for solid companies with low debt that are trading on cheap valuations: exactly what the market has rewarded in recent months, Evan-Cook pointed out.

Its highly differentiated global equities portfolio has comparable weightings in Asia Pacific, UK, European and North American stocks (around 20% of assets each), followed by 11% of Japanese stocks.

Performance of Kennox Strategic Value year to date against sector

Source: FE Analytics

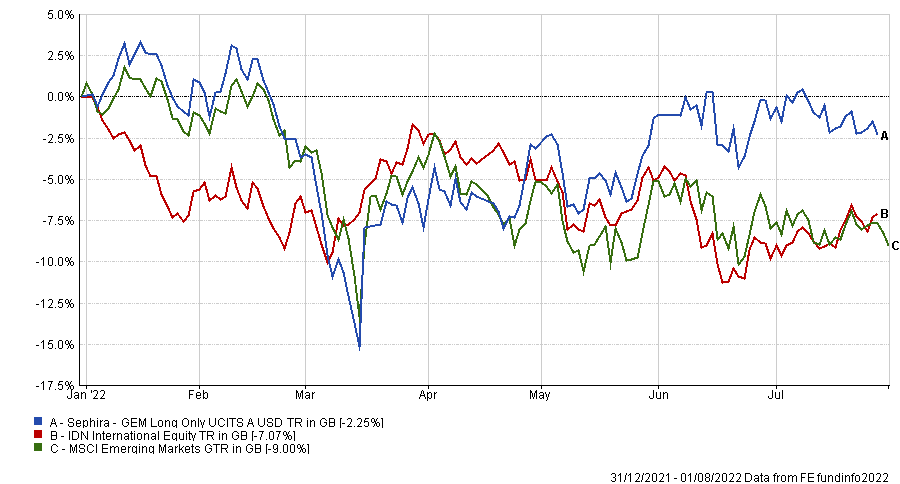

Sephira GEM Long Only was another favourite of Evan-Cook’s. It focuses on emerging markets and pays close attention to governance, “which is always important but particularly so in current markets”, and also valuation and wider country risks.

“Some decent Chinese stock picks and focus on companies in more resilient economies have contributed to significant outperformance in the last quarter,” said the manager.

Since January 2022, the fund outperformed its IDN International Equity sector by 5 base points, as shown below.

Performance of Sephira GEM Long Only year to date against sector and index

Source: FE Analytics

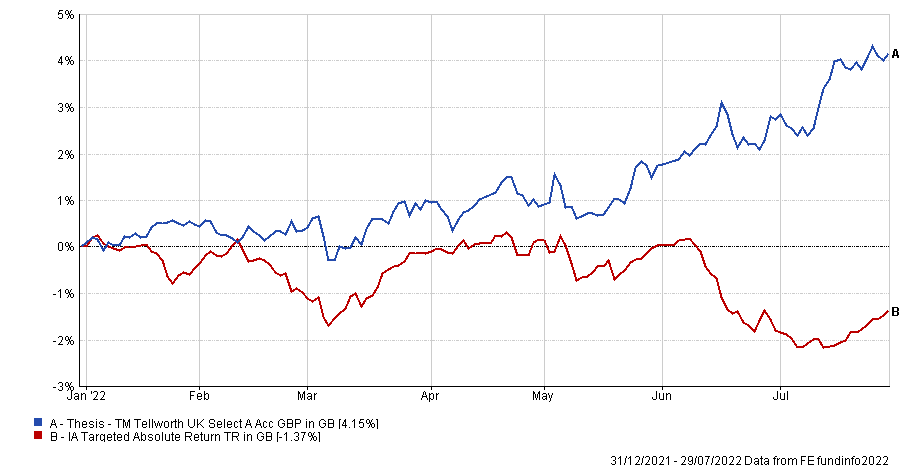

Turning to the domestic market, Scott Spencer, investment manager in Columbia Threadneedle’s multi-manager team, chose Tellworth UK Select.

