The geopolitical and economic developments of 2022 have disrupted long-held and much relied-upon convictions. Investors were largely taken by surprise by the market’s upheavals and have been left unsure as to which strategies can still help build an effective portfolio going forward.

Equities and bonds have been falling simultaneously, revitalising doubts about the effectiveness of the traditional 60-40 portfolio.

Concerns around a possible recession have also taken their toll, with data showing both declines in spending and economic activity but at the same time unemployment levels – another indicator for a recession – have remained under control.

Darius McDermott, managing director at Chelsea Financial Services, called these new, unusual conditions “imbalances” and his solution to navigate them is to “get creative”.

“The first step we are taking is to steer away from anything over-levered and exposed to the consumer,” he said.

“We are really worried about a recession and can no longer expect the market to behave the way we are used to because there are too many imbalances. The traditional model of growth, followed by a recession, after which the market picks up again, no longer applies.”

Chelsea’s approach has been to expand its allocation to strategic areas through investment trusts, which now comprise 30% of the company’s portfolios, and to re-evaluate big tech and US treasuries.

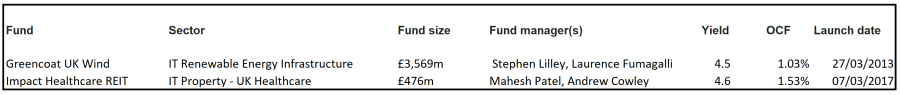

In the investment trusts space, one area of interest has been renewable energy, where McDermott highlighted Greencoat UK Wind in particular.

Benefitting from continuously high energy prices, the trust outperformed its IT Renewable Energy Infrastructure sector by 13.1 percentage points over the past year, as illustrated below.

Performance of trust against sector over 1yr

Source: FE Analytics

Return on capital payments are linked to the Retail Price Index and the yield has been more than 4.5% while growing with inflation.

Additionally, it has been trading close to its net asset value (NAV) when it usually trades on a big premium, as McDermott noted, before admitting that there are some political risks involved, however.

“No government should attack them but, unfortunately, renewables are vulnerable in this sense,” he said.

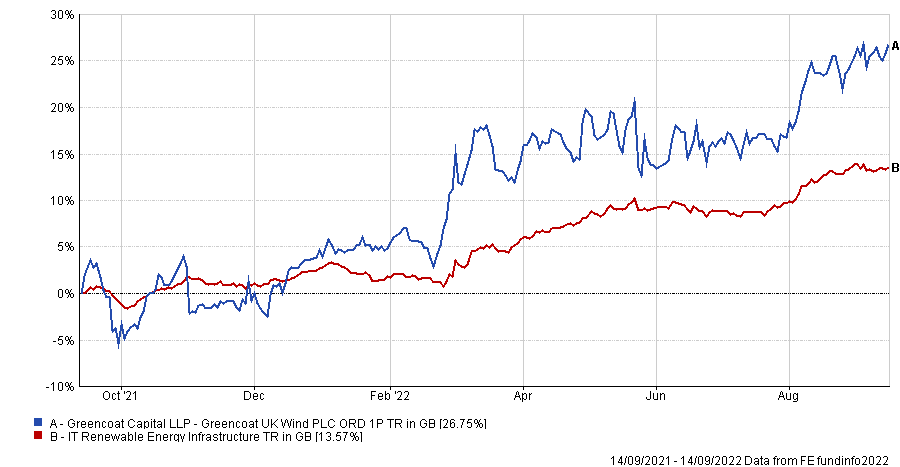

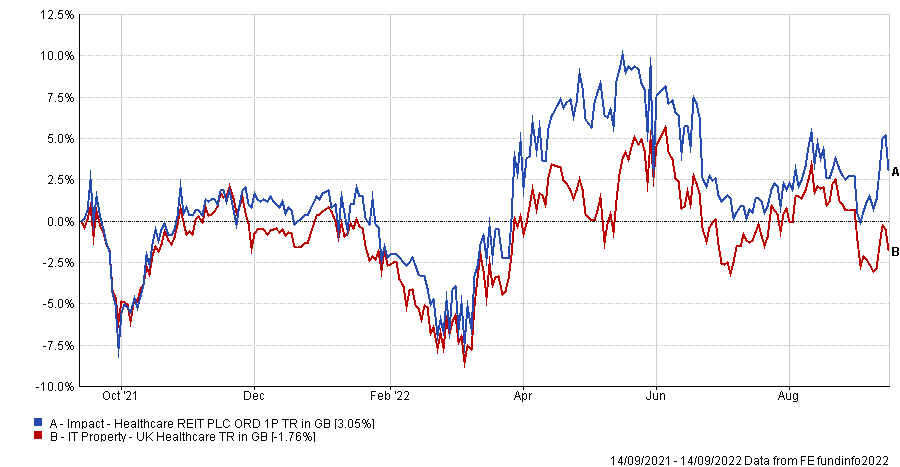

Another promising sector according to McDermott was healthcare property, with the Impact Healthcare real estate investment trust at the top of his favourites list.

Its £530m portfolio, is comprised of 131 properties let to 13 tenant partner that generated a strong performance in 2022 – the trust continuously stayed on top of its IT Property UK Healthcare peer group, as the graph below shows.

Performance of trust against sector over 1yr

Source: FE Analytics

“This is a unique investment opportunity not available via an open-ended fund. It’s 100% inflation linked (with a cap to safeguard tenants) in a sector characterised by low supply and high demand – and with an ageing UK demographic, demand will be even greater in the future.”

To mention another area with defensive cashflows that are not linked to the economic cycle, Chelsea chose supermarkets and infrastructure, both of which provide inflation linkage and growing dividends.

“For us, property and infrastructure have become essential in portfolios. We particularly like real assets and see interesting opportunities in the digital infrastructure field,” he said.

However, McDermott has not totally given up on the growth winners of the past decade. Indeed, he noted that the investment company structure has allowed the firm to buy exposure to big tech at significant discounts.

“Technology is not going anywhere in the long term, it’s very profitable with real profit growth (not just multiple expansion) and is not that expensive. Many exceptional businesses have fortress balance sheets and years of secular growth ahead,” he said.

“Take Alphabet’s cloud business, for example. It’s been loss-making but we actually think it has a lot of potential. And the company’s net income has never stopped growing.”

Lastly, Chelsea emphasised that 10-year US treasuries are investible again now that they are on a 3% yield. Being the only asset class with negative correlation to all Investment Association sectors (except IA UK Gilts), they are a “fantastic” portfolio diversifier.

“We don’t think ever higher rates are sustainable,” said McDermott. “But we are treading cautiously as there is still a big differential with inflation, and deflationary forces could reassert themselves in the medium term. We are holding them through an exchange traded fund (ETF).”