Humans often see what they want to see and many times it’s down to something called confirmation bias. This is a phenomenon where we subconsciously look for data points that support a pre-existing view.

Of course, many people try to remain objective and work through the data in a fair manner. However, there are often contradictory data series. So, the claim to be ‘data dependent’ is all well and good but which data do you decide to focus on, and which do you discard?

You will remember the often-used phrase ‘following the science’ during the Covid lockdowns but which science, which scientist, which group of scientists and which scientific conclusions should you follow? It soon became a very politicised term to justify a course of action.

A more recent example in markets was when the US experienced two consecutive quarters of economic contraction in the first half of 2022. Some claimed this was evidence of a classic recession, indeed the definition of a recession. Others pointed to the National Bureau of Economic Research, who officially determine recessions in the US, and we won’t know for some time whether they classify it as a recession or not.

In some aspects, it doesn’t really matter whether there is a technical recession or not. Of course, there will be a degree of symbolic importance, but much more important is whether the contraction, if that is what it is, is shallow and brief, or deep and long lasting. Nevertheless, what is fascinating is that some already argue there has been a recession, others argue otherwise, over a topic which, on the face of it, is fairly straightforward.

Fast forward to the present, which data should investors focus on now: the corporate profits season, the macro data, for example the numerous gauges of inflation and growth, or indeed comments from central banks? Of course, where to focus is an eternal quandary for markets.

Certainly, the path of central bank interest rates remains the key determinant of the direction of financial markets, accustomed as they are to excess liquidity. Of course, inflation and growth feed into this, as do the opinions, and therefore comments, of central bankers themselves.

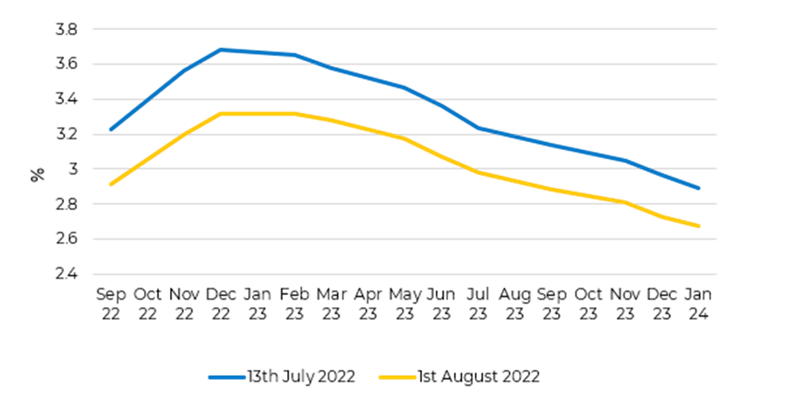

Market expectations for US Fed Funds

Source: Bloomberg. Estimated interest rates as at 3 Aug 2022

The graph shows market expectations for the profile of US interest rates, comparing expectations in mid-July and the beginning of August. Both periods had markets expecting a rate cut early next year and then easing throughout 2023. It’s fascinating that market expectations are for interest rates to be cut so soon after peaking, this has been unusual historically. Importantly though, expectations have become more dovish between the two dates.

Of course, these are just market expectations and markets are simply an aggregate of the same investors that sometimes see what they want to see. Either way, increasingly there is talk of a peak in both inflation and Fed hawkishness. Investors might be looking through the bad news, or only seeing good news. On the other hand, it might be that markets were too bearish and have been readjusting upwards to some better news.

Nevertheless, this more dovish stance has driven the latest up leg in the recent rally, led by growth stocks but not limited to risk assets. Bonds have had a very strong run too, across sub-asset classes. At the moment it’s not clear whether it’s a bear market rally, a degree of mean reversion, or something more sustainable.

From our perspective, it is ok to be undecided. There are some signs of inflation peaking but, equally, and probably more importantly, where is inflation going to settle? 5% would have a very different impact than 2% on economies and markets.

Our approach is to try to avoid seeing what we want to see. It’s not easy but in practice we have a number of mechanisms in our process which helps.

For example, our pragmatic approach to buying and selling is driven by positive and negative price momentum respectively. This is one of the elements of our process which leads us away from being too dogmatic about views and keeps the portfolios market relevant. For example, we are less convinced that inflation has peaked but, due to market dynamics, over recent weeks we have reduced our exposure to inflation beneficiaries and added to growth stocks, as well as adding to duration in US Treasuries.

Nevertheless, we are reluctant to read too much into central bankers’ tone, especially as their forward guidance has been generally poor of late. Importantly, if the market rally is to hold, expectations will have to be right that inflation and Fed hawkishness have peaked.

Anthony Rayner, multi asset manager at Premier Miton Investors. The views expressed above should not be taken as investment advice.