Justifying a home bias as a UK investor has been challenging for the best part of two decades as the exceptional returns from American stocks has made domestic companies unnecessary in many portfolios.

In fact, it has been downright harmful to returns. While the FTSE All Share is up 89% over the past decade, the MSCI ACWI has rallied 189.8% and the S&P 500 has posted a 232.8% return, meaning there has been a huge opportunity cost to holding domestic companies.

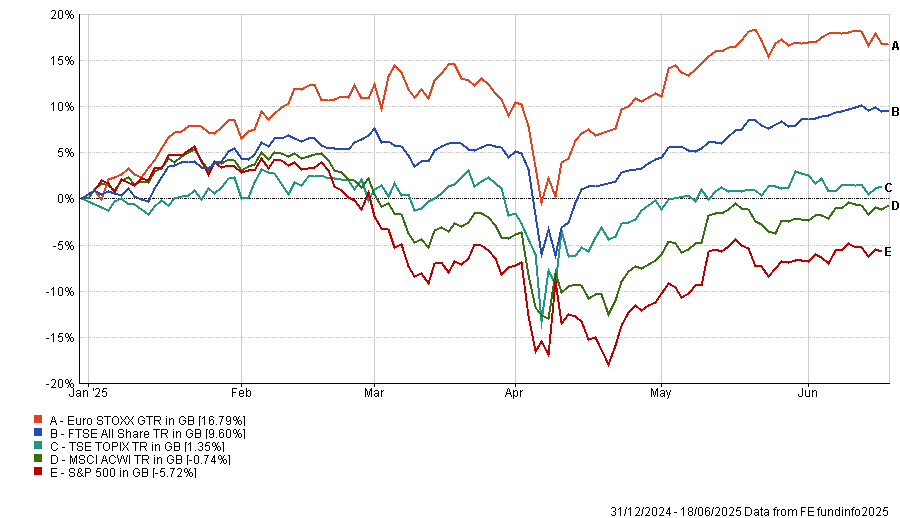

However, the tide seems to be turning and interest in the UK is rising. The FTSE All Share is one of the better-performing developed markets year to date, while the US and global markets have slid, as the chart below shows.

Performance of indices year to date

Source: FE Analytics. Returns in sterling.

James Coker, investment manager at Quilter Cheviot, said the US lagging other developed markets means “a degree of home bias is once again warranted”.

Tom Stevenson, investment director at Fidelity International, concurred: “Given their relative advantages, about 15% of your portfolio in UK shares would not be excessive.”

For particularly risk-conscious investors, VT Downing Fox’s Simon Evan-Cook said having a “third of your investable wealth” in the UK is a solid starting point.

Below, Trustnet looks at the reasons why investors might want to have a home bias in the coming years.

Valuation and dividends

Low valuations are part of the push for a greater home bias. Coker said: “The UK market trades at a 13.9x price-to-earnings ratio, relative to the eurozone on 14.5x, the US on 17.1x and the world index on 15.9x.”

Therefore, UK stocks are much cheaper than rivals around the world, giving them less far to fall in the event of a market downturn and plenty of scope to catch up to their rivals if markets rise.

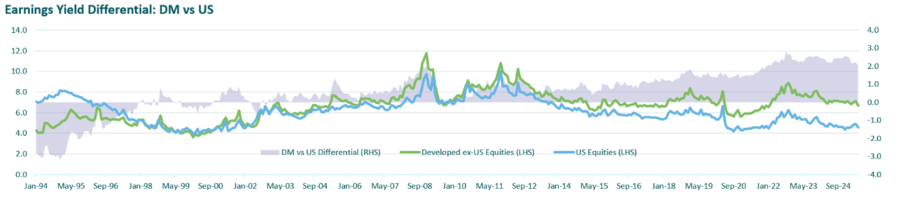

Put another way, Maria Municchi, fund manager at M&G Investments, noted that the UK is on an earnings yield (which is the inverse of the price-to-earnings ratio, calculating the earnings per share divided by the share price) of UK companies at around 7.5%, much higher than the US, where the figure stands at 4.5%.

“This differential is close to the highest point we have observed in the past 20 years,” she said.

Source: M&G Investments

Fidelity’s Stevenson added that valuations are the UK market’s “principal attraction”, but noted that investors should not ignore one of the strongest reasons to buy the domestic market: dividends.

Most UK companies offer “notably high dividend payments”, giving a competitive return regardless of whether shares rise rapidly. At present, the FTSE All Share has a yield of 3.6%.

Diversification

Evan-Cook said recent US underperformance relative to other developed markets is reminding investors of the importance of diversification.

Investors can forget about this if one market dominates for a long time, “meaning they end up heavily exposed when it [uncertainty] rears again”.

Tariffs are the “catalyst” that has exposed the dangers of having too much money in the US, causing investors to start looking closer to home.

The UK’s sector exposure is extremely different to the US, favouring financials, consumer businesses and energy compared to the tech giants that dominate in America.

Therefore, while the UK lacks exposure to structural trends such as artificial intelligence, domestic stocks have distinct risk factors that are unlikely to overlap with the rest of investors' portfolios.

Yet Coker said they are not “tied to the fate of the UK economy”, which contracted by 0.3% in April. He noted that companies in the FTSE All Share derive almost 70% of their returns from overseas, meaning they are a “conduit to the global economy”.

Another benefit is that investing locally takes away currency risk and limits exposure to the dollar, which some experts expect to depreciate, Coker added.

Risks

While a home bias may seem warranted, experts agreed that the composition of the UK market is a key risk.

“Like many indices, it’s concentrated in a few sectors and companies and if these happen to fare badly, then you will too,” Evan-Cook explained. The market itself has also become “disliked, and companies are moving away from listing here”.

For example, earlier this month, money transfer firm Wise announced that it intended to move its primary listing to the US, continuing an exodus of stocks from the UK market.

Stevenson added that this has created a knock-on effect where fewer companies have chosen to go public in the UK. This means it has been extremely challenging for the UK to narrow its valuation gap.

Equally, the UK faces “high debts and the need to raise taxes to stabilise government finances”, all of which are unsupportive of company growth in the domestic economy.

Municchi concluded that, while the UK seemed attractive, investors should be cautious.

With “elevated gilt yields and disappointing economic growth”, investors need to be careful with their home bias and ensure they do not let “familiarity breed overconfidence”.