As of right now, income investors can pick pretty much anywhere in the world and will be paid roughly the same amount over the next 10 years.

That was the takeaway from a Trustnet article last week, in which we looked at the best region for dividends over the coming decade.

Taking into account the current yields and historic 10-year average dividend growth, no region emerged as a clear winner, suggesting that investors do not have to take a binary bet on one individual high-paying market to achieve a sustainable pay-out.

As such, a diversified approach would work. Below, Trustnet asked experts for fund or investment trust picks from their preferred market region.

Starting with the UK, Rob Morgan, chief analyst at Charles Stanley, said the domestic market was “placed for a period of outperformance” going forward. His fund pick to capture it was JOHCM UK Equity Income.

The £1.6bn fund has a strict yield discipline and seeks to invest in fundamentally strong companies at an attractive price and relatively high starting yields.

The approach promotes a “naturally contrarian style”, which “gives it a different holdings profile to many other income funds”, with typically significant exposure to small- and medium-sized stocks.

Clive Beagles has co-managed the fund alongside James Lowen since inception in 2004, a “longevity rarely seen in modern-day fund management”, said Morgan.

“Those looking for income will find the yield an attraction. Importantly, this has the scope to grow over time as dividend pay-outs increase. The valuation-sensitive approach also makes it a good counterweight to more growth-orientated funds in a portfolio,” he added.

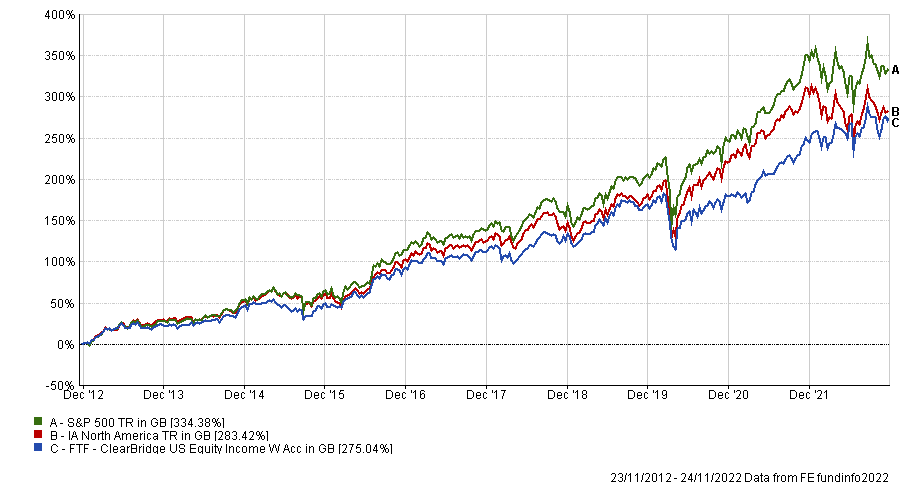

Performance of fund vs sector and index over 10yrs

Source: FE Analytics

For income from across the Atlantic, Ben Yearsley, director at Fairview Investing, chose ClearBridge US Equity Income, which he described as “quality value”.

Over 10 years, it produced below-average returns, but it improved its track record over five and three years, when it ranked in the second quartile of its IA North America sector, before rising to the top quartile over 12 months.

It invests in a portfolio of 40 to 60 undervalued companies (70% must be US companies) in any sector or industry, typically with a market capitalisation of $10bn or above.

The main argument in favour of US income, according to Neil Denman, manager of the Sarasin Global Higher Dividend fund, was that “dividend growth is supported by lower pay-out ratios, a strong culture of research and development, and robust balance sheets, specifically in sectors such as healthcare and information technology”.

It’s not surprising then that the fund is exposed to several of these trends.

Its main holdings include big tech (Apple, Microsoft), energy (Williams Companies, Enbridge) and healthcare companies (Merck & Co, UnitedHealth Group) and it currently yields 1.8%.

Performance of fund vs sector and index over 10yrs

Source: FE Analytics

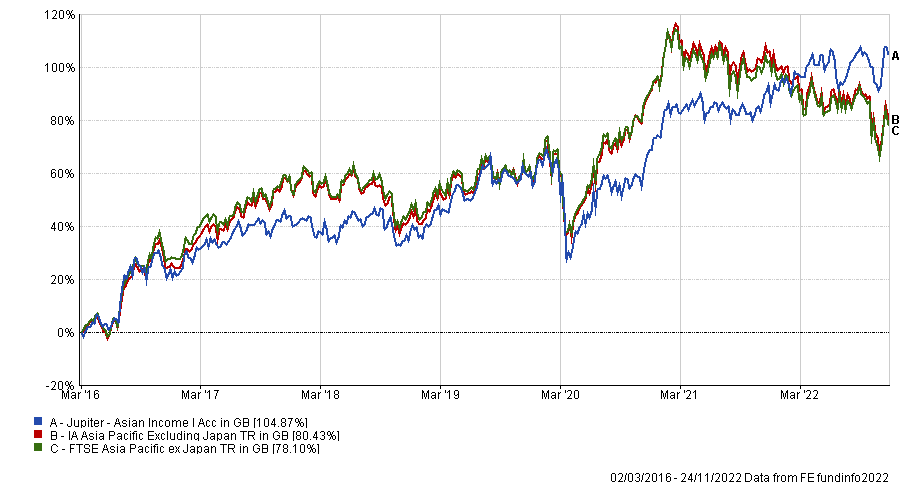

Alena Kosava, head of investment research at AJ Bell, focused on Asia and emerging markets. Her favourite Asian fund was Jupiter Asian Income.

With a combined focus on income and growth and a 4.7% historic yield, it is “materially ahead of the index and the IA sector, having delivered a 6.5% gain amidst falling markets”.

Managed by Jason Pidcock, the portfolio is comprised of approximately 30 names, focusing on large-cap companies, and carries an emphasis on bottom-up stock selection. Notably, it entirely disposed of its Chinese exposure earlier in the year.

“Political risk has been a significant concern for many investors since the Chinese government began implementing its common prosperity policies, whilst heightened tensions with Taiwan proved to be the final straw,” explained Kosava.

The fund also carries a “material overweight” to Australia (35% exposure) relative to the broader index (18%). At a sector level, it is biased towards energy, industrials and technology.

Performance of fund vs sector and index since launch

Source: FE Analytics

Among the broader emerging markets, Kosava went for the JPM Emerging Markets Income fund and the related JPMorgan Global Emerging Markets Income trust.

They are both “closely aligned and credible EM income strategies with a breadth of analytical support combined with a dedicated portfolio management team focusing on the income consideration”.

The fund yields 4.2% and is diversified across 90 names, so it “offers sufficient compositional breadth while ensuring diversity of drivers underpinning its dividend”.

The trust yields 4.8% and has a higher exposure to China (30%) compared to the open-ended vehicle and the broader index benchmark (26%).