Energy funds are poised to end 2022 on a high as they maintain their place at the top of the performance tables, although FE fundinfo data shows that two niche funds have recently jumped past them to make the highest year-to-date returns.

Surging inflation, rising interest rates and the war in Ukraine have taken their toll on investors this year as markets around the world have fallen and few assets aside from commodities have offered any respite.

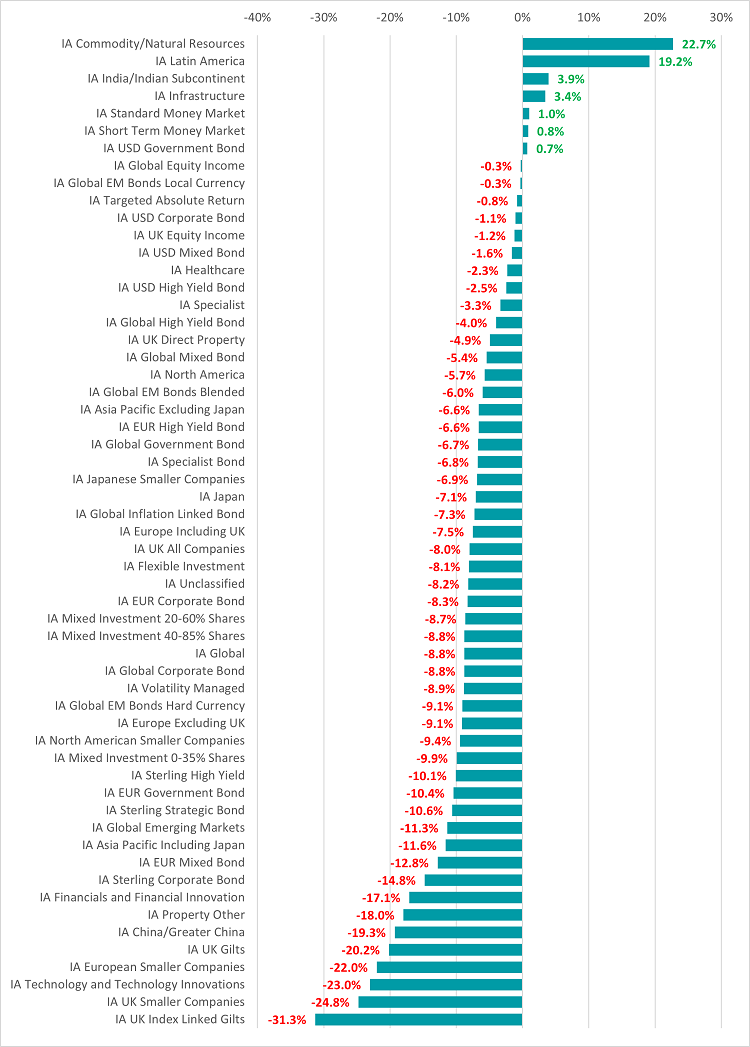

Just seven of the Investment Association’s 57 fund sectors are showing a positive average return for 2022 to the end of November, with IA Commodity/Natural Resources being the leader by some way. Thanks to rising commodity prices, especially in the energy space, the peer group is up 22.7%.

IA Latin America is the only other sector posting a double-digit return, with its 19.2% average gain being significantly higher than third-placed IA India/Indian Subcontinent’s 3.9% rise.

Performance of Investment Association sectors over 2022 so far

Source: FE Analytics

The average IA UK Index Linked Gilts fund, on the other hand, has lost 31.3% over the past 11 months as investors fled fixed income assets at the same time they were dumping stocks. IA UK Smaller Companies funds were among the worst hit, with the average portfolio dropping 24.8%.

But which individual funds are standing out?

While energy funds have dominated the leaderboard for the bulk of 2022 – owing to the surge in oil & gas prices – last month two new entries took the top two places in the overall Investment Association performance rankings.

