Some of the best-known funds of the past decade that soared to new highs have come back down to earth somewhat over the past three years.

Since the outbreak of Covid-19, markets have been volatile. At first, funds with huge technology allocations benefited, while latterly it has been ‘value’ stocks that have come to the fore.

This rotation has caught many fund managers out and left previous winners of the past decade languishing at the foot of the table.

Perhaps nowhere is this clearer than in the IA Global sector, where three long-term heroes have turned into short-term zeroes.

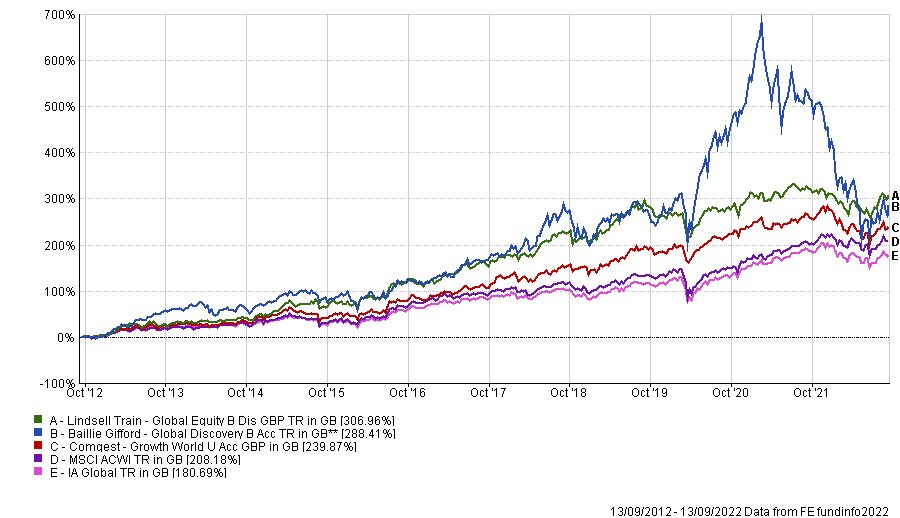

Lindsell Train Global Equity, Baillie Gifford Global Discovery and Comgest Growth World have been standouts in the sector over the decade, returning between 307% and 239.9%, as the below chart shows.

This has been good enough for a top-quartile performance among their peers, as well as beating the notoriously difficult to match MSCI ACWI index.

Total return of fund vs sector and index over 10yrs

Source: FE Analytics

However, as the chart also shows, performance has tailed off in recent years. Indeed, all three portfolios have slipped to the bottom quartile versus their rivals over three years.

Louis Tambe, senior investment analyst at City Asset Management, said all of the funds fit into the growth style of investing – but this can be a broad brush and their interpretations of growth are very different.

“At one end of the spectrum you have the Baillie Gifford Global Discovery fund which is generally looking for companies growing rapidly and could potentially double the size of their business over five years,” he noted.

“This often means they are not yet making an accounting profit, tend to be smaller in size and earlier in their development cycles.”

This has been particularly challenging so far this year. Baillie Gifford Global Discovery is down 26.1% since the start of 2022 and lost 20.6% in 2021, as its stocks took a hit from rising interest rates.

As rates rise, savers no longer need to look years into the future to get growth and as such the discount rate applied to these future earnings is much higher than it has been, making these stocks less attractive.

Conversely, Lindsell Trian Global Equity hunts at the larger end of the market, investing in more established companies that are already profitable or generating significant amounts of cash flow, able to grow their businesses at a slower but more consistent rate and benefitting from strong barriers to entry for competitors, Tambe said.

This style of investing is known as quality growth and is also used by the team at Comgest Growth World, which looks for companies that can compound over time, rather than buying fast-growing stocks.

Although they are down over three years, these funds have had a better 2022 than the Baillie Gifford fund above. Indeed, it was during the pandemic-led tech boom in 2020 and the topsy-turvy (but ultimately bullish) market of 2021 when these portfolios struggled more than this year.

When asked which of the three was the most likely to turn around their recent run of poor fortune, analysts had an overwhelming favourite.

Tambe argued that Lindsell Trian Global Equity would be able to turn things around in the current environment where capital is more scarce, thanks to higher borrowing costs and a higher cost of equity).

“Many of its businesses will have experienced environments like this before, have stronger balance sheets to survive a recession or rising cost base and have more pricing power with an existing customer base,” he said.

Nick Wood, head of fund research at Quilter Cheviot, agreed. He said that the fund had a “very consistent process”, focusing on 20-35 stocks with durable, cash-generative franchises. This tends to lend the portfolio to a bias towards the defensive consumer staples sector.

There is also a natural home bias, with just under a third of the portfolio in UK companies, which is much higher than the weighting in the global index. This exposure has been a hinderance in recent years, but helped at the margin in 2022.

“The argument for retaining faith in the fund is simple – an unchanged process and philosophy, and proven ability to add alpha. The uncertain environment may benefit those more durable businesses able to withstand the pressures of inflation, whilst the portfolio as a whole is likely to continue to protect capital in falling markets,” he said.

Finally, Dzmitry Lipski, head of funds research at interactive investor, said the Lindsell Train fund made the best choice for those looking for a satellite option that could afford to take on the risk associated with equities.

“Managed by highly regarded investors who follow a strict discipline and commitment to their investment approach which has proved very successful and although there has been much focus and scrutiny on the shorter-term performance in recent times, year to date is looking strong and is vindication for the strategy,” he said.

| Fund | Sector | Fund size | Fund managers (s) | Yield | OCF | Launch date |

| Baillie Gifford Global Discovery | IA Global | £1,067m | Douglas Brodie, Luke Ward, Svetlana Viteva | N/A | 0.78% | 03/05/2011 |

| Comgest Growth World | IA Global | £825m | Laure Negiar, Zak Smerczak, Alexandre Narboni, Richard Mercado | N/A | 0.90% | 29/03/2017 |

| Lindsell Train Global Equity | IA Global | £5,901m | Michael Lindsell, Nick Train, James Bullock | 1.0% | 0.65% | 18/03/2011 |