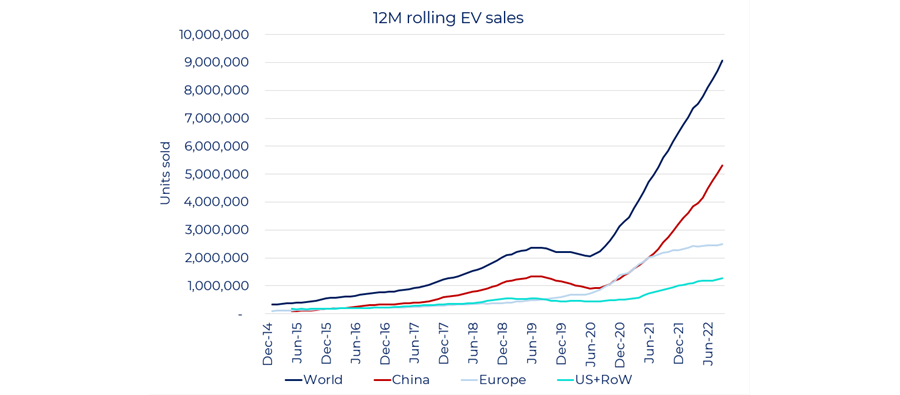

Electric vehicle (EV) adoption continues apace in 2022. Nearly 7 million plug-in vehicles having been sold year to date – more than in 2019 and 2020 combined and the latest monthly data suggests battery electric vehicles (BEVs) have now reached a 13% share of new car sales, with total plug-in penetration (BEV + Plug-in Hybrids) reaching 17%.

Global sales are currently growing 60% year-over-year driven largely by China, which now accounts for 60% of sales. Europe is a distant second, with around one quarter of overall EV sales, while the US trails at under 10%.

Source: Guinness Global Investors

Much of this growth has been driven by policy, with governments now subsidising 10-30% of the price of an electric vehicle, while bringing forward the timeline on banning internal combustion (ICE) sales.

Looking ahead, we believe that we are now at a tipping point where improving economics, driving range, and charging times begin to drive mass adoption.

Economics

Electric vehicles cost more to buy but have lower overall running costs. Excluding China, the IEA suggest that BEVs are typically $15,000 more expensive to purchase.

Adjusting for the higher gasoline and electricity prices seen in 2022, we estimate that lifecycle running costs for an electric vehicle in Europe and the US are $23,000 and $13,000 lower respectively than the ICE equivalent, justifying the upfront price premium.

Range

The average range of a battery electric vehicle sold in 2021 was around 215 miles, just under half of an ICE equivalent. This is clearly inferior, yet average daily driving distances are only 25-55 miles, meaning that most EVs are easily capable of handling everyday distances, and the market is rapidly waking up to this reality.

Charge time

Level one and two chargers (available in residential and commercial environments) are cheap and can replenish 5-30 miles of range per hour. Level three fast chargers, however, are the game changers. These offer fast charging on longer trips, delivering 200-600 miles of range per hour.

Once again, China is leading the regional charging infrastructure roll out with seven electric vehicles per charger whereas the EU and US lag behind at 15-20 EVs per charger.

The recent rapid growth in electric vehicle sales has caught many forecasters by surprise, leading to swift revisions to long-term adoption rates. For example, BNEF revised its 2025 forecast for EV sales penetration up to 23% in its 2022 outlook report, up from 16% in 2021.

It is encouraging to see consensus moving closer to our long-held forecasts for electric vehicles to make up 20% of new global vehicle sales by 2025, 50% by 2030 and predominantly all new vehicle sales by 2040. At that point, it implies an overall population of one billion EVs, over 60 times greater than the global stock in 2021 of 16.5 million.

The journey towards an electric vehicle-dominated car population will continue to enjoy government support, which, alongside further improvements in battery technology, will drive an acceleration to a smarter transportation system.

Dan Hobster is an investment analyst at Guinness Global Investors. The views expressed above should not be taken as investment advice.