Now “may be an interesting time to invest” in the £924m AVI Global trust, according to Numis analysts, after the firm revealed its final results for the year to the end of September.

The analysts had a positive view after returns impressed despite the headwinds generated by a widening portfolio weighted average discount – or the difference between the intrinsic value of the underlying assets to net asset value (NAV), which went up from 29% in September 2021 to 38% today.

These discount levels are in line with previous periods of market stress and an expected outcome of the current environment characterised by persistent inflation, they said.

But the trust’s NAV only declined 7.3% on a total return basis over the year to the end of September compared with a 9.6% loss made by its benchmark, the MSCI AC World ex-US index.

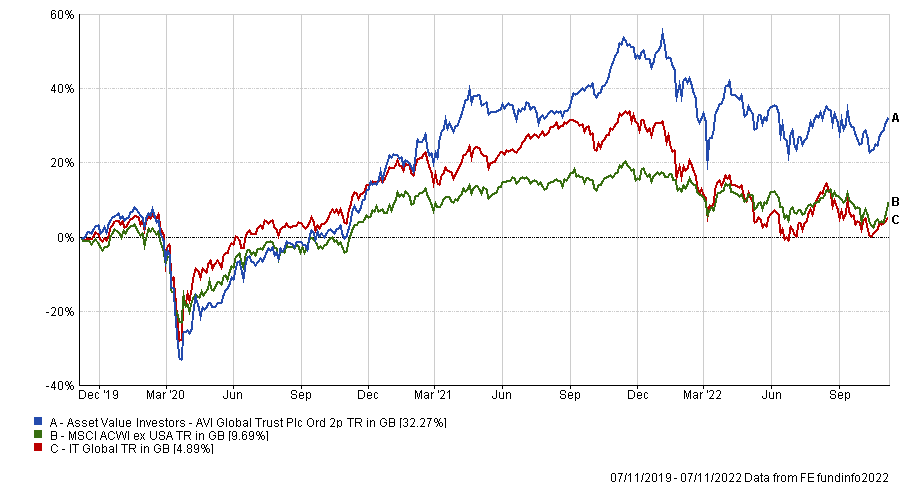

This contributed to it being one of the strongest performers in the IT Global Equity peer group over the past three years, as shown in the graph below and was attributed to manager Joe Bauernfreund’s value approach, which has blossomed this year as more growth-orientated strategies have struggled with rising inflation and interest rates.

Performance of fund over 3yrs against index and sector

Source: FE Analytics

The trust has an “interesting and differentiated mandate”, according to the analysts, as it typically focuses on overlooked and under-researched stocks that offer attractive value with a potential catalyst to narrow the discount, while also working to improve corporate governance.

Bauernfreund is using the current environment to extract value through his active approach and the use of gearing, which the manager will deploy “in due course” to help drive long-term returns, they noted.

Indeed, in the investment managers’ part of the annual financial report, Bauernfreund said there were numerous opportunities ahead, despite the negative backdrop.

“As a global fund, we will always be correlated with broader markets. With that said, our experience shows that discounts widening and panic provide opportunities. Valuations – both within the portfolio and our wider universe – are increasingly attractive,” he said.

“Through our own activism there is scope for unlocking value, independent of the broader market. This will play an increasingly important role in our returns in an uncertain world, and with the opportunity to deploy gearing in due course, we remain confident in our ability to take advantage of this and drive attractive long-term returns.”

Bauernfreund also highlighted how the trust’s active engagement in positions such as Fondul Proprietatea and DTS have resulted in such companies becoming the largest positive contributors in the portfolio. The returns on the two investments since the initial purchase was 133% and 34.2%, respectively.

“Such engagement and other types of idiosyncratic opportunities can generate absolute returns regardless of the performance of broader markets. This is an increasingly relevant part of our arsenal, particularly during periods that are less hospitable for equities en masse,” he said.

“Our portfolios are constructed from the bottom up, based on fundamentals and the prospects for NAV growth and discount narrowing. We see little merit in trying to time markets and wholly subscribe to the adage that it is time in the market, not timing the market, that matters. As such, we typically aim to stay more or less 100% invested at all times.”

AVI Global also announced the appointment of Graham Kitchen as its new chairman. Kitchen will step up from his position as non-executive director following the forthcoming annual general meeting on 20 December 2022.