Equity income funds are being increasingly looked at by investors since the market downturn that dominated 2022’s opening half started to reverse in recent weeks, research by Trustnet has found.

The first six months of the year saw markets rocked by heavy falls when investors went into risk-off mode because of surging inflation, interest rate hikes, the risk of recession and Russia’s invasion of Ukraine.

While many of these concerns are still in place, stocks have rebounded from the lows in June and have been grinding higher for the past six weeks. Investors are latching onto a ‘peak inflation’ narrative and hoping central banks will slow or pause their rate hiking plans.

The MSCI AW World index, for example, dropped 11% in the first half of 2022 (in sterling) but is up 10.7% since 1 July. Positive returns have been made by most major indices over this period, including the S&P 500, FTSE All Share, Euro STOXX, Topix and MSCI Emerging Markets.

Similarly, corporate bonds were down in the first half but have made a positive return since then, while commodities – which had shot up in the first part of the year – have fallen in price more recently.

With this in mind, we looked at the factsheet views on Trustnet to get an idea of what investors have been researching more recently. While we are not claiming this is any form of fund rating or endorsement, there are millions of pageviews on Investment Association funds, giving a useful insight into what investors are interested in at any given period.

In order to do this, we took the pageviews of each fund over the opening half of the year and worked out their share of the total then did the same for pageviews since 1 July. The difference in pageview share allows us to see any changes in interest between the first half’s sell-off and the more recent rally.

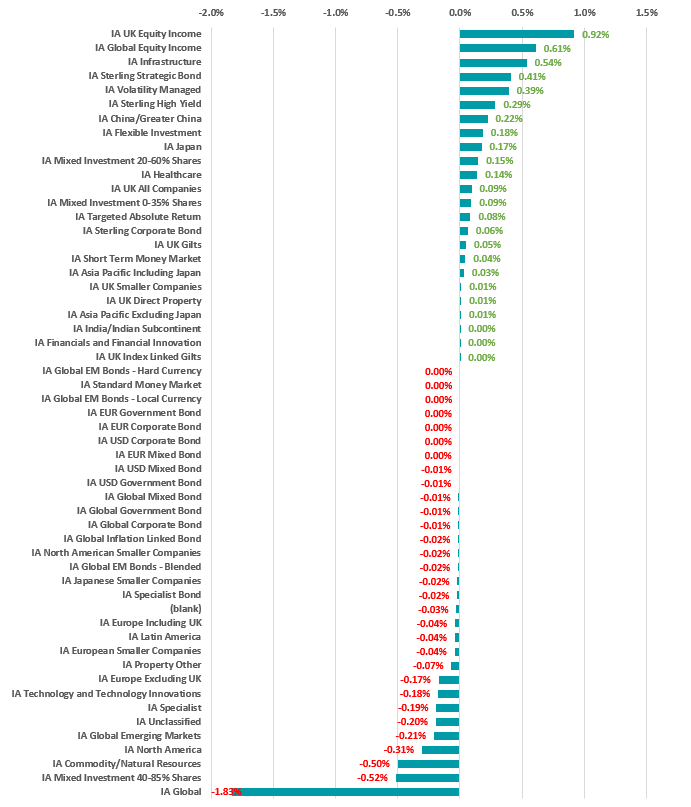

Change in Investment Association sectors’ Trustnet research share

Source: Trustnet

The chart above shows what this looks like when examined by Investment Association sector.

For example, the sector with the biggest uptick in research activity on Trustnet since the market started to rally is IA UK Equity Income. In the opening half of 2022, IA UK Equity Income funds accounted for 4.8% of the fund factsheet views on Trustnet but this has grown to 5.71% during the past six weeks, an advance of 0.92 percentage points.

In second place is the IA Global Equity Income sector, showing a clear interest in equity income as investors look for ways to get ahead of decades-high inflation. Linked to this is the interest in IA Infrastructure funds; infrastructure is a classic inflation hedge and hunting ground for income investors.

On the other hand, investors have been spending less time looking at IA Global funds. These have been the persistent favourites over recent years, attracting significant inflows as investors looked away from the UK.

Another interesting point is the fall in research in IA Commodity/Natural Resources funds, which jumped up the popularity rankings in the first part of the year when investors wanted exposure to rising commodity prices. This seems to be easing now, however, as commodities softened recently.

