Investors in tech stocks that have fallen behind their competitors should beware that they are unlikely to ever regain their leading edge, according to Ben Rogoff, manager of the Polar Capital Global Technology fund.

The tech sector has been hit hard this year as the market has turned against growth businesses. Shares in mega caps such as Alphabet and Microsoft are down by up to a third, even though the underlying businesses remain sound.

Performance of stocks in 2022 ($, share price only)

Source: Google Finance

Yet these are among the better performers in the sector; another former mega cap, Meta, is down 67% after a change of privacy settings on iPhones hit its business model.

While Rogoff is bullish on the long-term prospects for the tech sector, he warned investors against looking for bargains among this type of ‘fallen angel’.

“We try to avoid companies that are on the wrong side of history or on the wrong side of massive change,” he explained.

“This is not a mean-reverting industry when things go wrong: when it turns out that you're Yahoo and not Google, you rarely become Google again. And so we tend to be pretty strict about selling stocks where the investment thesis is changing.”

He also avoids value stocks in the tech sector, for similar reasons.

“We're not interested in companies that are at the end of their corporate lifecycle,” he continued.

“We understand all too well what happens to businesses at that point: they use M&A or they leverage their balance sheet – whatever they can to maintain the facade of growth, because very few people want to work for tech companies that aren't ‘growth’ tech companies. We see those as value traps.”

Meta’s chief executive and co-founder Mark Zuckerberg has attempted to revitalise the company by investing heavily in the metaverse, an immersive 3D virtual space.

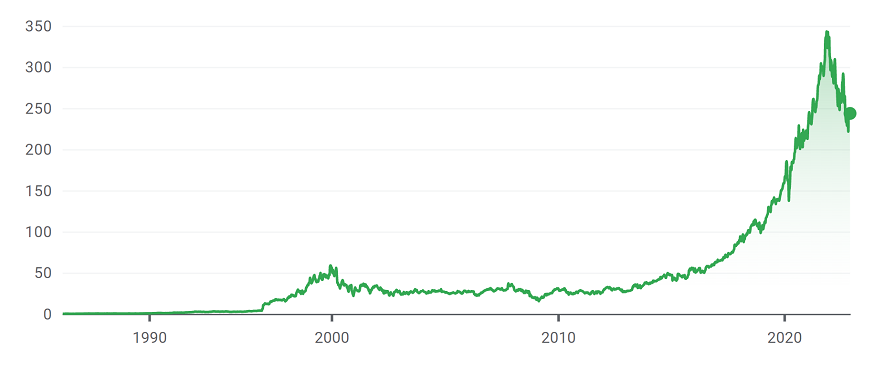

Performance of Meta stock since IPO ($, share price only)

Source: Google Finance

While many people are sceptical about the potential in this area, Rogoff claimed it simply represents the end point of numerous trends that are already well under way, such as working or shopping from home.

However, Rogoff’s strategy involves waiting until themes have been adopted by 5% to 30% of a market before investing in them. He said this has not only allowed him to avoid 99% of the blue-sky themes that never caught on, but also the even greater number of themes that took much longer to become profitable than early investors expected. He predicted the metaverse will end up in the latter category.

“We think the timeline is wildly out,” he added. “We do the work on these themes with a view to participating in them when they are ready as investments. Our sense is the metaverse is today where the internet was in the 1980s: for most people, there really wasn't an internet in the 1980s. There were things like Prestel, and Minitel in France. And that's very much our model for what the metaverse will look like.

“We've meaningfully reduced our exposure to Meta because of our differences of opinion about the timeline of the metaverse and therefore the reinvestment risk involved in that pivot that Mark Zuckerberg is currently undertaking with shareholder money.”

Considering Rogoff’s aversion to former tech leaders that have lost their way, the identity of the number one stock in his portfolio may come as a surprise: Microsoft.

In 2013, a BBC article named then chief executive Steve Ballmer as one of the five worst company managers of the year, after Microsoft “missed one market shift after another”, including music players, search engines and smartphones. On the latter, Ballmer once famously said: “There's no chance that the iPhone is going to get any significant market share. No chance.”

However, his replacement Satya Nadella transformed the company by embracing a culture of innovation and pivoting it towards the cloud computing market.

Performance of Microsoft stock since IPO ($, share price only)

Source: Google Finance

In a 2020 interview with interactive investor, Rogoff admitted he was surprised by the speed of Microsoft’s reinvention.

“If you told me seven years ago that this would be my largest position, I would have probably laughed at you, but the company’s done a phenomenal job of pivoting to software as a service, or a more recurring revenue model,” he said.

“It has built out the second largest public cloud offering, Azure, which is second only to Amazon’s AWS.

“And in the crisis, it was very positive in terms of its offerings in communications, like Microsoft Teams for example, but also Office 365 and just facilitating remote work.”

He added: “I have to say, I’m not a big fan of hackneyed phrases like ‘new normal’, but I do think this is a new normal, and I don’t think we’re going back to the old world.”