Investors always pay special attention to diversification while building their portfolios, but it becomes especially relevant in times of distress, when it is dangerous for all of your investments to move up or down in tandem.

Investments that have similar holdings, weightings, tilts or biases tend to be highly correlated to each other, or exposed to similar risks. If an investor is over-exposed to them, they might be caught in a downward spiral should the style or asset class go out of favour.

One diversification parameter is correlation, or the measure of how related the performances of two funds were during a certain period of time.

In this new series, Trustnet looks at the funds and trusts most commonly held by UK investors and highlights those that have shown high levels of correlation to them – suggesting that the combination of the two might be best avoided in a balanced portfolio.

We begin with the IA UK All Companies sector, using the £4.9bn Lindsell Train UK Equity as our benchmark – the biggest fund in the sector excluding exchange traded funds, index trackers and passive funds.

To better understand what type of funds that might have high correlation to it, we asked Scott Spencer, investment manager in the multi-manager team at Columbia Threadneedle Investments, what role Lindsell Train UK Equity plays in a portfolio and what it does.

“The Lindsell Train team looks to invest in companies with strong balance sheets and repeatable and predictable cashflows that will continue to generate superior returns over the long run, with the aim to hold them for the very long-term and let the earnings compound,” he explained.

“This focus on quality, compounding businesses, has resulted in a very low turnover approach to investing and short-term valuations of the companies are much less important than the underlying quality and resilience. This quality bias has historically resulted in strong downside protection in more volatile market environments.”

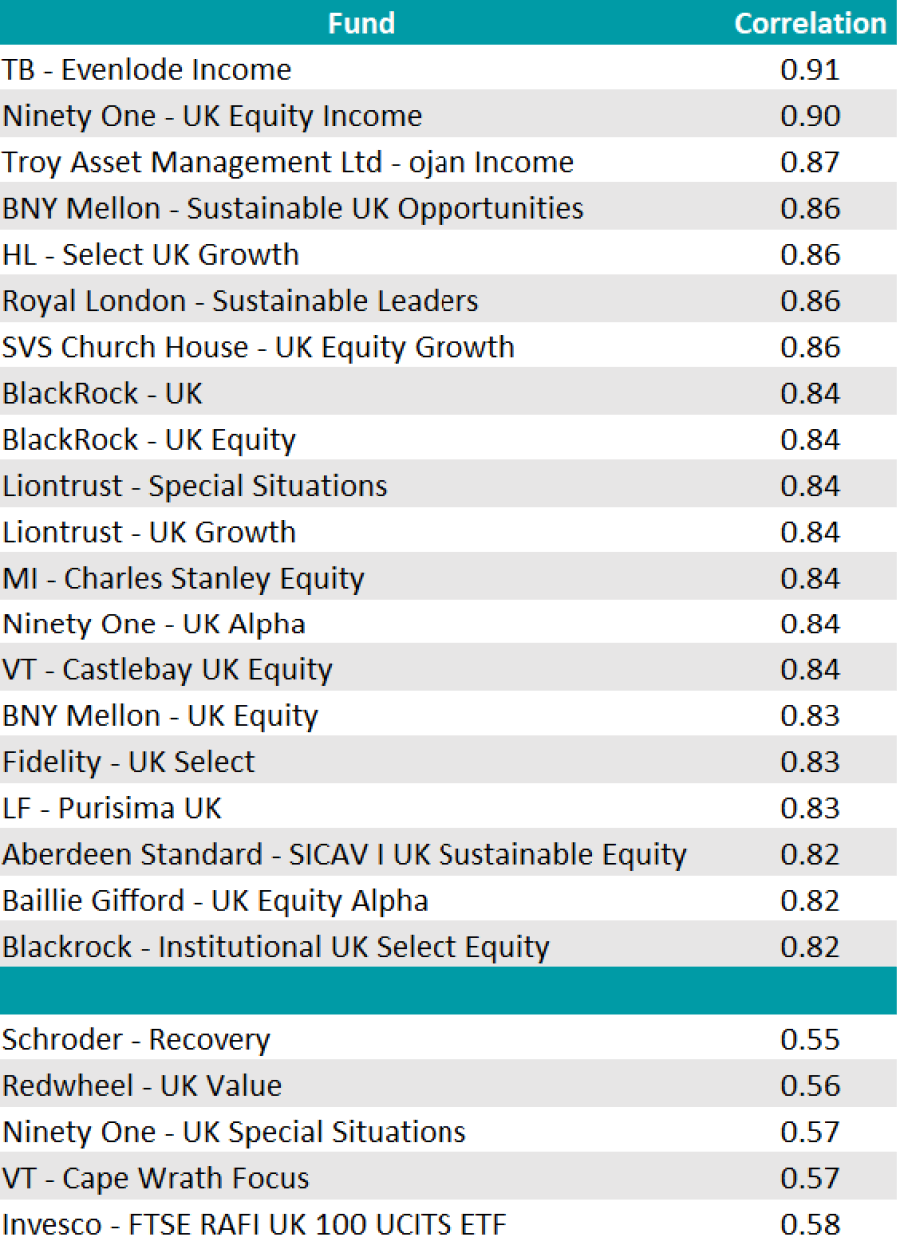

So looking at the data from FE Fundinfo and allowing a certain underlying degree of correlation that all funds in one sector have to each other, we find out which funds have shown the highest level of correlation to the Lindsell Train fund over five years.

Funds with the highest and lowest correlation with the Lindsell Train fund over 5yrs

Source: FE Analytics

The funds that have shown the most similar performance pattern to Lindsell Train were equity income funds, displaying correlation levels between 87 and 91%.

The most correlated was Evenlode Income, where four of its top 10 holdings were in common with Lindsell Train. The portfolio had a 0.91, or 91% correlation to the Lindsell Train portfolio.

In second and third position came Ninety One UK Equity Income and Trojan Income, respectively – all three funds have more than 40% of their portfolios invested in financial services and consumer products.

Performance of funds vs sector over 5yrs

Source: FE Analytics

Some funds in the growth space also had significant correlation to Lindsell Train, including HL Select UK Growth, SVS Church House UK Equity Growth and Liontrust UK Growth (86%).

Conversely, appearing further down the table, value and recovery strategies were the least correlated to Lindsell Train. Schroder Recovery and Redwheel UK Value were in the last two positions, at 55 and 56% respectively.

More aggressively tilted funds also showcased low correlation to Lindsell Train, which, according to multi-manager Spencer, makes them a particularly interesting option to hold alongside.

“Given its defensive characteristics, Lindsell Train pairs well with more valuation sensitive UK funds and those which are more cyclically biased,” he said.

As a good example he picked Artemis UK Select, with a 64% correlation.

“Fund managers Ed Legget and Ambrose Faulks believe that changes in company expectations lead to changes in share prices. So, they look for companies that are experiencing some form of change which is not currently reflected in the share prices,” he said.

“The portfolio tends to trade on much cheaper earnings multiples than both the market and Lindsell Train, and the correlation between the two are fairly low, providing good diversification benefits.”