Many companies that are resilient to inflationary pressures are being overlooked by investors, according to Steve Wreford, manager on the Lazard Global Thematic Equity team.

He is a strong believer that inflation will remain far above expectations over the next decade, so much so that he launched the Lazard Thematic Inflation Opportunities fund earlier this month to prepare for the coming period.

The market is pricing in that inflation will be around 2.8% over the long run, but Wreford pointed out that inflation in the US averaged 7.3% in the financial crisis between 1968 and 1982.

“To go from a market expectation of 2.8% to a period where you may see inflation reaching the levels of the 1970s is an absolutely enormous shock to the system,” he said.

“I don't know what the level of inflation will be over the next 10 years, but I do believe that the market is materially under-pricing the risk that it will be a lot higher than that.”

Investors don’t need to look far to find inflation-resilient companies trading at decent prices. Many large-cap global businesses have durable business models that have not yet been recognised by the wider market.

Wreford said: “Our strategy is all about finding undiscovered gems and that doesn't necessarily mean going into smaller companies.”

Some companies such as Microsoft have been grabbed up by investors who have realised the security it can offer in an inflationary environment, but Wreford has avoided it.

It is expected to face wage inflation from a shortage of skilled employees, but the strength of the Microsoft’s brand means it can push this increase on to consumers without losing much custom.

Despite this, Wreford has steered clear, stating: “That ability to pass through prices is what I would describe as a simplistic pricing power, but everybody knows that and that’s why Microsoft is valued the way that it is.

“It's a perfectly reasonable, compounding, long-term company that you could own for many years, but it doesn't have the undiscovered aspect that we're looking for in inflation opportunities.”

Instead, he has allocated towards other companies benefiting from the loyalty that consumers have to their brand, such as Coca-Cola and McDonalds.

Both have a franchise model, so many of the price increases to their operating costs do not hit either company directly.

“The franchisee who owns a McDonald's restaurant has to absorb higher wage costs and higher input costs, so as revenues go up, that just improves the picture for McDonalds,” Wreford explained.

Despite this outflow-reducing dynamic, the share prices of McDonalds and Coca-Cola are down 9.1% and 2.3% respectively in 2022, suggesting that many investors do not see the appeal.

Share price of Coca-Cola and McDonalds in 2022

Source: Google Finance

Another example of companies that relieve cost pressures through consumers are Visa & Mastercard, which have a more direct link with inflation.

Both companies charge around 3% from each payment customers make through their service, which could mean a higher income if prices are going up.

Wreford said: “If your overall basket of goods is going up by 20%, then so is the amount that Visa or MasterCard get, and they don't have to do anything for that at all. The Visa and MasterCard networks have already been built, so that provides a great inflation hedge.

“Actually, there are rare examples of companies that do better in an inflationary environment.”

Again, both MasterCard and Visa are down 20.4% and 17.2% respectively this year, indicating that the market does not see a benefit from these inflation-hedging characteristics.

Share price of Mastercard and Visa in 2022

Source: Google Finance

Contractual companies are another area that Wreford has focused on – not only can they increase the cost of their services onto consumers, but their contracts can lock customers into a fixed plan and ensure long-term income.

There “tend to be quite boring companies” within this contractual theme, such as Waste Management, but their inflation-hedging potential has largely been overlooked by the market, according to Wreford.

He added: “If they see higher input costs, higher wages, and higher energy costs, then they can just pass that through contractually. That hasn't been necessary in recent years because inflation was so low – it's only recently that those companies have suddenly come into their own.”

Waste Management’s share price is up a modest 1% in 2022, which may have been boosted by a positive report in the second quarter when it revealed a 12.3% increase to total revenues year-on-year.

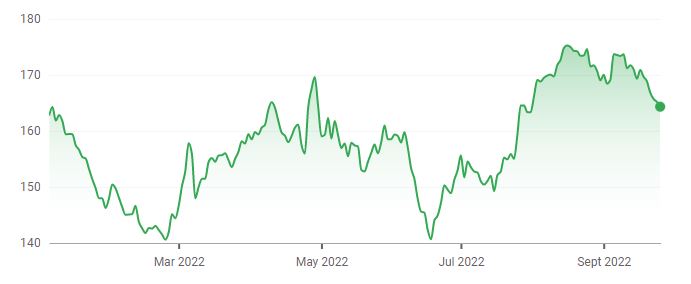

Share price of Waste Management in 2022

Source: Google Finance

Wreford has put a lot of conviction into inflation remaining high for longer than the consensus forecast. However, he has selected stocks that could do well if his predictions fall short, even if performance is not as high as he’d hoped.

Wreford said: “We could be wrong, and if we are, then our hope is that we still own a perfectly reasonable set of stocks in the portfolio that could deliver similar returns to that of the market.

“However, if we're right, and inflation is significantly higher than forecast, perhaps up at that very high level of the 1970s, then the set of securities ought to materially outperform versus the rest of the market.”