The UK has been the best place for income over the past 10 years, data from Hargreaves Lansdown has revealed, and it remains the place to be for those looking for dividend-paying stocks.

Investors who chose to invest in the UK 10 years ago have achieved the greatest level of income and the best income growth when compared to other regions.

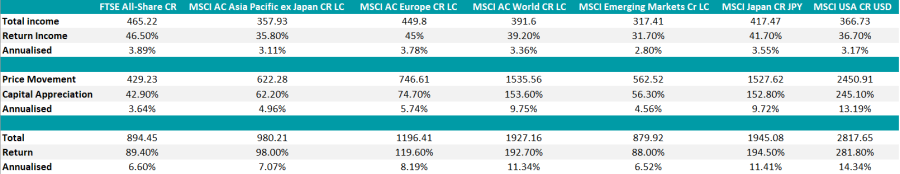

On the other hand, an investor hoping to get an income from the emerging markets had to settle for the lowest pay outs, as the table below illustrates.

Source: Hargreaves Lansdown

In the table, the total income indicates the dividends an investor would have received over a 10-year period, based on the local currency for each region, rebased to 1,000, explained Kate Marshall, lead investment analyst at Hargreaves Lansdown.

“For example, the FTSE All Share return is based on an initial £1,000 investment in the UK, while the MSCI USA return is based on an initial $1,000 investment in the US,” she said.

The return income figure shows the return in percentage terms. An annualised figure is also included, as well as capital (share price growth) and total returns (a combination of income and capital), which have been added for reference.

In total, the FTSE All Share paid out 46.5% of the initial starting pot in dividends over the decade, while the MSCI AC Europe index was second at 45% and the MSCI Japan paid out 41.7%.

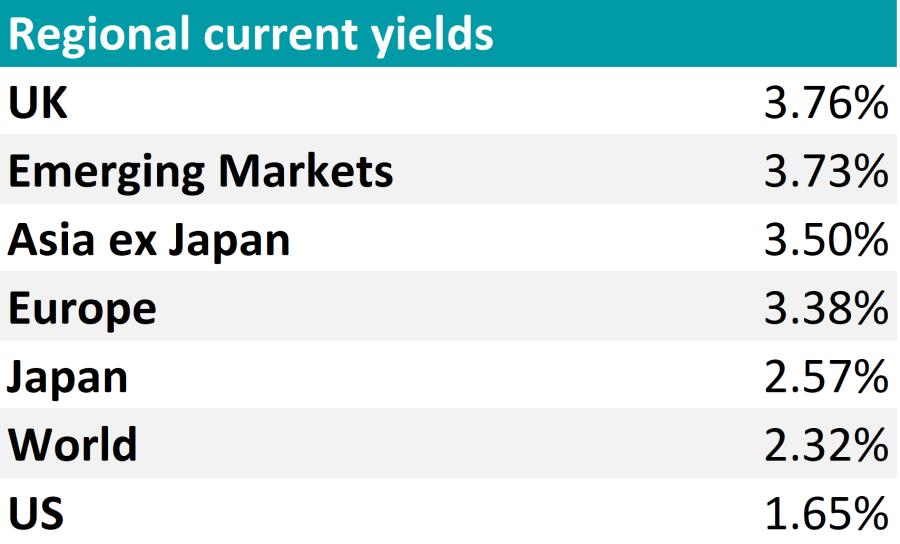

Today, Marshall said the UK is the highest-yielding market and, while it has faced headwinds this year, the FTSE All Share has held up better than most global markets thanks to the high weighting to oil and gas, mining and financials stocks, which have rebounded in 2022.

Source: Hargreaves Lansdown

“The UK is out of favour with many investors, but we expect it to remain a place for income over the long run,” she said.

However, the emerging markets are now on a similar yield and “an increasing number of companies based across Asian and the emerging markets have started to pay dividends over the years”, she noted.

“That said, yields move inversely to share prices, so it’s worth noting that as Asian and emerging stock markets have fallen in value this year, which has caused relative yields to increase.”

While the US is the lowest-yielding market, it is home to several large tech companies focused on growth, so the yield is lower, but the capital returns have been far higher than the UK or emerging markets, as the table highlights.

“It’s worth noting that yields will change over time, depending both on share price movements as well as the level of dividend growth (or lack thereof) from individual companies. While the UK and emerging markets currently look to be the highest yielding markets, the level of income received will also depend on the ability of companies to increase earnings and pay dividends,” said Marshall.

She stressed that these calculations are based on investments made in local currencies, and therefore do not reflect what a sterling-based investor would have received, whose bottom line would be affected by currency movements and tax implications.

The analyst added that dividend growth has been volatile over the time period and from year to year, and that it is not possible to invest in an index, so “this is an entirely theoretical exercise”.