Seb Jory, the fund’s co-portfolio manager, has earned praise for his methods to collect and use data. In particular, he contributed to the development of several models to improve the forecasting of UK economic data in the wake of the Brexit vote in 2016, which today constitute the basis of his analyses.

Moreover, Jory makes use of data-driven techniques to gain insights at company level which, when combined with fundamental stock selection analysis, are used for idea generation on both long and short stock ideas, Spencer observed.

The £300m absolute return fund is typically market-neutral with factor risk actively monitored and controlled, meaning that the vast majority of returns will be driven by stock selection on both the long and short book.

“With its alpha-driven approach the fund is a good diversifier in portfolios compared to many other equity-based absolute return funds which carry a semi-permanent net long position and therefore a meaningful correlation to equities,” Spencer added.

“Given the current market backdrop, we think this market-neutral approach will continue to be pertinent in the coming quarters.”

Performance of Tellworth UK Select year to date against sector

Source: FE Analytics

Kingswood group investment analyst Sam Buckingham singled out Slater Growth as his favourite fund from 2022’s first half.

The £1.2bn fund, managed by Mark Slater, aims at long-term capital growth by investing in attractively priced companies that exhibit sustainable growth potential.

Whilst the fund is not exclusively focused on small- and mid-caps, having Tesco as one of the top holdings, the vast majority of holdings are.

Buckingham emphasised that Slater, who has an impressive 17-year track record, targets a price-to-earnings growth ratio around 1, in order to avoid growth-traps.

“Slater has managed this strategy through multiple economic cycles and market environments, which gives us greater conviction that he can continue to replicate the strong track record built so far,” said Buckingham.

Performance of Slater Growth year to date against sector

Source: FE Analytics

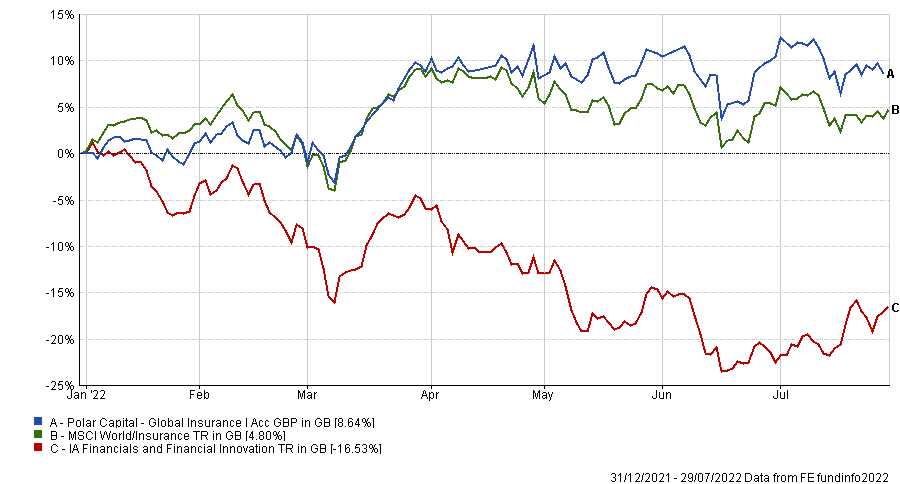

Lastly, Fairview Investing director Ben Yearsley opted for Polar Global Insurance which offers exposure to the niche area of insurance and can be a useful way of playing dollar strength.

“I've been a fan of this fund for many years as it's a consistent long-term achiever. It has defensive characteristics and is never going to be the most exciting fund in your portfolio, but the consistency should shine through in tougher periods for the market,” he said.

With £2.1bn asset under management, the fund had an excellent first half of 2022, as the chart below illustrates.

Performance of Polar Global Insurance year to date against sector and index

Source: FE Analytics

It also had an exceptional year, finishing 49th out of 3,491 IA funds.