Global trusts were some of the biggest benefactors of the growth wave that dominated throughout the 2010s, loading up on US tech companies that soared.

In the past five years alone, the IT Global Equity Income and IT Global sectors have delivered investors a total return of 30.3% and 21.4% respectively.

However, both the sectors have suffered from the rotation towards value this year, with IT Global down 20.8% and IT Global Equity Income falling 7.7% in 2022.

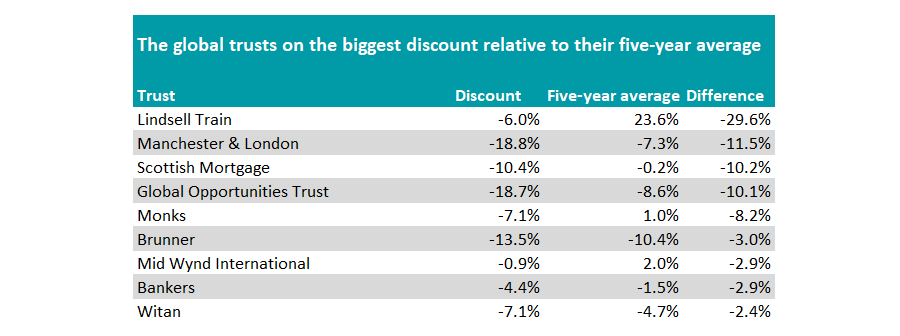

Trust prices have followed suit, with many of the portfolios that outperformed for much of the past cycle now trading at large discounts.

Here, Trustnet reveals the IT Global and IT Global Equity Income trusts trading at more than a 2 percentage point discount to their five-year average. We also stripped out trusts with less than £100m in assets under management (AUM) as their discounts can be much more variable.

Source: QuotedData

Lindsell Train is currently selling at the biggest discount relative to its five-yea\r average, with investors able to grab the portfolio 29.6 percentage points cheaper than its five-year average price.

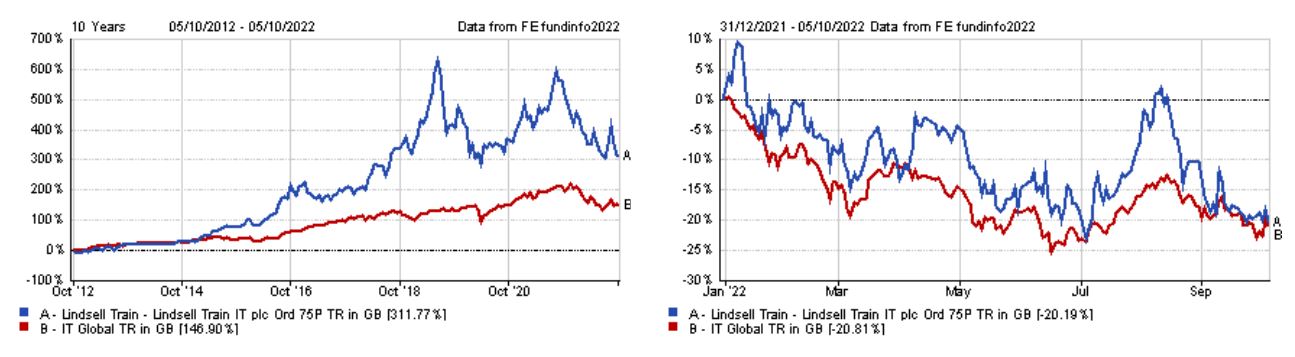

It was the second-best performer in the IT Global sector over the past decade, making a total return of 311.8%, but the trust is down 20.2% since the start of the year.

It sold at an average premium of 23.6% versus the net asset value (NAV) over the past five years, but this has fallen to a 5.6% discount as performance has tumbled.

Total return of trust vs sector over the past decade and in 2022

Source: FE Analytics

James Carthew, head of investment companies at QuotedData, said the trust was “bathing in the success” of Nick Train’s strategies for many years, but that too much relies on the shoulders of one man.

Not only does it possess a lot of “key man risk”, but the large premium was inflated by an unsustainably high volume of inflows, which is now balancing out as investors sell their holdings in the trust.

Carthew added: “We have long argued that, while the management company was undervalued in the NAV, Lindsell Train should not have achieved the massive premium heights that it did. At its peak, Lindell Train’s premium was approaching 90%, which was far too high in our view.”

The other two global trusts on the biggest discounts are Manchester & London and Scottish Mortgage, which are trading 11.5 and 10.2 percentage points cheaper than their five-year averages.

Total return of trusts vs sector in 2022

Source: FE Analytics

Carthew said that these are the two portfolios that investors most associate with growth investing and technology stocks, hence the massive sell-off as sentiment dwindles.

Contrastingly, Alliance Trust, F&C Investment Trust and Securities Trust of Scotland are less exposed to high-growth themes and are more expensive than their five-year average price.

Of all the portfolios examined, the Securities Trust of Scotland was the only one to trade at a premium – it is selling 1.6% higher than its net asset value (NAV), compared to an average 3.2% discount over the past five years.

The trust is down 3% in 2022 but is performing 4.7 percentage points better than its peers in the IT Global Equity Income sector.

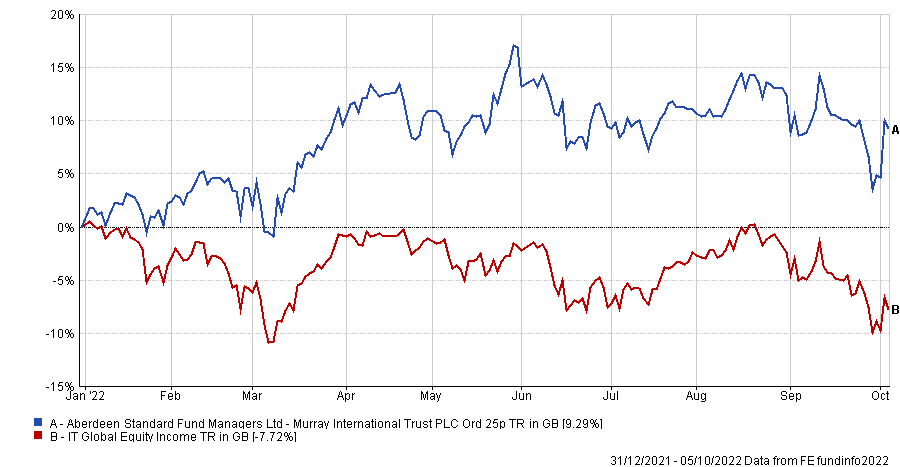

The only portfolio to make a positive return in the sector this year was Murray International, up 9.3%.

Total return of trust vs sector in 2022

Source: FE Analytics

Despite this substantial outperformance, the trust’s discount is 4.1 percentage points cheaper than its five-year average.

Carthew said that investors “are yet to cotton onto its improved performance”, so a higher re-rating can be expected once its high returns are realised by the wider market.

The trust has not followed the crowd into popular stocks that trade at inflated prices, according to Juliet School Latter, research director at FundCalibre.

She said that this has left the portfolio full of “sustainable, long-term growth opportunities where valuations have yet to reflect widespread popular recognition”.

The trust’s managers were also earlier than their peers at predicting central bank’s quantitative easing measures, so its holdings are well poised for a period of tighter monetary policy.

School Latter added: “The companies in the portfolio should be better able to weather market volatility and higher inflationary environment. I think it’s a good long-term holding, which offers investors some unique characteristics.”