The bond market in the UK has already bottomed out, with all the interest rate hikes in this tightening cycle more than priced in already, according to Stephen Snowden, manager of the Artemis Corporate Bond fund.

In a recent Trustnet article, Bruce Stout of the Murray International said equity markets had yet to reach “peak fear”, as we hadn’t seen any forced selling.

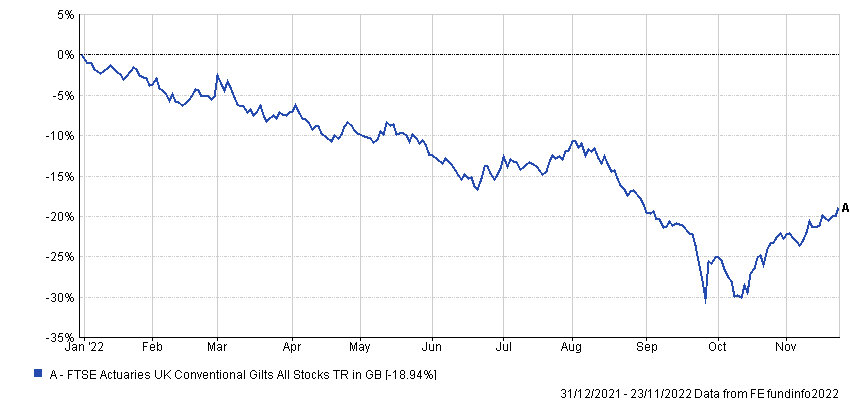

However, Snowden claimed it is a different story in the UK fixed income market, where the FTSE Actuaries UK Conventional Gilts All Stocks index is already up 14.3% since the height of the panic over former chancellor Kwasi Kwarteng’s disastrous mini-Budget.

Performance of index in 2022

Source: FE Analytics

When asked if he felt UK fixed income in general had already passed “peak fear”, he replied: “Yes, would be the easy answer. The peak of cheapness that was delivered by the considerable economic and political uncertainty that we were in six weeks ago has clearly passed, and markets are much more reassured by Rishi Sunak and Jeremy Hunt.

“But I personally do not believe the base rate hikes that the market has priced in will be delivered.”

The main reason why Snowden said bond yields are excessive is down to the inability of homeowners in the UK to cope with higher rates. While only 20% of mortgage holders are currently on variable rates, another 30% are on fixed-rate contracts that will end before the start of 2024.

Data from Moneyfacts showed the average five-year mortgage rate has risen from 2.3% to just under 6% over the past year.

“Whenever you're in a highly indebted society, either personally or on the government level, the economy is much more sensitive to interest rates, and that's why we think we will see a material impact on economic growth and consumer confidence long before we reach the peak of what's been priced in,” Snowden added.

He also predicted inflation will fall significantly in the next year or so. While CPI recently hit 11.1% for the first time since 1981, the Office for Budget Responsibility claimed the UK could enter a period of deflation by 2024.

Snowden was sceptical that the drop would be this extreme but said it would be prudent to lock in yields at their current levels, especially in corporate bonds where they are particularly high.

“Inflation today is 11% but I think it will fall to around 3% within a few years and we’re getting [corporate bond yields of] 6%. While not compensating for inflation in the next 12 months, they should handsomely compensate you for years beyond that,” he said.

“The average life of a UK corporate bond is nine-and-a-half years, so if you buy now, you've got nine years of that very high income that will, on average, substantially surpass what inflation is delivering.”

Snowden admitted there are still risks in corporate bonds, but he said he can’t think of a better alternative for beating inflation on a risk-adjusted basis. The manager accepted they could underperform equities when the market turns, but pointed out that yields on corporate bonds are considerably higher than dividends, representing another tailwind for the asset class.

“When yields have been high in previous decades, people have bought bonds, but we're seeing fewer companies issue them,” he continued.

“Whenever your dividend yield is materially above your corporate bond yield, it makes sense to issue bonds, buy back shares or pay dividends because your cost of funding is cheap, but now the reverse is true.

“I'm not saying companies will stop buying back shares, paying dividends or investing in plant equipment, but the hurdle rate to get over is now substantially higher.”

He added: “As a result, we have more demand for corporate bonds and less supply, and that is a very healthy backdrop for returns over the medium to long term.”

Corporate bond managers such as Snowden can be expected to talk up the prospects of their asset class, but others without a vested interest are similarly optimistic.

Guy Monson, chief market strategist at Sarasin & Partners, said: “We see increasing value in UK investment grade corporate bonds, particularly from issuers in less cyclical or global industries. Yes, we expect a UK recession, but we think it will be mild – especially with energy prices capped, employment strong and savings robust.”