Fees are something that hit the spotlight when times are tough and investors look for cheaper ways to make their money work harder.

This year, with most major markets falling, it has been (and remains) crucial to get the best deal. While this is usually in the form of whether to buy a more expensive active or cheaper passive fund, there are other ways that savers can watch the pennies.

One such option is to look at the fees charged by fund platforms. Whether you pay a fixed fee or a percentage of your overall pot can make a big difference, as can the cost of trading. While making a switch can be daunting, in some cases it could save hundreds of pounds a year.

Below, Trustnet looks at the cheapest and most expensive options for investors with a range of cash pots, from £5,000 to £50,000, using data from consultancy The Lang Cat.

The colour coding represents the best and worst value, with green being the cheapest and red being more expensive.

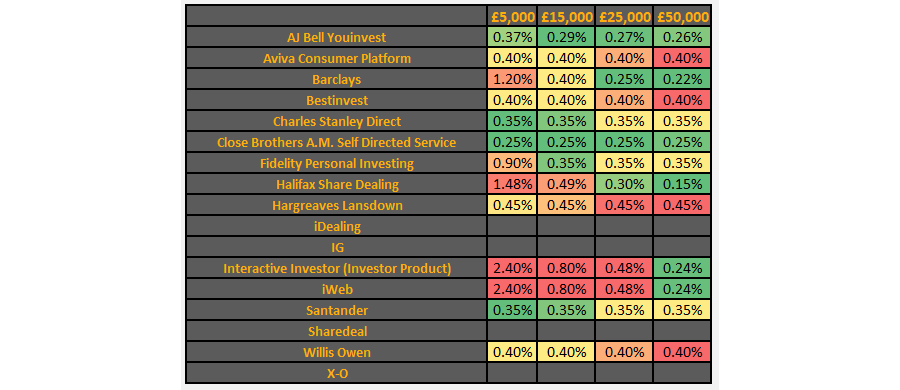

How much it costs to invest lump sums in just funds with different providers

Source: The Lang Cat

To get these results, we looked at the cost of investing on a platform for one year, including ongoing platform fess, any additional wrapper charges and trading where applicable.

We also assumed all investments were made within an ISA wrapper, only involved funds and included four transactions (buys or sells) over the year.

Close Brothers is the cheapest for investors with smaller pot sizes, costing 0.25%, a consistent percentage fee across all pots. Santander has the same fee structure, but charges 0.35%.

AJ Bell and Close Brothers are consistently the cheapest platform to buy funds through, appearing green across all pots. Hargreaves Lansdown is broadly more expensive, although it is better value for those investors that are starting out or have less to invest.

Flat-fee based firms such as interactive investor or Halifax are among the most expensive for investors with smaller pots, but become much cheaper for those with larger amounts.

Paying £9.99 per month becomes much better value when there is more invested, but equates to as much as 2.4% of a £5,000 pot.

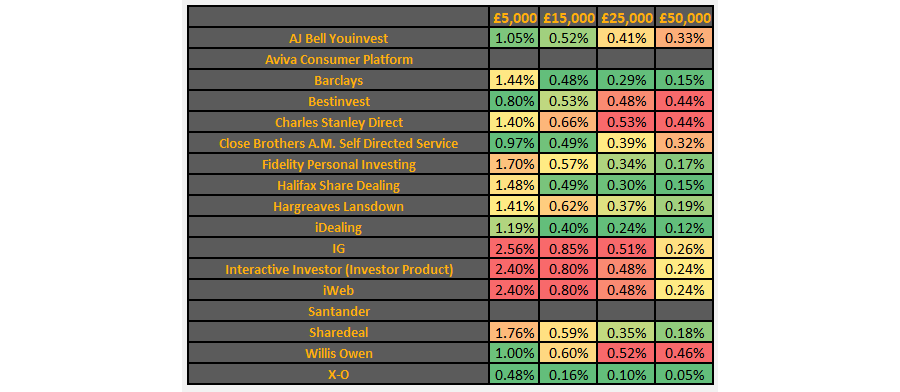

Turning to investment companies and shares, fund platforms typically charge investors more, particularly for those with smaller pots, as can be seen in the table below.

Here we looked at the cost of investing on platform for one year including ongoing platform fess, any additional wrapper charges and trading where applicable. We again assumed all investments were made in an ISA, with all holdings being in investment companies and four transactions made in the year.

The cheapest option for investors with £5,000 is X-O at 0.48%, while Bestinvest is second at 0.8%. Typically, however, there are higher trading costs for stocks (which investment trusts are classified as), as well as different charges.

A £5,000 fund portfolio with AJ Bell, for example, would be charged 0.37% over the course of one year, but an investment trust-only portfolio would be hit with a 1.05% fee.

How much it costs to invest lump sums in just trusts with different providers

Source: The Lang Cat

However, for investors with more money, platforms were significantly cheaper. Indeed, the 0.17% paid by Fidelity Personal Investing customers for a trust portfolio was half the amount a fund-owning customer was charged.

X-O remained the cheapest options for investors of all pot sizes, while Bestinvest, Charles Stanley and Willis Owen were expensive for more affluent investors. Once again, the flat-fee products from interactive investors and IG were pricey for investors with smaller amounts.

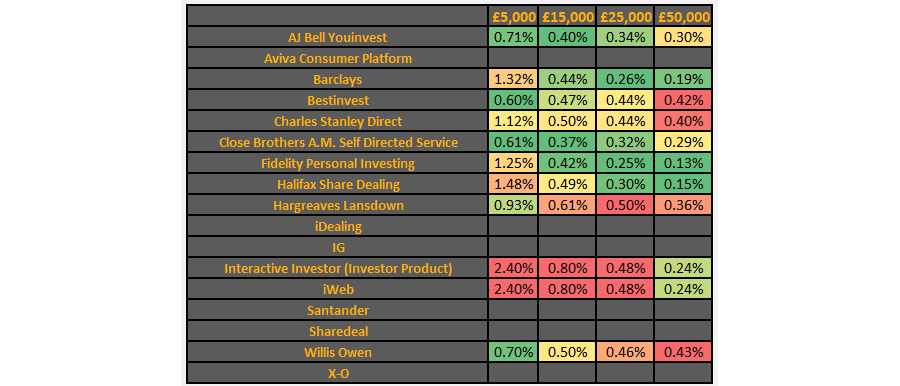

Lastly, Trustnet looked at the cheapest and most expensive options for investors that have an even 50-50 split of funds and investment trusts.

This table assumes investment in an ISA, 50% in funds and 50% in investment companies and two fund transactions and two trust buys or sells in the year.

How much it costs to invest lump sums in funds and trusts with different providers

Source: The Lang Cat

Overall, Fidelity is the cheapest for most pot sizes, although is moderately expensive for smaller pot-sizes. The 0.13% charged on £50,000 is the cheapest, while it is also the least expensive for £25,000 pots and competitive for £15,000.

Once again, interactive investor is among the most expensive for those with around £5,000 to invest, but is competitive for those with £50,000.

Bestinvest works out the cheapest for investors with £5,000, but rises in relative cost the more that is saved, while Close Brothers, AJ Bell and Barclays are consistently reasonably priced.