Ruffer’s Alexander Chartres has warned investors not to react to a sudden fall in inflation, as this is more likely to be a blip on an upwards trend rather than a return to post-financial crisis conditions.

The market spiked earlier this month after US CPI for October fell to 7.7%, which was below the expected figure of 7.9% and the lowest annual increase since January.

Meanwhile, the Office for Budget Responsibility claimed that the UK could experience deflation as early as 2024.

However, Chartres, who runs the LF Ruffer Total Return fund, said that the transition to a period of structurally higher inflation was never going to be a smooth one.

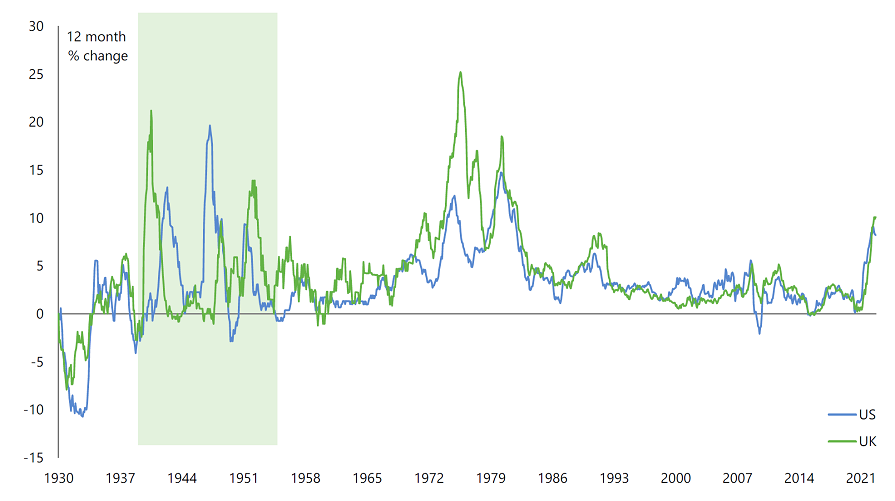

“The key word is volatility,” he said. “It's not going to go up and stay up indefinitely. It's going to jump like in World War II and its aftermath, when you had massive state intervention or fiscal activism, significant disruption of labour markets and supply chains, and huge accumulated savings suddenly got spent – you name it, there are a lot of echoes.

US and UK inflation

Source: Ruffer

“Brace yourself not only for sharp spikes in inflation, but also the sharp falls: don't be surprised at the disinflationary wave coming.”

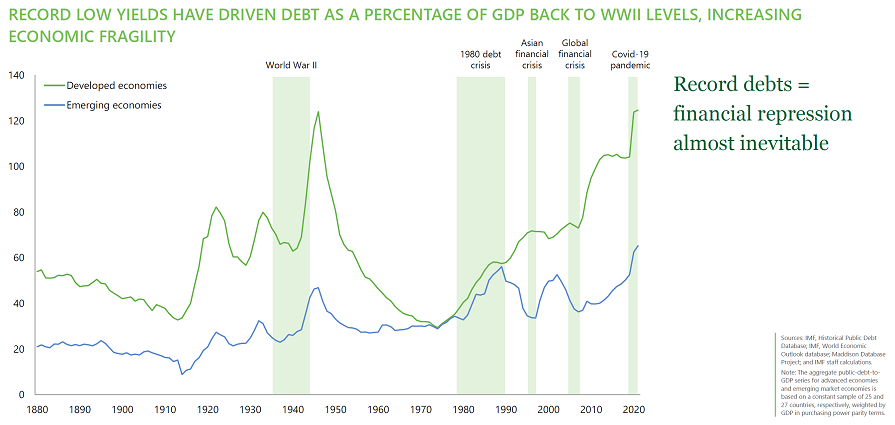

One of the reasons why Chartres claimed inflation will remain structurally higher is due to the amount of debt in the system, which bears another resemblance to the post-World War II period. This makes it more difficult for central banks to raise interest rates to bring price increases under control.

He also pointed to a global trend that is “unprecedented in the history of mankind” – voluntarily moving to less efficient sources of energy.

“All economic activity is energy-transformed,” said Chartres. “Energy equals prosperity. The problem is that for various reasons, including but not solely related to ESG [environmental, social and governance] factors, we haven't been investing enough in energy infrastructure, either in terms of fossil fuels or new energy.

“[In 1991], energy was about 13% of the S&P’s market cap. On the eve of the Covid meltdown, it was about 2%. No one wanted to own the fundamental building blocks of economic activity, but we're going to need a lot more of this stuff.”

High energy prices have been blamed for rising food prices this year, due to increased transportation costs and the role of fossil fuels in fertiliser production.

Chartres warned that price shocks in fuel and food have implications that go well beyond financial markets, and played a part in the French Revolution, the Arab Spring and the more recent unrest in Sri Lanka.

The manager said other reasons to be wary include heightened tensions between the US and China.

“That means you’ve got to watch out for lobster pots: delicious morsels with potentially high returns,” he continued.

“While they are easy to get in to, they are very difficult to get out of, as anyone doing business in Russia has found out. Major firms self-sanctioned after the Ukrainian war started and almost all of them are listed. Some of them we own, like BP which took a 10% haircut on Rosneft. Don't own things the government can print lots of or confiscate from you.”

This is why he is wary of the long-term prospects for fiat currencies. He noted that in 1980, “when [Margaret] Thatcher and [Ronald] Reagan began a small-state revolution”, gold and global equities had the same market cap. Today, it is 10 to one in favour of equities. While Chartres doesn’t think that number will equalise any time soon, he said a neutral store of value looks interesting in the current environment.

Where he said cash does have its uses is in its liquidity, which allowed him to take advantage of dislocations this year.

“You want to be anti-fragile and using cash is part of that,” he explained. “But using derivatives is what I really mean by that. That's allowed us to be on the other side of the unwind of the ‘everything bubble’ where all conventional assets fell together this year. That's why we're up while all conventional assets are down.”

Performace of fund vs index in 2022

Source: FE Analytics

He added: “Ruffer’s portfolios are designed to make money even if we're completely wrong. We don't think we'll be right all the time. We might even be wrong about the views I set out today, but even if we are, we are trying to build a portfolio that will mean you are protected and we keep growing in all conditions.”