Investment grade bonds now look more appealing to BlackRock than stocks, because attractive valuations, strong balance sheets and moderate refinancing risks suggest they could hold up better in a downturn.

The group – which is the largest asset management house in the world, running some $9.6trn –took a neutral stance on developed market stocks back in May, citing “a worsening macro outlook”.

This followed comments from Federal Reserve chair Jerome Powell, who had insisted that the central bank would hike interest rates until inflation started to fall back to a healthy level. BlackRock, on the other hand, believes that “reality will be more complex” and this approach threatens to push the economy into recession.

In its latest note, BlackRock said it now prefers investment grade (IG) credit over equities on a tactical horizon because it thinks they are better placed to cope with a new market regime characterised by higher volatility.

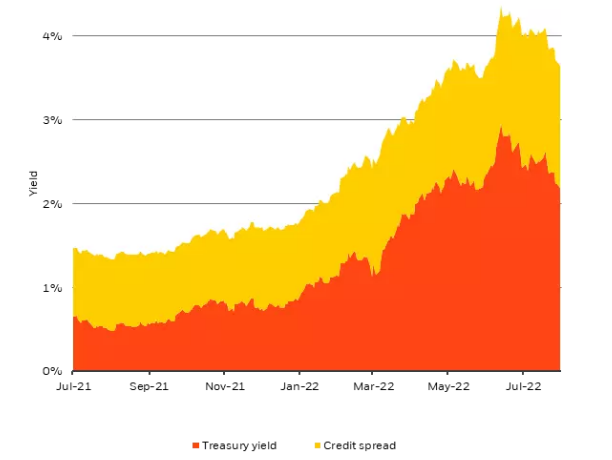

Citing the chart below, BlackRock chief fixed income strategist Scott Thiel said: “Yields look more attractive than at the start of the year, in our view. That’s because of a surge in government bond yields (red area in chart) and a widening of spreads (yellow area), the risk premium investors pay to hold IG bonds over government peers.”

US Treasury yield and IG credit spread, Jul 2021–Jul 2022

Source: BlackRock Investment Institute, with data from Bloomberg, Jul 2022. The yellow stacked area shows investment grade credit option-adjusted spread of the Bloomberg Global Aggregate Credit Total Return index Value Unhedged in US dollars over US Treasuries in percentage points. The red area shows the yield of US Treasuries as a portion of the overall index yield.

Since June, markets have been buoyed by the notion that slowing economic growth would cause central banks to ease up on their tightening programmes, prompting a fall in bond yields and 10%-plus rally in equities.

“We still like IG credit at these levels. Spreads have only marginally narrowed as investors lean back into equities,” Thiel continued.

“Plus, we think higher coupon income provides a cushion against another yield spike as markets price in the persistent inflation we expect. Equity valuations, meanwhile, don’t reflect the chance of a significant slowdown yet, so earnings estimates are still optimistic, in our view.”

BlackRock’s strategists also think that investment grade companies are in “good shape”, pointing to low levels of debt servicing, falling leverage and the fact that defaults are the lowest since 2014. In addition, the number of companies that are being promoted from high yield status to investment grade is outpacing those falling down the rankings.

Thiel also said that other trends in the corporate bond market are supportive of an overweight towards credit.

“First, supply is relatively low. Corporate bond issuance is down almost 20% this year versus 2021, according to S&P. Many issuers could be waiting to see if financing conditions improve before issuing more debt,” he explained.

“Second, refinancing needs don’t look pressing after a surge in issuance last year. For example, typical US IG bond issuance of around $1trn a year easily exceeds upcoming maturities of less than $600bn a year through 2029, S&P data show.”

Looking ahead, BlackRock does not agree with the market consensus that the global economy will undergo a “gentle contraction” that leads to falling rates and lower inflation – it does not believe a ‘soft landing’ is possible given the current macro backdrop.

“Central banks will have to plunge the economy into a deep recession if they really want to squash today’s inflation – or live with more inflation. We think they’ll ultimately do the latter – but they are not ready to pivot yet,” Thiel finished.

“As a result, we see lower growth and elevated inflation ahead. We see bond yields going up and equities at risk of swooning again. IG credit, in our view, benefits from relatively high all-in yields that reflect moderate default probabilities.”