A record £11.3bn was saved into fixed-term accounts in October, the latest savings and borrowing data from the Bank of England showed, as higher interest rates have led to improved savings returns from cash accounts.

It is the highest amount since records began in December 1997 and constitutes an additional £6.2bn that flowed into banks and building societies compared to the £8.1bn registered in September.

Laura Suter, head of personal finance at AJ Bell, attributed the increase to growing competition in the savings market as well as the rise in interest rates.

“People made the most of a leap in savings rates and shifted their money into fixed-term accounts in their droves in October, marking the highest savings on record,” she said.

“Rates leapt up following the mini-Budget and fierce competition in the savings market – four times as much as the previous month.”

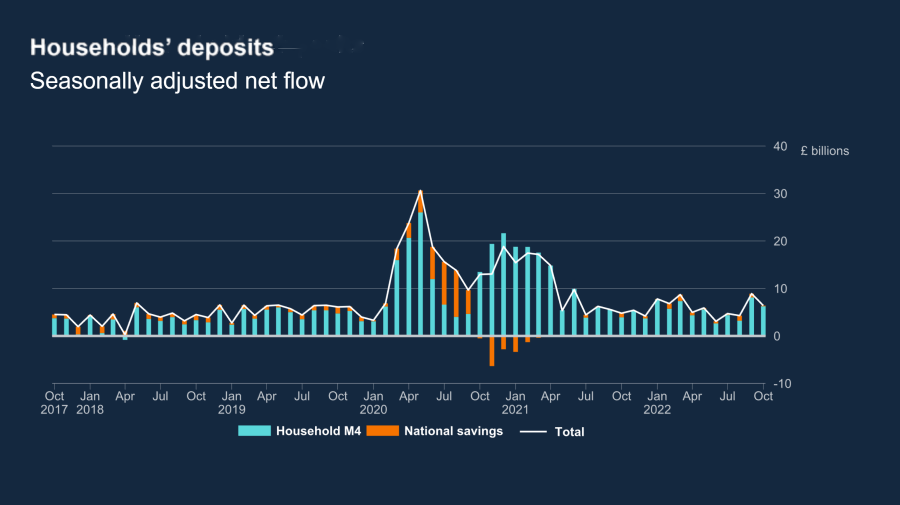

Source: Bank of England

In the new economic environment, banks and building societies have afforded to ramp up the annual expected returns (AER) of their products in an attempt to attract new customers.

The effective interest rate paid on individuals’ new time deposits with banks and building societies rose from 2.49% in September to 3.26% in October, the largest monthly increase since December 2021 when Bank Rate increases began.

At 3.5%, the average rate on two-year fixed-rate bonds reached its highest since 2009, with peaks at 4.75% offered by Investec Bank and QIB, 4.68% by Zenith Bank and 4.65% by Market Harborough BS.

Three-year bonds also hit a 13-year high, with the top providers in this bracket being Zenith Bank with its 4.75% and Market Harborough BS at 4.65%. The Bank of London and the Middle East offers 4.5%.

Among ISA products, the best fixed rate available is 4.65% on two, three and five-year bonds, provided by the State Bank of India. Nottingham Building Society pays 4.4% yearly until the end of January 2026, while the best-paying one-year bond is Shawbrook Bank’s, yielding 3.78%.

However, competition squeezed some players. National Savings and Investments [NS&I], whose inflows fell 25% in November compared to the previous month, was left out of the race.

“Savings in NS&I fell out of favour, as savers found better rates elsewhere and the government-backed provider couldn’t keep up with the savings war. Savers put £200m in Premium Bonds and NS&I’s other accounts, a quarter of the amount they saved in September,” said Suter.