Investors who drip-feed their savings into a stocks and shares ISA each month could pay as much as 32% in fees, according to data from The Lang Cat.

Those just starting out may not have a large pot to get them started, instead saving as much as they can each month.

This method of investing is known as pound-cost averaging, meaning that investors buy shares or units each month at both low and high points.

While it may mean lower returns if shares rise from the initial starting point, it also mitigates losses on the downside, as new shares are bought at lower prices with the potential to rebound.

However, investors who choose to do this could face hefty charges unless they are with the right platform, according to new data.

Indeed, for investors that buy funds, some platforms (iWeb and interactive investor) charge more than 20% to investors putting away £100 per month, while the cheapest (Close Brothers) will cost a fraction of this: 0.25%.

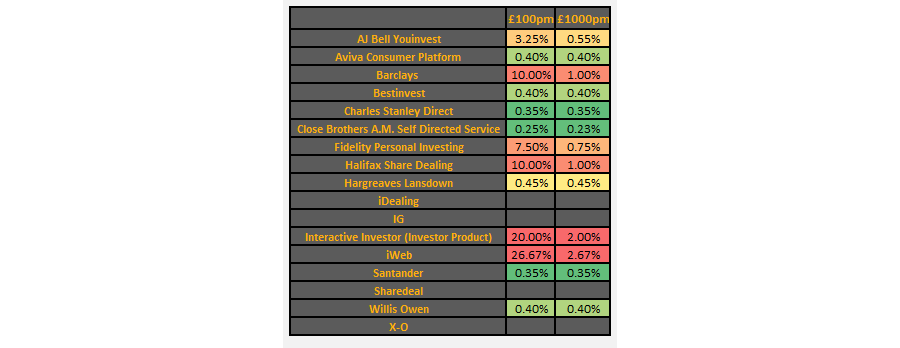

In the table below, we have looked at the average cost of investing on each platform for one year including platform fees, additional wrapper charges and trading, assuming a single fund purchase each month.

We have assumed investment in an ISA, although some platforms impose a minimum monthly subscription and have thus been excluded from some monthly payment levels. We also compared the difference between saving £100 and £1,000 each month.

How much it costs to invest monthly in just funds with different providers

Source: The Lang Cat

Flat-fee providers are the most expensive, with the likes of interactive investor and iWeb charging 20% and 26.7% respectively to investors that put away £100 per month, while Barclays and Halifax both charge 10%.

Conversely, Close Brothers costs just 0.25% while Charles Stanley (0.35%), Santander (0.35%) and Bestinvest (0.4%) are also competitively priced.

For investors that can afford £1,000 per month, these same firms remain the cheapest, although the price of the more expensive platforms also drops.

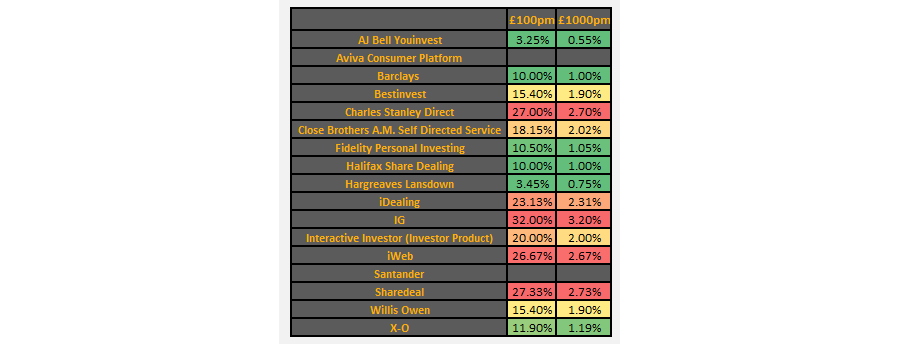

A similar pattern emerges with investment trusts, which are priced as shares and therefore have a different fee structure to funds.

Here, investors paying £100 per month into an ISA would be hard-pressed to justify the expense. Indeed, while savers in funds could pay as little as 0.25%, the cheapest platform for investment companies is 3.25% through AJ Bell, while Hargreaves Lansdown’s 3.45% is also competitive.

Most platforms charge between 10% and 20%, with IG working out the most expensive at 32%. These fees include platform costs, ISA charges and trading costs, assuming the purchase of shares in one investment company per month.

Investment trusts are cheaper for investors who can afford to put around £1,000 per month into an ISA, although the 0.55% and 0.75% charged by AJ Bell and Hargreaves respectively are still more expensive than fund-only investors would pay with the cheapest rival.

How much it costs to invest monthly in just investment trusts with different providers

Source: The Lang Cat

All of these figures assume a starting pot of £0 however. Over time, the amount held in an ISA would increase and these fees would reduce. For more information on the costs associated with different pot sizes, we covered this yesterday.

All data for both articles was accurate based on publicly available charging structure information with some details verified via conversations by The Lang Cat with platforms in January 2022.