After the recent turmoil in the gilt market and sterling’s precipitous fall against the dollar, UK investors might be wondering how much value is left in the UK market and where.

According to Ian Lance, co-manager of the Temple Bar Investment Trust, momentous crashes are often the result of overreactions or extrapolations from investors’ side – be it in the fixed income or equity space.

Below, he discusses how he tries to exploit these “overreactions” in the UK equities market, why he won’t invest in department stores and why there is a lot further to run for energy stocks.

Can you sum up your investment process?

We believe that, when things are going well, investors tend to assume that they are going to stay that way and will overvalue investments, and when things are bad they have a tendency to undervalue them; so we try to identify areas of the market where investors are overreacting and therefore mispricing companies.

Once we have identified an area and a stock, we calculate the intrinsic value of the business, typically looking for share prices that are half the intrinsic value, in order to catch 100% upside.

At that point, we will buy the stock slowly, scaling into it, and we're willing to hold it for a long period of time.

What are the areas where investors are overreacting at the moment?

Cyclicals would be one. People are pricing a recession as if companies’ earnings are going to go down and never recover again. But in my 33 years in the job I can't remember a single economic cycle that went down and didn't recover. The clue is in the title, it is called a cycle for a reason.

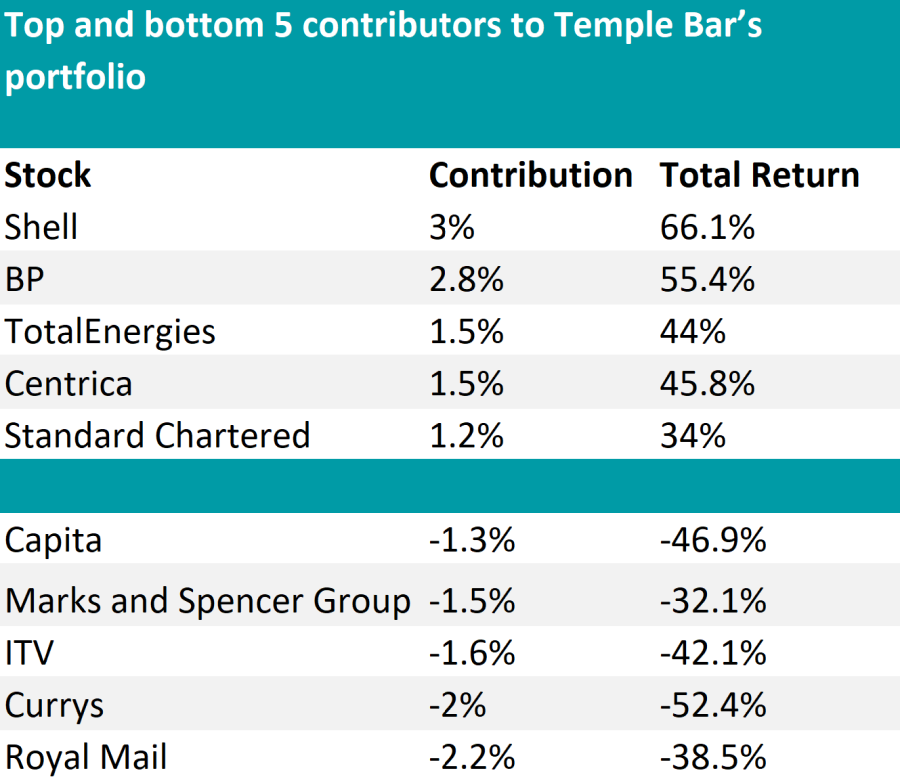

What were your best and worst calls of the past year?

The worst stock over the past year has been Royal Mail. Its UK business is encountering opposition from the unions as it tries to change working practices in order switch from a letter-focused enterprise to parcels. Currently, it’s losing about a million a year.

But we see potential in its European parcel business, GLS, which makes about 7% margin and grows at about 9% per annum, making at the moment about £350m a year.

The best calls have been the energy stocks, which, at around 21%, make up the biggest sector within the portfolio. We own Shell, BP and Total and they’ve done really well in this conjuncture.

Source: Temple Bar Investment Trust

Do you think this performance will continue?

I do and my conviction has to do with the decreasing amount of investment these companies are doing.

Back in 2013, the industry’s exploration expenditure – so the money spent trying to replace its production – was about $600bn a year. Today, that figure is down to $250bn a year. And we know exactly why that is, companies have been responding to requests to cut back investment in fossil fuels.

The trouble is that people expected, perhaps foolishly, that demand would go down at the same rate as supply. If you're not going to replace your production then supply must go down, as it actually has, but demand hasn't.

At today’s stage demand and supply are very tightly balanced, which was driving oil prices up even before the war with Ukraine, and the profits of these companies went up. At the moment, we don’t see changes to this picture, far from it.

Are there any sectors you won’t invest in?

We only rule things out on intrinsic value arguments. We don’t invest in department stores, because we think that’s an industry in decline. We also question commercial property, of which we think there’s too much, given the current working-from-home arrangements and hybrid models, which aren’t likely to change, in our opinion.

And lastly, tobacco might also look cheap, but people are smoking less and higher cigarette prices won’t continue to offset lower volumes for much longer.

Performance of trust against sector and index over 1yr

Source: FE Analytics

How do you use gearing?

We are conservative investors, we don’t want be taking on too much risk and having to become forced seller of assets at the point where you want to be buying assets. So we never take gearing above 8%, which we think is our neutral position.

At the beginning of the year people were still pretty positive about things and we started feeling a bit nervous so took some gearing off. As the market later came back quite a long way, we put half of the gearing back on and we'll probably put some more, if things carry on being as weak as they are at the moment.

What do you make of the current turmoil in the UK market?

I think there's been a large-scale overreaction over the last couple of days. I can see that people are concerned about government debt going up, but I don't think it was a significant as seems to be suggested by the sort of sell off in the gilt market.

And on sterling: there are there are two positives from sterling weakening. One is the competitiveness point of view; the other that lots of our companies in the portfolio have revenues in dollars, and so do many FTSE companies, which are getting big upgrades.

I really am sitting here scratching my head wondering why the market is punishing them when sterling going down equals their earnings going up.

What do you do outside of fund management?

My three children are grown up but still keep me reasonably busy, and so does my Portuguese water dog. My wife and I do open water swimming and take part in a few competitions.