Everyone’s talking about gold at the moment and it’s not hard to see why. The price has nearly doubled over the past few years, breaking previous record highs, and drawing in a wave of investor attention.

Several factors have contributed to this renewed demand. Heightened geopolitical risks, including tensions in the Middle East and Russia’s invasion of Ukraine, have revived interest in gold as a safe-haven asset.

At the same time, growing fiscal concerns in the US and speculation around the long-term future of the US dollar have added fuel to the fire. Central banks in emerging markets have responded by steadily increasing their gold reserves, adding to the momentum.

Against this backdrop, it’s natural that investors are rethinking the role of gold in a modern portfolio. But before rushing to chase the rally, it’s worth stepping back and asking a more fundamental question: what are gold’s actual characteristics and do they justify a more strategic allocation?

With that in mind, there are several characteristics I think investors should consider before joining the gold rush.

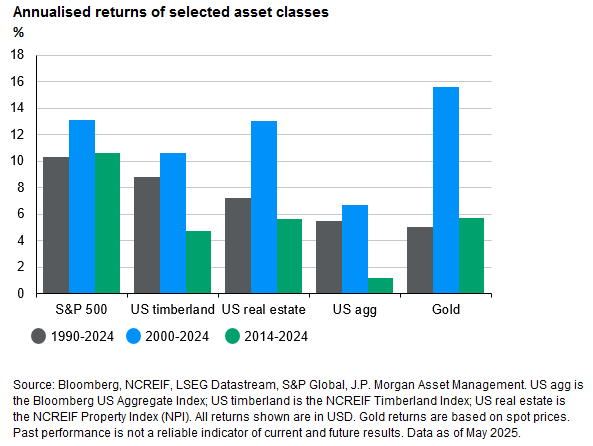

First, gold’s long-term performance depends heavily on timing. Over the past three and a half decades, gold was the worst-performing major asset class both in absolute terms and on a risk-adjusted basis. It lagged stocks, real estate and timberland, and delivered similar returns to bonds, but with three times the volatility.

But shift the start date just 10 years later, and gold rises to the top of the table. Over the past two and a half decades, it was the best-performing asset class in absolute terms outperforming stocks, bonds, and other real assets such as real estate and timberland.

Source: JP Morgan Asset Management

Second, gold is highly volatile, often suffering long periods of stagnation. The reason for this variability lies in the nature of gold itself. It doesn’t produce income or earnings, so its value is driven almost entirely by sentiment around inflation, macro stress, and the credibility of fiat currencies.

These narratives can be powerful, but they are cyclical, unpredictable, and prone to reversals. Take the post-1980 period as an example. After hitting an inflation-fuelled high, gold fell in real terms for two decades and didn’t reclaim its 1980 peak (adjusted for inflation) until February 2025. That’s a 45-year drawdown in real terms.

Source: JP Morgan Asset Management

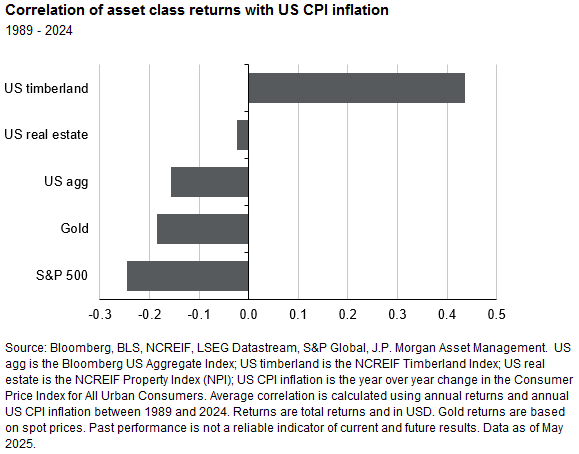

Third, the inflation hedge narrative doesn’t always hold. Gold is often seen as a hedge against inflation and it performed well in the 1970s. But over the past four decades, the relationship has been far weaker. On average, gold’s correlation with US inflation has been negative, not positive.

Source: JP Morgan Asset Management

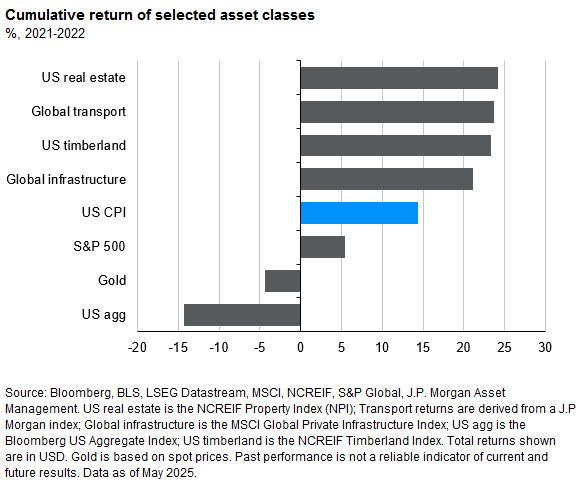

Even during the inflation spike of 2020–2022, gold prices declined — making it one of the worst-performing major asset class over that two-year stretch. While gold may act as a hedge against inflation in specific regimes, it is far from reliable in doing so.

Source: JP Morgan Asset Management

Fourth, gold generates no income. This may seem obvious, but in an environment where investors can now earn 4-5% from bonds and core real assets, the opportunity cost of holding gold is real.

It produces no income, and unlike productive assets, there is no underlying cashflow to grow over time. Any return depends entirely on changes in price, which rely heavily on sentiment rather than fundamentals.

In contrast, core real assets have delivered remarkably stable returns over the past three decades, with income often accounting for more than two-thirds of total return. That stability not only helps to lower overall portfolio volatility but also provides investors with a regular income stream.

So, what role should gold play in a portfolio?

Given today’s backdrop, gold clearly has a place. As a hedge against geopolitical shocks, deglobalisation, and weakening trust in fiat currencies, a modest allocation can offer diversification and optionality. And given the recent rally, many investors may regret not having owned more.

But gold is not a panacea. It’s volatile, generates no income, has a patchy track record as an inflation hedge, and has endured long periods of stagnation. Other core real assets, such as infrastructure, real estate, and timberland, share many of gold’s defensive attributes while also offering greater stability and a steady stream of income.

That’s why gold should not be seen as a silver bullet but as a source of diversification and optionality within a wider real assets strategy. On its own, it may be unreliable, but when paired with income-generating, lower-volatility assets like infrastructure or real estate, it can strengthen portfolios for a range of market regimes.

In a world of heightened uncertainty, owning some gold makes sense. Relying on gold as your only diversifier does not.

Aaron Hussein is a global market strategist at JP Morgan Asset Management. The views expressed above should not be taken as investment advice.