As the European economy slides into a likely recession, investor concerns naturally turn to the consequent increase in corporate debt defaults.

Despite our expectations of a 1.4% Eurozone real GDP contraction in 2023, we believe high yield default rates will only rise moderately. Importantly, at current spread levels, European high yield more than compensates investors for the anticipated default losses.

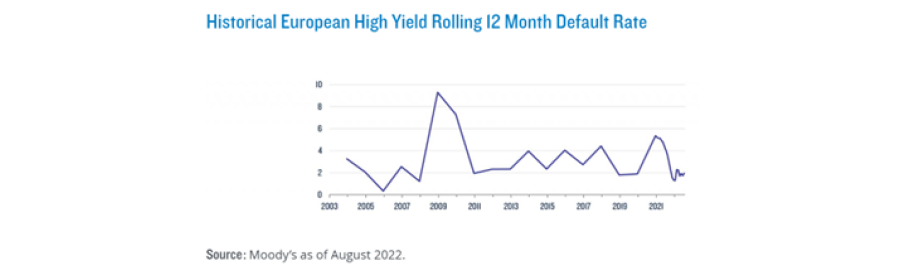

European default rates averaged 2.9% between 2010 through to the end of 2021, compared to 3.6% in US high yield bonds over the same period, according to Moody’s.

Moving to the more volatile period in 2022, European default rates remain contained, with the latest 12-month trailing default rate at 2.1%. Yet, nearly all of this year’s defaults are Russian or Ukrainian issuers, as the Western European-only universe has recorded default rates of only 0.4%.

Some of the more pessimistic scenarios with stickier inflation and a deeper recession estimate a default rate of up to 4% in 2023, which is still well below the 8.3% average during the global financial crisis of 2008-09.

A decade of low defaults

Quantitative easing since 2015 kept default rates low by lowering borrowing costs and supporting valuations. In addition, European high yield bonds benefited from a robust profit backdrop. Recent defaults do not typically mean that bond issuers run out of liquidity or fail to pay. Instead, defaults are mostly restructurings that involve investors accepting a partial haircut on the debt and/or swapping debt for equity.

In addition, the ratings quality of the European high yield index has improved in recent years: 69% of the market is now rated BB, versus 59% in 2010, and 5.1% is rated CCC, versus 12% in 2010. This improved quality supports the expectation of lower default rates in the future.

Even during the pandemic, defaults remained limited, as governments cushioned the shock with widespread fiscal support and capital markets helped issuers with liquidity needs.

Bottom-up default analysis

While the prior economic forecasts may indicate the direction of travel for default rates as the cycle evolves, they provide little information about the prospects of individual issuers or the health of balance sheets. Also, most top-down models do not incorporate the fact many firms have no debt maturities due for several years.

Similarly, most top-down models do not incorporate current levels of inflation, which helps some companies – particularly those with pricing power – by reducing the real liability of their nominal debt stock.

Finally, these models do not count equity support. If shareholders perceive there is equity value in a business, they may support it with an equity injection instead of negotiating with debt holders.

Our credit analysts therefore use company-specific knowledge of European high yield issuers to supplement top-down default estimates. We recently conducted this analysis under three macroeconomic scenarios: moderation, recession, and stagflation, and in doing so, we identified a number of key drivers of our outlook for defaults.

Credit selection can lower defaults

In the economic downturn approaching, we see vulnerability in cyclical and consumer discretionary sectors, such as certain retailer and leisure names and believe opportunities in cyclical sectors lie at a different, earlier stage of the credit cycle.

By contrast, telecoms firms, packaging producers, and utilities appear more insulated due to their pricing power. Avoiding vulnerable issuers and overweighting issuers with pricing power can substantially increase returns.

In addition, we carry higher cash levels at times or use hedges to keep risk at appropriate levels. It is also important to maintain liquidity as volatility presents attractive relative-value opportunities.

Default picture positive for returns

In sum, we expect defaults to remain below external analysts’ top-down forecasts. Second, we expect defaults to stay in-line with historical averages. Even in our most severe downside scenario, we do not expect cumulative four-year defaults to exceed 12% – i.e., we expect them to remain below 3% per year, on average.

These rates remain around historical averages, rather than the higher levels we saw during the global financial crisis of 2008-09 or during the pandemic in 2020-21.

With these default expectations in mind, we think current yield levels, especially in certain non-cyclical sectors, more than compensate investors for expected default losses on a medium-term basis.

Timing markets and entry points into specific asset classes, such as European high yield, is difficult. Yet, as a potential recession and further spread widening approaches, a peak level in credit spreads and all-in yields may lie in the near future. This combination will present an attractive entry point for investors with longer time horizons.

Jonathan Butler is head of the European leveraged finance team at PGIM Fixed Income. The views expressed above should not be taken as investment advice.