Ruffer Investment Company has taken its equity weighting to the lowest level in almost 20 years, with just a quarter of the portfolio invested in stocks.

In its final results for the year to June 2022, managers Duncan MacInnes and Jasmine Yeo said the “particularly dangerous period” we are currently living in has caused them to reduce risk in the portfolio, including dropping its stock allocations to just 25%, the lowest since 2003.

They have also increased the portfolio’s duration to offset the rise in bond yields and have switched from gold equities to bullion, despite noting that the asset had been a “failure of conventional safe havens in recent times”.

“Despite inflation and war being front page news, gold has misfired. We still think it has a valuable role to play, but this greater correlation with risk assets is a consequence of gold’s increased financialisation,” they said.

The changes were announced in Ruffer Investment Company’s full-year financial results, in which the trust reported a share price total return of 5.6% for the 12 months to June 2022, while the net asset value was up 6%.

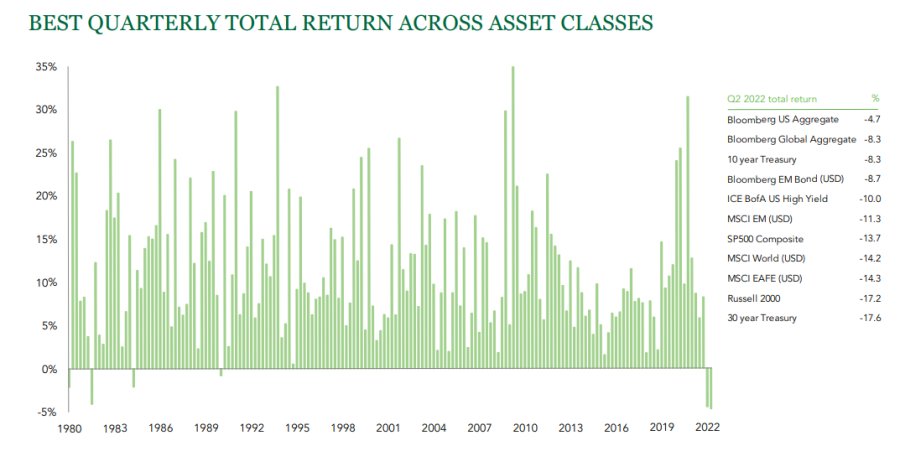

However, the managers noted that the first half of 2022 had been particularly challenging for investors, who have had nowhere to hide since the start of the year. Since the turn of the year, even the best asset class making a loss, as the below chart shows.

Source: Ruffer

“History shows how rare it is that there was nowhere to hide. However, this wasn’t an anomaly – the second quarter was worse,” the managers said.

It means that, for the first six months of the year, a traditional 60:40 portfolio split between global equities and bonds was down around 17%. Conversely, the trust made a gain of 2.9%.

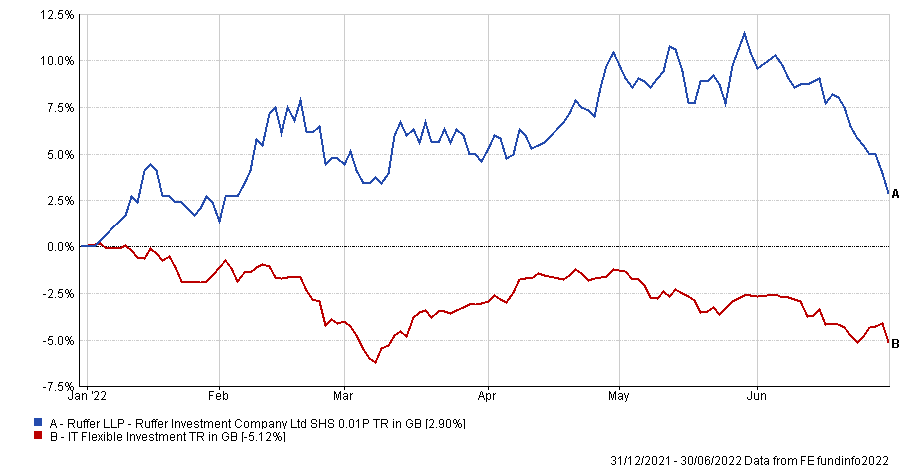

Total return of trust vs sector over 6 months

Source: FE Analytics

“With nowhere to hide in conventional assets, it is no surprise that it was the portfolio’s unconventional protective assets that drove performance in the first six months of calendar year 2022,” said the managers.

Interest rate options and equity puts via the Ruffer Protection Strategies fund added 4.4% of performance, while credit protection was used as a hedge to rising interest rates.

However, as fears of recession grew in the latter half of the period, the trust was hampered by its exposure to the auto manufacturing sector with Volkswagen (down 25%) and General Motors (45%) together costing the portfolio -0.5% in overall performance.

Meanwhile, the “political omnishambles” in the UK meant that the trust’s exposure to mid- and small-caps detracted 0.4% overall.

“The carnage in the long-dated inflation-linked bond market should also not be understated. These assets cost the portfolio 6% and the 2073 index-linked bond was down as much as 54% from its November 2021 all-time high,” the managers said.

“We have long called these assets the ‘crown jewels’ in our portfolio due to our conviction that they should provide the perfect protection in the world of financial repression we are entering. We are still of this view. But the sensitivity to rising rates we have warned about, has now been felt.”

While the managers said they have “never had higher conviction on the long term”, they conceded that the short term is “far murkier”.

The new regime of higher inflation volatility will be akin to after the second world war, but the staccato nature of higher growth and inflation will be driven by government stimulus.

“The great moderation of inflation, growth and geopolitics enjoyed over the past 40 years is over,” they said.

However, while inflation is desirable as a control for debt, too much is a problem so in the short term there will be no good choices and central banks and governments face an “impossible tightrope”.

Tighten conditions too much and unemployment will surge and recession will seem more likely, while not tightening enough could lead to a wage-price spiral

All of this suggests that inflation will remain “surprisingly and persistently high” for some time, suggesting now is not a time to risk capital and making cash look like a good tactical play.

“There are times for a get rich portfolio and times for a stay rich portfolio. We believe this is the latter. There will be better moments and better prices in the future,” MacInnes and Yeo said.