In a feature published last week, data by Hargreaves Lansdown showed that the UK has been the best dividend-paying region over the past 10 years, but will it be able to maintain its primacy in the next 10, or will another region move ahead of it?

While nobody knows what the future will hold, we have crunched the numbers in search of clues.

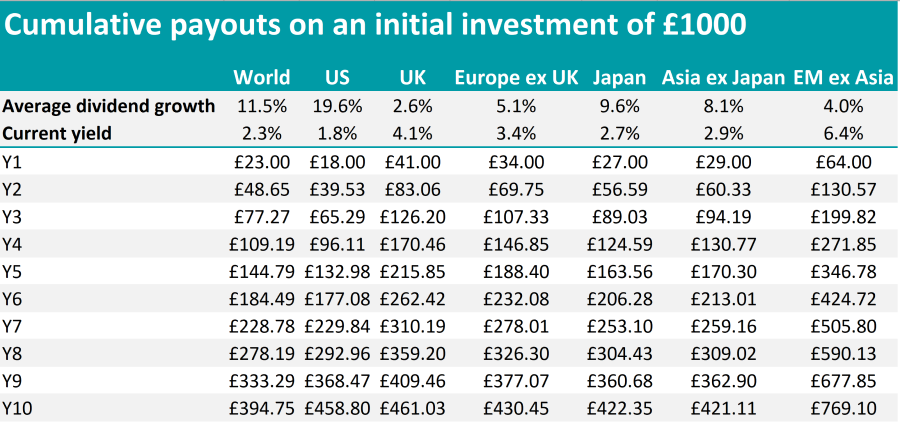

We started with Datastream data from Brewin Dolphin on current dividend yields and 10-year dividend growth. By putting these two figures together, we calculated how much income an investment of £1,000 could make for someone over 10 years, in a hypothetical scenario where dividend growth and share prices remained the same.

Source: FE Analytics

The data suggested that emerging markets will come out on top. Neil Denman, manager of the Sarasin Global Higher Dividend fund, was surprised by the results.

“It is astounding how close the developed market cumulative payouts have become after 10 years. The table highlights the importance of total return and compounding. Year-on-year, annual income from US equities is the same as emerging markets,” he said.

However, if he had to choose, he “would opt for the US every time”.

“The US dollar is the central bank currency of the world. The growth in dividends is supported by several factors, including lower payout ratios, a strong culture of research and development, and robust balance sheets – specifically in sectors such as healthcare and information technology.”

He said you also need to take into account the different risks that come from relying on emerging markets, such as currency fluctuations and ESG failings.

“I would question whether a 4% dividend growth rate keeps up with inflation rates in emerging markets, as the real value of this income stream may be lower than the £769 presumed, due to the above risks,” Denman added.

“For total returns, it is prudent to take a global approach and to keep in mind the power of compounding the US offers. The liquidity in the US market is an additional reason for greater exposure to the region versus emerging markets,” he concluded.

Rob Morgan, chief analyst at Charles Stanley, pointed out the central question of this article was flawed, as it would be foolish to take a major bet on one market.

“The cheat answer is that you want elements of all regions, as they all bring something a bit different in terms of income profile and industry make-up,” he said. “Often it is best to have a lower starting yield and superior growth, but steady and predictable dividend compounders are also a valuable component of a portfolio. The former favours US, Japan and Asia, the latter Europe and (especially) the UK. A good spread is the best option.”

But in the end, he still went for the UK.

“I do think that a particular opportunity is emerging in the UK market. With only 1.5% in the tech sector, it’s been a poor performer for a long time now, but the ingredients seem to be in place for a period of outperformance. Valuations are low, both relative and absolute, owing to widespread investor disdain,” he said.

“But more importantly, the market may be underestimating the potential for dividend payouts to increase. Earnings are healthy, dividend cover is high and the make-up of the UK market with its skew towards energy, commodities and generally well-capitalised financials should be relatively resilient during a period of rising interest rates.”

Finally, Ben Yearsley, director at Fairview Investing, said he thought Asia was “well placed”.

“It has a growing population, aspiring middle classes, lots of urbanisation and is simply well placed for growth, which is what you need if you want growing income. A growing revenue base leads to growing income,” he explained.

“Asia doesn’t look great on the table, but that would be my pick for the next decade. Most investors have lots of UK income already and Asia is probably the next best thing.”