The pound plummeted 4.9% to $1.03 on Monday – its lowest ever level – before regaining some ground to $1.08. Sterling is now down more than 20% against the dollar this year.

Yet despite the scale of the fall – which has been attributed to chancellor Kwasi Kwarteng’s mini-Budget and unfunded tax cuts – there are concerns that the pound has yet to bottom out.

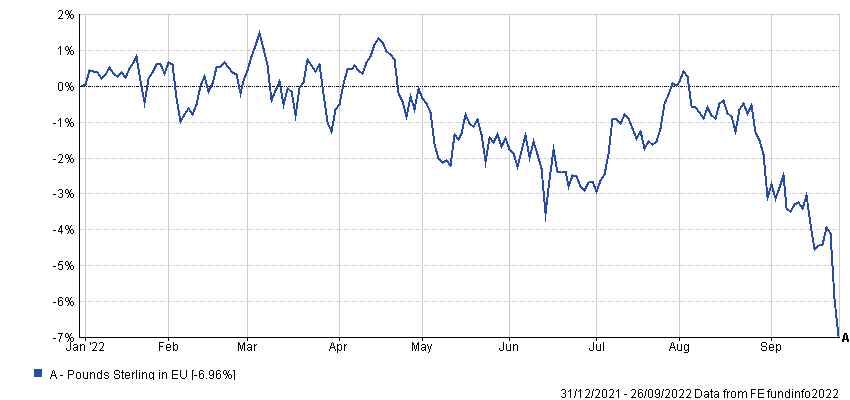

Performance of currencies in 2022

Source: FE Analytics

In a Twitter post, former secretary of the US treasury Larry Summers claimed the value of the pound could soon fall below that of the dollar and euro.

“I was very pessimistic about the consequences of utterly irresponsible UK policy on Friday,” he said. “But I did not expect markets to get so bad so fast.”

While the most obvious way in which the falling pound affects us can be seen when we travel abroad and find our money buys us less, Sarah Coles, senior personal finance analyst at Hargreaves Lansdown, said there are far more serious implications to the weakening of the currency.

“The plunging pound is effectively picking our pockets and making us poorer,” she explained.

“The market reaction to the tax and spending plans announced on Friday will have a profound impact on everything from the cost of filling up the car and supermarket prices to debt repayments and the value of our savings.”

Below, Coles reveals how the falling pound will affect the way we spend, invest and save.

Spending

The analyst began by pointing out the price of anything that is listed in dollars – including oil – has suddenly become more expensive for Britons.

“It means that despite the fall in the global oil price, we’re not likely to feel the benefit at petrol pumps in the UK,” Coles explained.

“Likewise, anything bought in from overseas will be more expensive. It will affect everything from components and raw materials to supermarket staples and a vast array of high street basics.”

She added: “These rising costs will feed into higher prices and push inflation even higher. For anyone whose budget was already stretched to breaking point, this will mean even more pain at the tills.”

When it comes to planning a journey abroad, Coles said holidaymakers will now have to prepare to pay more or consider scaling back their plans. This doesn’t just apply to trips to the US, as the pound has fallen against a range of currencies, even those that have problems of their own such as the euro.

Performance of currencies in 2022

Source: FE Analytics

“You can still make an enormous difference by shopping around for the best possible exchange rate,” Coles said.

“Whether you choose a current account or credit card with no overseas fees or buy your currency in advance for a better deal, you can get far more for your money than if you exchange it as a last-minute afterthought at the airport.”

Investing

The impact on your investments will depend on what you hold and where those companies make their money. While your first thought may be to shy away from the UK market, Coles pointed out that the FTSE 100 tends to benefit from a weak pound, as it is full of multi-national companies that earn most of their money from overseas. This will be worth more when it is converted back into sterling.

Rob Burgeman, senior investment manager at RBC Brewin Dolphin, said the ideal companies to own are those that manufacture in a weak currency, such as sterling, and sell on in a strong currency – at the moment, predominantly the dollar.

“Similarly, companies that have significant sales abroad, but report in sterling, also should benefit. While not as spectacular as the first category of companies, these will often manufacture and sell locally, so their net profits will be commensurately higher when reported back in sterling terms.

“The effect currency can have on investments is just one of the reasons why we would always recommend taking professional advice before making any significant financial decisions,” he explained.

Burgeman named pharmaceuticals AstraZeneca and Haleon, consumer staples manufacturers Unilever and Reckitt, and alcoholic beverage group Diageo as examples of UK-listed companies that will benefit from the weaker pound.

It is not all good news, however, with Coles pointing out that any business that makes its money in the UK is likely to face challenges.

“Retailers and other businesses that buy goods in from overseas face rising costs,” she said.

“They can try to pass the higher cost of imported goods on to consumers, or they can try to cut their operating costs, but the speed with which sterling has fallen is going to make life horribly difficult. That's why the more domestically focused FTSE 250 is likely to be more sensitive to the weaker pound.”

Saving and borrowing

Because the falling pound is likely to push inflation higher, savers will see the real value of their money erode faster.

“If you leave your money languishing in a high street easy-access account paying less than 0.5%, runaway inflation will very quickly consume the spending power of your cash,” said Coles.

“The Bank of England is expected to counter higher inflation by raising rates, which will feed into better savings deals, but it would have an awful long way to go before closing the gap on inflation.”

Coles said this means it is more important than ever to shop around for the most competitive deal on your easy-access savings. You should also consider whether it makes sense to fix money you won’t need for the next year or so in return for a better rate. The best one-year fixed rate is currently 3.5%.

There is bad news for borrowers on variable deals, however.

“Many credit card companies reserve the right to push up rates when the cost of doing business rises, so keep your eye out for notifications,” the analyst continued.

“Within the mortgage market, more than three quarters of people are protected by fixed-rate deals. However, for anyone whose deal is expiring or on a variable rate, higher rates will add significantly to their monthly costs."