The past three years have been a taxing time for many markets around the world, but perhaps no more so than in the UK, where political instability, a lack of global technology innovators and disappointing economic growth have led to an uninspiring market.

Yet there are pockets of excitement. Oil and mining stocks, once viewed as old economy dinosaurs, have returned to the fore, taking the place at the top of the tables from quality-growth companies that have thrived over the past decade on low interest rates and anaemic growth.

This rotation has caught most by surprise and has left fund managers that were once at the top of the tree now languishing at the bottom.

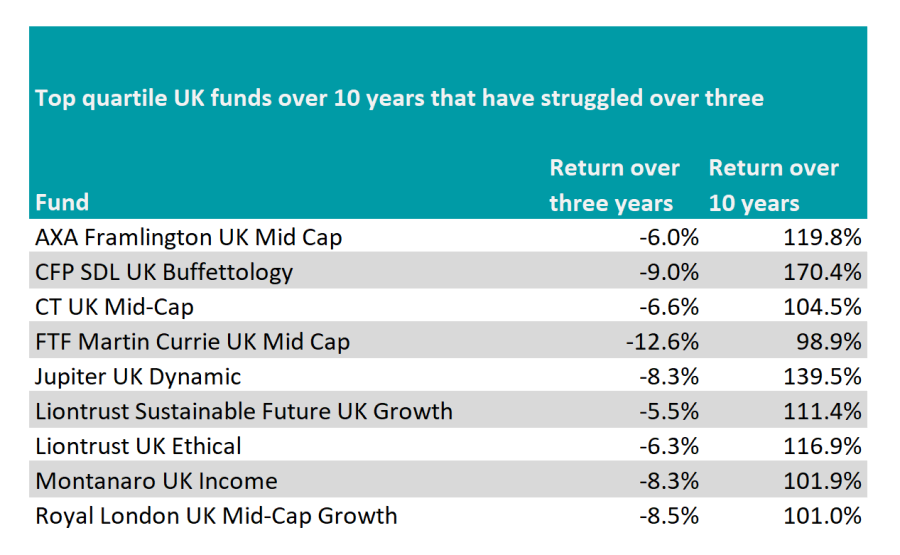

Indeed, below is a table of the UK equity funds that have made top-quartile returns over a decade, but have suffered over the three years.

Source: FE Analytics

The predominant theme among these portfolios is mid-caps, which were hit hard during both the Covid pandemic and the subsequent rotation to value.

During the pandemic, investors moved away from these stocks as they are perceived to be riskier than their large-cap counterparts. It was hoped that smaller companies might rebound after the pandemic, but rising interest rates, political instability and slow growth has impacted their returns.

Yet these funds have performed well over a decade, suggesting that over the long term there are reasons to be optimistic.

However, when Trustnet asked fund pickers which portfolio from the above list they expect to come through the current market volatility with the best potential for future growth, the top pick was not a mid-cap fund.

Instead, Liontrust Sustainable Future UK Growth got the nod. Gavin Haynes, director at Fairview Investing, said that it was not surprising that the portfolio had struggled over the past few years, particularly in 2022, as the growth themes have taken a backseat to the likes of fossil fuels, mining, tobacco and arms stocks – none of which fit the fund’s philosophy.

“A recent meeting with lead manager Peter Michaelis reinforced my belief that this fund can revert back to its longer-term impressive track record. The focus is on generating superior returns by investing in sustainable companies and themes haven't such as decarbonising the energy system and resource efficiency are here to stay,” said Haynes.

The portfolio was also the pick of Ben Williams, head of fund research at Saunderson House, who said that he liked the fund’s three main pillars: cleaner (using resources more efficiently); healthier (improving the quality of life of people around the world; and safer (making systems we rely on more resilient).

“This leads to core portfolio of high-quality growth companies, allied with smaller holdings in niche ‘adaptors and innovators’, that are capitalising on change, accessing new markets and also growing strongly,” he said.

It also tends to lead the managers towards small- and mid-cap stocks, which, as mentioned above, have struggled versus their large-cap peers.

“Having arguably hit valuations last year that were looking rather expensive, a number of the funds’ top holdings have retraced significantly and now trade on more earnings and cash flow metrics,” Williams noted.

“We therefore believe this offers an attractive entry point to a portfolio exposed to a wide range of sustainability themes, and irrespective of its sustainable investment philosophy, a fund offering structural ‘growth at a reasonable price’.”

Louis Tambe, senior investment analyst at City Asset Management, said for investors who wanted an alternative selection, the Jupiter UK Dynamic fund also makes for an interesting option having gone through a particularly tough period.

Despite not being a dedicated mid-cap fund, it too has been hampered by its allocations further down the market capitalisation spectrum.

“This has been one of the hardest hit areas this year due to a combination of worries around UK inflation, economic slowdown and more recently the chaos surrounding our government,” he noted.

Manager Luke Kerr came into the year with a positive outlook on the asset class and a relatively cyclical portfolio, but despite “wrong-footed”, Tambe noted that the manager is “using all the tools available to him in his flexible process” including short positions as well as run high cash levels.

“The cyclical positions have been cut and he is shorting some structurally challenged companies and those with high debt levels which remain expensive in his view,” he said.

Additionally, on the long side, Kerr has focused the portfolio on quality companies with strong balance sheets, where the market is already pricing in severe earnings falls.

“This has resulted in outperformance of their FTSE 250 (excluding investment trusts) benchmark during falling markets in September, but lagging performance whenever there is a market bounce as we have seen so far in October,” Tambe said.

“We would expect this trend to continue in the short term (outperformance if markets remain challenged) and given the cash available for him to start buying companies on ‘fire-sale’ valuations to be well-set for future outperformance when we start looking through the current negativity.”