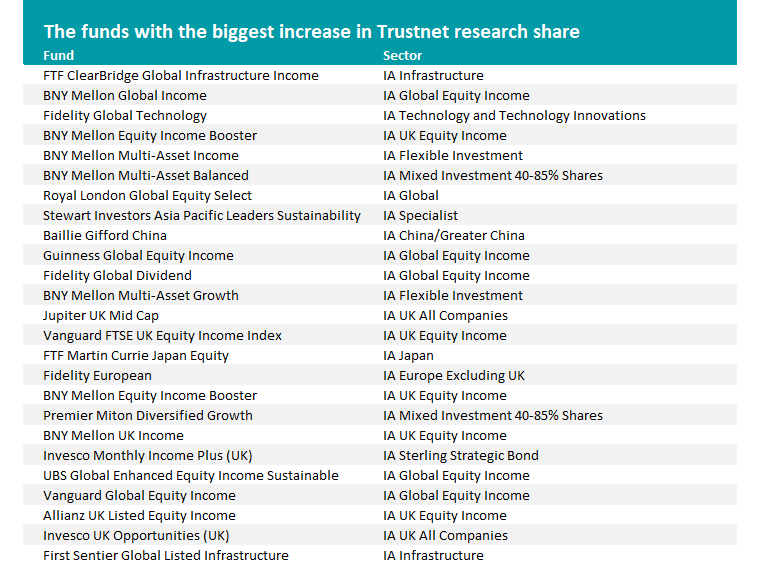

Source: Trustnet

The above table reveals the 25 funds that have seen the largest uptick in research on Trustnet over recent weeks.

FTF ClearBridge Global Infrastructure Income has benefitted from the biggest increase in popularity as investors pursue both income and protection from inflation. The fund was the 51st most researched fund on Trustnet in the opening six months of 2022 but has climbed to 14th place in recent weeks.

Managed by Nick Langley, Shane Hurst, Daniel Chu and Charles Hamieh, the £1.6bn fund is up 17.6% over 2022 so far – making it the best performing member of the IA Infrastructure sector. It also has the peer group’s highest five-year total return (70.9%).

First Sentier Global Listed Infrastructure, one of the best known members of the sector, is the only other IA Infrastructure fund to appear among the 25 funds with the biggest increases in interest.

But a significant number of the funds highlighted above are from the two Investment Association equity income sectors, reflecting the uptick in interest for this style of investing.

Among these are well known funds such as BNY Mellon Global Income, Fidelity Global Dividend, BNY Mellon UK Income and Vanguard Global Equity Income.

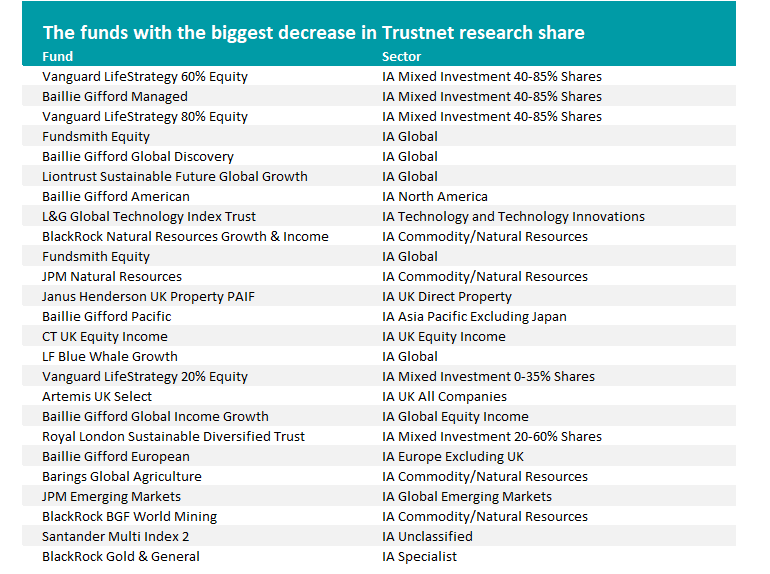

Source: Trustnet

The funds with the biggest fall in their Trustnet research share are some of the largest names in in the Investment Association universe, such as Vanguard LifeStrategy 60% Equity and Fundsmith Equity.

But this doesn’t mean investors have lost all interest in these funds. Vanguard LifeStrategy 60% Equity is still the most viewed factsheet on Trustnet while Fundsmith Equity holds onto second place. Instead, it appears investors have been broadening the types of funds they are looking at in 2022 to include areas that were previously overlooked, such as infrastructure.