Source: FE Analytics

HSBC MSCI Turkey ETF and iShares MSCI Turkey UCITS ETF have jumped into the lead after posting year-to-date total returns of just under 100%. This was down to a very strong November: both funds were up close to 17% over the course of the month.

Turkey is suffering from some of the highest inflation in the world with its inflation rate reaching 85.5% in October 2022. However, the Turkish central bank has been cutting interest rates as part of president Recep Tayyip Erdogan’s unorthodox economic policy.

While this has led to one of the highest growth rates among G-20 countries, savings have been hit and many Turkish citizens have poured money into the stock market to make a return. This has led Kemal Kilicdaroglu, Turkey’s main opposition leader, to warn of a bubble in the country’s stock market.

Aside from the new names in the top two spots, however, the rest of the table is full of the same funds that have been present for much of the year.

As noted, beneficiaries of rising oil & gas prices such as iShares S&P 500 Energy Sector UCITS ETF, Xtrackers MSCI World Energy UCITS ETF, iShares Oil & Gas Exploration & Production UCITS ETF and BlackRock BGF World Energy are among the 12 funds in the top 15 that focus on energy stocks.

Away from commodities and Latin American funds, the only other strategies to break into the top 25 best performers over 2022 so far are a few ‘systematic’ funds that aim to make positive returns in any market environment. These include AQR Systematic Total Return UCITS, AQR Managed Futures UCITS and Winton Trend.

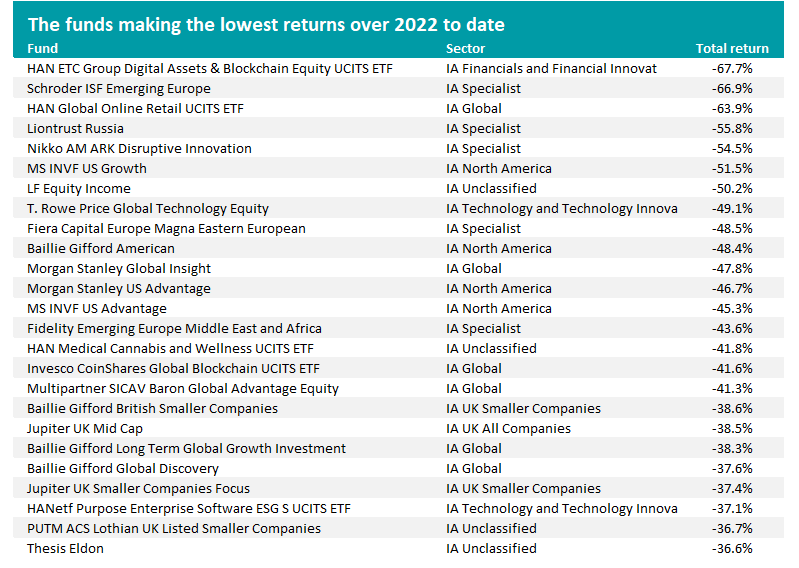

When it comes to the worst performers – shown below – the same themes that have been in play all year can be seen in November’s results.

Source: FE Analytics

HAN ETC Group Digital Assets & Blockchain Equity UCITS ETF has made the heaviest loss, dropping 67.7% after higher interest rates soured investor sentiment towards growth stocks (especially those in the tech space) and digital currencies.

Other funds that have been caught out by the reversal in fortune for growth investing include Nikko AM ARK Disruptive Innovation, T. Rowe Price Global Technology Equity, Baillie Gifford American and Invesco CoinShares Global Blockchain UCITS ETF.

Meanwhile, the war between Russia and Ukraine has hit the likes of Liontrust Russia, Fiera Capital Europe Magna Eastern European and Fidelity Emerging Europe Middle East and Africa while an aversion to the lower end of the UK market cap spectrum can be seen in the losses of Baillie Gifford British Smaller Companies, Jupiter UK Mid Cap and Jupiter UK Smaller Companies Focus.