Baillie Gifford Positive Change, Lindsell Train Global Equity and Rathbone Global Opportunities are all among the global portfolios managed by FE fundinfo Alpha Managers that won’t cost you an arm and a leg.

Thrifty investors might want to focus on funds with below-average charges without compromising on quality and without having to turn to passively managed vehicles, which are less expensive but are said to have a worse chance of delivering above-average returns over the long run.

As such, Trustnet is running a series looking at the top-rated managers charging the least for their portfolios. Previously, we looked the IA UK All Companies.

In the 526-strong IA Global sector, there are 63 funds run by Alpha Managers. However, when taking fees into account, there were only 18 that have an ongoing charge figure (OCF) below the sector average of 0.81%, as shown in the list below.

Source: FA Analytics

The cheapest on the list was Schroder Global Equity, a £1.2bn fund that achieved a FE fundinfo Crown rating score of four.

Heavily invested in the US, which make up 69% of the portfolio, and the technology sector (28% of assets), the fund has managed to contain losses while the sector has fallen out of favour for its valuations, now perceived as too expensive.

Despite this headwind, it sits in the second quartile for returns over one year, falling from the first quartile where it has ranked over three, five and 10 years.

Fund manager Alex Tedder said in the fund’s latest factsheet: “In the first half of the year stock selection was negative particularly in industrials, materials and financials.

“Our holdings in energy, healthcare and information technology added value in the period, with particular contributions from emerging markets and the UK [Shell].”

The next two cheapest both belong to fund group Baillie Gifford. The investment house has a large representation in the ranking, taking up almost 50% of the entire table.

The Global Stewardship and Positive Change funds ranked second and third, with OCFs at 0.53% and 0.54%, respectively.

According to Square Mile researchers, Baillie Gifford Positive Change “is currently one of the most attractive responsible fund offerings in the market, with a strong emphasis on both returns and providing a positive impact over the long run”.

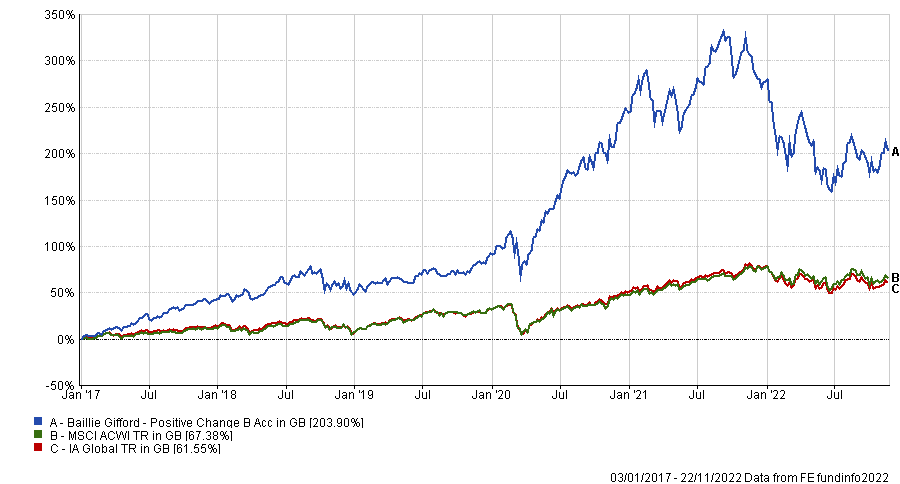

Launched in January 2017, it benefits from “a proven growth investment style and a collaborative teambased approach”, they said.

Expected to struggle when the value or cyclical areas of the market outperform, the fund has managed to stay in the top performance quartile of the sector since inception, although it has struggled over 12 months, when it fell into the bottom quartile and was down 15 percentage points below the average peer.

Performance of Baillie Gifford Positive Change vs sector and benchmark since launch

Source: FE Analytics

Another fund in the sustainable investments bracket is Stewart Investors Worldwide Sustainability, which is highlighted by Square Mile for having historically held an underweight to the US equity market when compared to its MSCI ACWI benchmark.

“Given the absolute return mindset, the fund's performance profile may widely vary from the index and will typically lag global equities in sharply rising markets or when riskier stocks are in favour and perform better in falling markets,” the analysts said.

Recently, it has risen to the second quartile over six months but it remains in the bottom quartile over one year and in the third quartile over three, five and 10 years.

Other notable names in the list include Lindsell Train Global Equity and Rathbone Global Opportunities as well HL Select Global Growth and Ardevora Global Equity.