Job Curtis has told City of London shareholders there will be better places to be invested when the market eventually recovers, as the trust’s income mandate will prevent it from accessing the most damaged stocks.

Value investors tend to lead the rebound from bear markets, as they have a higher exposure to cyclical stocks whose earnings quickly accelerate once the economy starts growing again.

Although Curtis (pictured) is a value investor, he said that to take full advantage of a rebound in these stocks, you need to own them when the outlook for the underlying businesses is at its most pessimistic – which tends to make them unsuitable for an income portfolio.

“We have seen some severe share price falls and value is beginning to emerge,” the manager said.

“The difficult thing for an income investor is you might see some long-term value in a stock, but you have to wait for it to be back in the dividends before you invest.

“So we’re probably not the best vehicle for a recovery – you would need to buy into things when they’re really in a crisis and losing money, so not paying a dividend.”

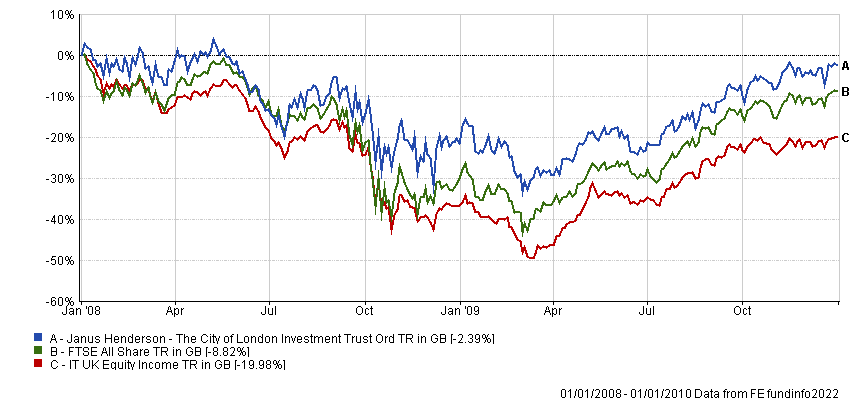

Data from FE Analytics shows that while City of London held up better than the FTSE All Share and its IT UK Equity Income sector in the market crash of 2008, it lagged both measures in the recovery of 2009.

Performance of trust vs sector and index 2008-2009

Source: FE Analytics

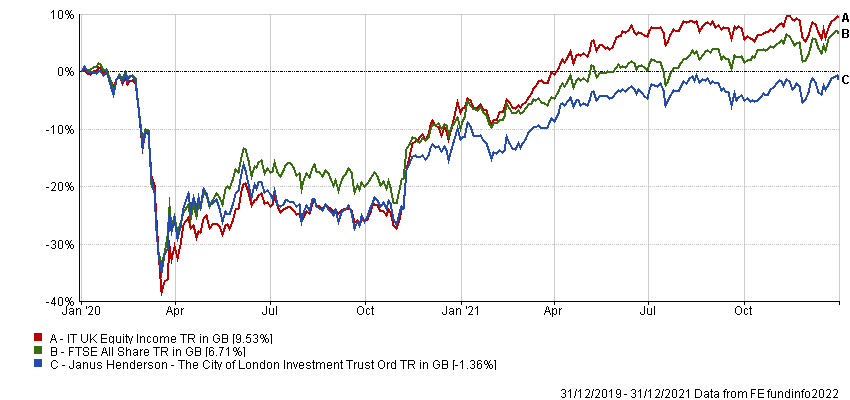

Although the trust had the same relationship with its sector in the Covid-related market crash of 2020 and the subsequent recovery, it underperformed the FTSE All Share in the initial correction, which the manager blamed on a high level of gearing going into the crisis and an underweight position in pharmaceuticals. Again, it lagged the index in the rebound.

Performance of trust vs sector and index 2020-2021

Source: FE Analytics

One sector where the trust is currently underweight is consumer discretionary, which tends to suffer during recessions as households have less disposable income. However, Curtis was negative on the sector long before headwinds began mounting this year, predicting these companies would take the longest to rebuild their dividends and profitability after “they were totally shot to pieces during the pandemic, not through any fault of their own”.

As a general rule though, he is reluctant to dismiss entire sectors.

“I like reading about what my competitors are up to and I often see a fund manager say, ‘I will never own a bank’, or ‘I will never own a utility or energy company as there is too much interference from the government’.

“But I think it’s a great mistake to shut areas of the market off. There are periods when it's good to own banks and good to own oil companies and so on.

“We have a diversified portfolio and if you've got a twin objective of income and capital generation, it's very important not to have your eggs in one basket.”

In terms of where he is looking for opportunities, Curtis said value has emerged in battered FTSE 250 stocks, particularly in those with a cyclical tilt. The key here is a strong balance sheet, as the combination of debt and collapsing profits can prove deadly in a downturn – especially for an income manager.

“You've got to think about your bank manager first before you pay your dividend or your bondholders,” he added.

Yet he said that even where balance sheets are strong, it is too early to move into a lot of cyclical names.

“What tends to happen is that buy-side investors anticipate the change in time and sell or reduce their holdings,” the manager explained.

“[Sell-side] analysts are guided more by the companies they work for. They tweak their estimates down, but it's their job to make massive macroeconomic assumptions.

“So you get the share price underperformance, then the company comes out with a profit warning and there’s another lurch down. There are no prizes for being too early, you’re just left with a lot of egg on your face.”

Overall though, Curtis said it will pay to remain invested in the UK. The FTSE All Share has underperformed global markets since 2016 when international investors “took a pretty dim view of the referendum result”, while the US powered ahead of everyone as its tech giants went from strength to strength.

Yet the manager pointed out the UK’s underperformance has begun to narrow this year, which he said could hint at the shape of things to come.

Performance of indices in local currencies over 10yrs

Source: FE Analytics

“A couple of years ago, some esteemed fund managers were really writing off the UK,” he added.

“One very successful growth manager said the FTSE 100 was a 19th century index. But we've recently discovered that we do still need oil and natural gas. Banks can make profits. Mining companies can pay spectacular dividends. The UK is outperforming this year, but there's still a long way to go.”