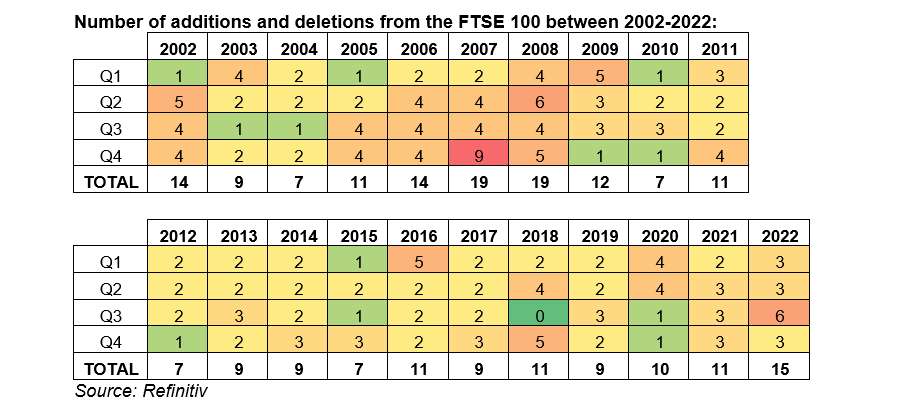

Weir Group, Beazley and abrdn have been promoted to the FTSE 100 in the latest quarterly rebalance by FTSE Russell, making 2022 the year with the most changes to the UK’s major index since the end of the global financial crisis.

There have already been 12 changes to the index this year – the highest since 2009, according to data from Brewin Dolphin – with a further three taking place in the latest rebalance.

John Moore, senior investment manager at RBC Brewin Dolphin, said: “The amount of change to the FTSE 100 this year underlines how far the tide has gone out and how unloved many UK companies are – the level of M&A activity over the past 12 months is further proof of that.

Changes to big indices such as the FTSE 100 have become more important as the money tracking them has surged, according to Ben Laidler, global markets strategist at social investing network eToro.

“The amount invested in global exchange traded funds (ETFs) has almost doubled to a dramatic $8.6trn since 2018,” he said, adding that the FTSE 100 could be garnering more attention as it is “the world's best performing major stock market this year”.

Below Trustnet looks at the new entrants, which will join the FTSE 100 on 19 December.

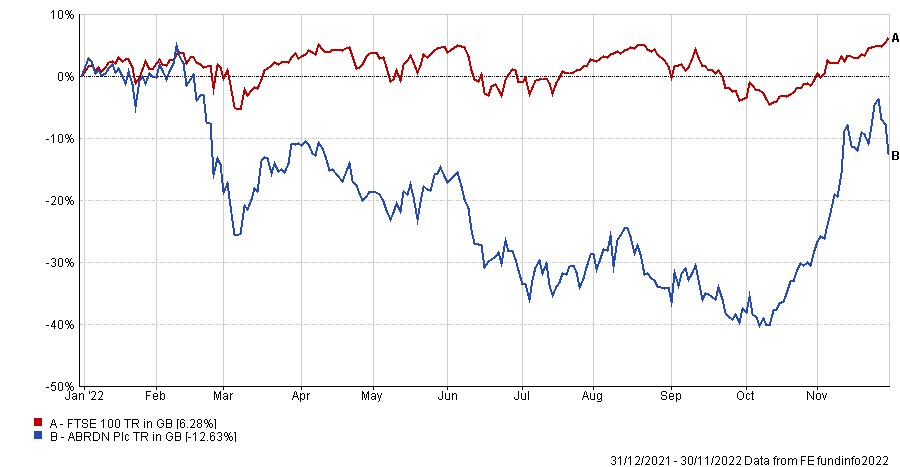

abrdn

It was a short-lived visit to the FTSE 250 for asset manager abrdn, which climbed back up into the premier index at the first time of asking, having only been relegated in the last reshuffle.

Susannah Streeter, senior investment and markets analyst Hargreaves Lansdown, said it has been a volatile year for the Edinburgh-based investment company, as shares were dragged down amid the financial market volatility.

Total return of abrdn vs FTSE 100 YTD

Source: FE Analytics

“Outflows from its funds caused nervousness among investors and it was ejected from the FTSE 100 at the last review. But in recent weeks the company appears to have turned a corner, helped by a rising appetite for risk sending its share price sharply upwards and putting it in pole position for promotion back into the top flight,” she said.

The asset manager is known for its emerging market and smaller companies funds in particular, she noted, which tend to do well when investors are willing to take on more risk.

However, while the firm has concentrated on its direct-to-consumer offering, it will need to “generate sustained and meaningful inflows to remove the risk of fresh volatility returning to the share price”.

