The use of index funds has been called into question on countless occasions, but the evidence and rationale in support of using low-cost index-trackers to provide diversified access to global equity and bond markets has always stood up to the challenge.

That’s not to say there is no case for active. Although Vanguard is synonymous with index investing, our roots are in active management – our fund line-up when we launched in 1975 comprised 11 active funds – and it is probably our best kept secret that we’re one of the largest active investment managers in the world.

We think that gives us a good perspective on the active-versus-passive conversation and we believe that low-cost active funds have a place for investors comfortable with the risk of underperformance in pursuit of alpha.

At the same time, we see three main reasons why low-cost index funds can form a core holding in many investment portfolios: the zero-sum game theory, the effect of costs and the difficulty of persistent outperformance.

Zero-sum game theory

At the heart of index-fund investing is the zero-sum game theory, which states that, in short, for each position that outperforms the market, there must be a position that underperforms the market by the same amount, meaning the excess return of the aggregate of all active positions equals zero.

In other words, before costs, a total-market index fund provides the performance of the market while the likelihood of active funds beating the average market return is ‘just’ 50%.

Effect of costs

The zero-sum game describes a theoretical cost-free market, which isn’t reflective of reality. Hence, after costs, the likelihood of beating the market simply by chance is, by definition, less than 50%.

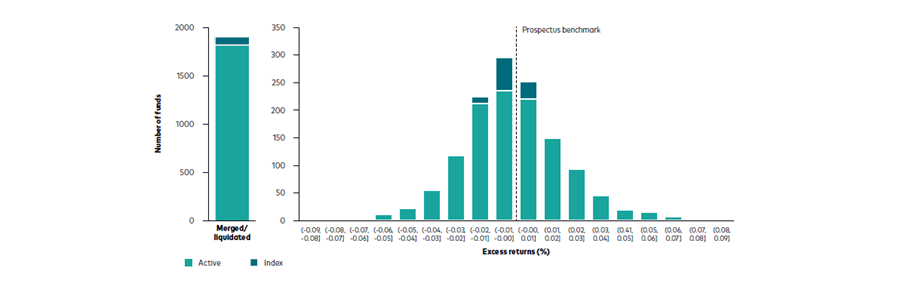

This point is illustrated in the chart below, which shows the distribution of returns in excess of their benchmarks for all equity mutual funds and ETFs available for sale in the UK, net of fees, over a 15-year period to the end of 2021.

Distribution of UK equity funds and ETFs’ excess returns

Source: Vanguard

The data captured in the chart includes assets invested in mutual funds and ETFs, so it doesn’t cover the whole market, but the overarching message holds true: the majority of funds analysed failed to deliver excess returns after considering costs in the form of expense ratios over the period. The results were similar for UK fixed income funds and ETFs. In short, costs eat into investor returns and make after-cost outperformance more difficult. The higher the cost, the harder it becomes to outperform.

Persistent outperformance is scarce

We’ve established that outperformance is difficult with net excess returns often less than zero, but what about the active funds that do outperform? How consistent is their performance?

We analysed performance persistence across all active equity funds available in the UK over a 10-year period ending 31 December 2021 and found that only 26% were able to maintain a top-quintile rank from the first five years in the second five-year period.

Hence, while not impossible, consistent outperformance is very difficult to achieve. What’s more, our research finds that the majority of funds that do outperform their benchmark in the long run underperform for a number of years until they finally beat their benchmark, meaning investors need to be patient to allow alpha to materialise over the long-term.

Active or index? The answer is low cost

At Vanguard, we know there are talented active managers out there capable of delivering persistent net outperformance relative to their benchmark or the wider market. That’s why our considerations are not based on absolutes but on likelihoods – and the likelihood of persistent net outperformance hinges on the manager’s skill, fund costs and the investor’s patience.

The zero-sum game combined with the drag of costs on performance creates a high hurdle for active managers in their attempts to deliver net outperformance. This hurdle grows over time and can become insurmountable for the vast majority of active managers.

As a result, for most investors, a low-cost, total-market index-tracker fund represents an ideal core holding. However, if an investor wants to invest in pursuit of market-beating returns and is comfortable with the risk of underperformance, we think a well-diversified, low-cost active fund could add value to their portfolio over time.

Jan-Carl Plagge is head of active-passive research at Vanguard Europe. The views expressed above should not be taken as investment advice.