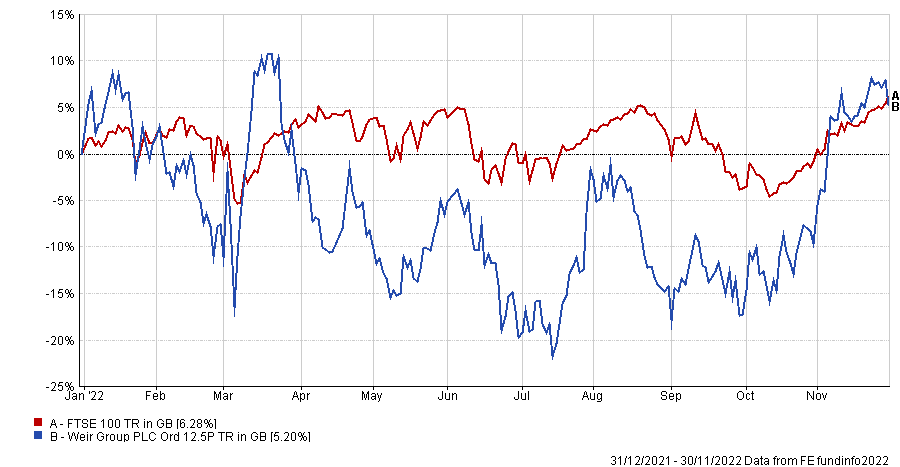

Weir

Glasgow-based industrial engineer Weir Group also got promoted after shares rose around 20% since the last review in August.

Moore noted that it is a “great example” of a company that has taken self-help measures to lift itself out of a potentially “tricky position”.

“It refocussed its business on mining and aggregates, moving away from its previous main market of oil and gas. At the same time, the company has truly engaged with its environmental impact and taken steps to improve its position on that front,” he said.

The company had struggled as investors feared that the ongoing effects of China’s zero-Covid policy and anaemic global growth could hinder returns, but recent results have proved resilient.

Street added: “Maintaining its full-year revenue and profit guidance is not to be sniffed at in the current market.”

Total return of Weir Group vs FTSE 100 YTD

Source: FE Analytics

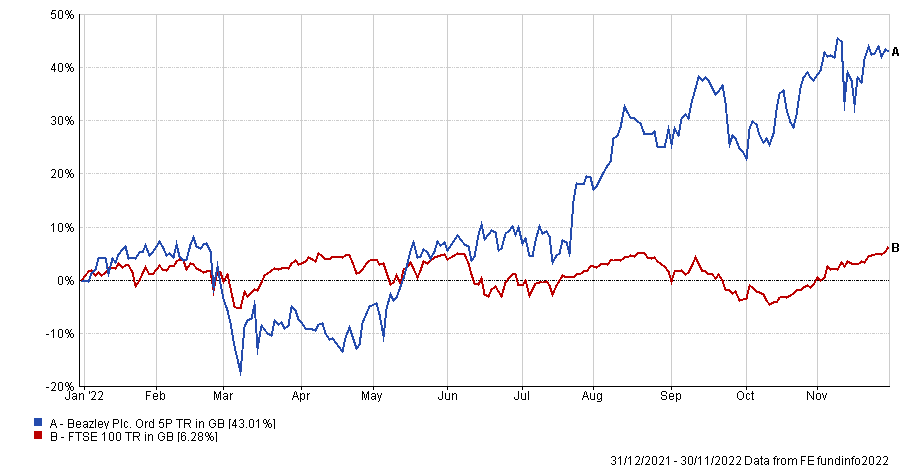

Beazley

Last up, specialist insurer Beazley has joined the space race, committing to pursuing more cyber-focused business and raising £350m in a share placement to accelerate its growth plans.

It hopes to capitalise on demand for cover, which is outstripping supply in the market, according to Streeter, and in the nine months to September gross written premiums jumped by 22%, while premium rates on renewal business increased by 17%.

“These results and its plan for growth have sparked the appetite of investors and there appears particular interest in Beazley’s involvement in the first rocket launch on UK soil at SpacePort Cornwall, given it provided a policy covering risk of loss of the payload alongside insurer Marsh,” she said.

While there are risks, including climate change, Beazley could be well placed to capitalise on more difficult conditions and could become a market leader in this area, Streeter added.

Total return of Beazley vs FTSE 100 YTD

Source: FE Analytics

The leavers

The casualties to be demoted to the mid-cap FTSE 250 index are oil major Harbour Energy, vet specialist Dechra Pharmaceuticals and asset manager Intermediate Capital Group.

On Harbour Energy, Laidler said: “Shares in the UK’s largest independent oil company, whose market capitalisation has slumped to the lowest in the FTSE 100 at £3bn, are down 34% in just the past three months, under the double whammy of sharply lower oil prices and the government’s 35% oil windfall tax.”

Meanwhile, Streeter noted that Dechra Pharmaceuticals was boosted during the pandemic by people buying pets, but additional costs from higher inflation have affected the businesses.

“Although demand for the pharmaceutical company’s veterinary products has been reasonably strong, there have been worries that with incomes facing a squeeze, spending per head could decline,” she said.

Finally, Intermediate Capital Group slumped after it missed earnings expectations for the first half of the year. The fund group has struggled as private equity and other alternative assets have come under pressure, while its defensive funds have lost ground to traditional bond portfolios, which offer good yields.