Investors have barely had to worry about dividends or income over the past decade as capital gains and market growth meant there were easy wins to be made from technology and other fast-growing sectors.

But as this has reversed in 2022, Guinness Global Equity Income manager Ian Mortimer says investors will have little choice but to look more closely at dividends.

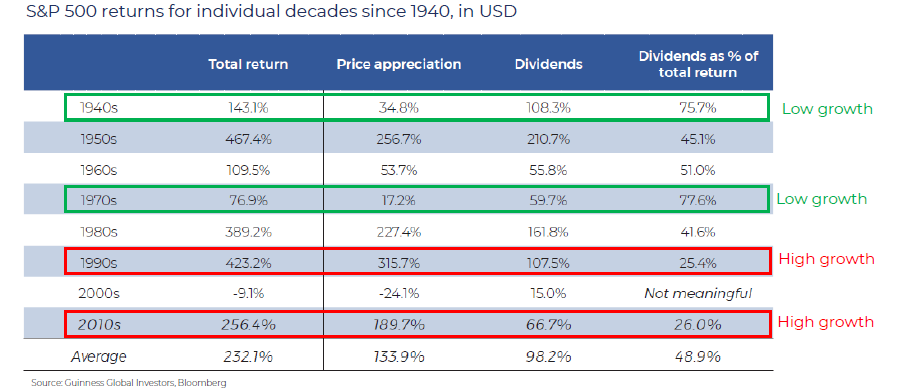

He highlighted the below chart, which shows the composition of total returns made by companies in the S&P 500 index over different decades, split between dividends reinvested and capital appreciation.

On average dividends are quite important, accounting for about 50% of the total return over the entire period from the 1940s to the present day.

While each decade is different, he said one way to slice the data is to look at high-growth periods, such as in the 1990s and 2010s, and low-growth ones.

When the market is rising and investors are making high total returns, the amount made from dividends as a percentage of the overall is much lower at around 25%.

“It is still important and worth considering, but markets are much more focused on price appreciation and growth,” Mortimer said.

Turning the data on its head, however, during lower-growth periods, such as the 1940s and 1970s, dividends are a much higher proportion of the total return and are therefore much more relevant.

“We are not saying necessarily that we are in the 1970s or 1940s – I think there are arguments as to why now is different – but if we just take a high level view that we may be entering a period of lower growth (where there is evidence that this could be the case), then in that scenario the dividend as a proportion of your return is much more relevant,” said Mortimer.

This point was echoed by Fran Radano, manager of the North American Income Trust, who said the past decade has been an anomaly in history that meant dividend return was at an exceptionally low a proportion of total returns.

“Since 2013 it has been a growth market with a growth backdrop, and it crowded out the dividend payers. It [dividends as a proportion of total returns] might not get back to the same level any time soon, but it will rise a decent amount given the new backdrop of inflation and interest rates,” he said.

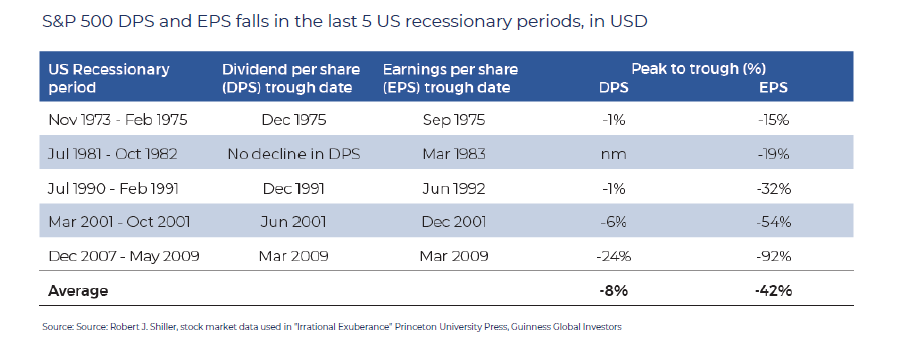

He then continued to look at times when there have been significant recessions, which many believe will become the current environment in the coming months.

“Looking specifically at times where there has been a significant recession, [the below chart] shows the volatility of your earnings and dividends. What you can see is that in each of these periods, the peak to trough of the dividends per share and earnings per share,” he said.

Although dividends do decline, at around 8% on average they tend to fall significantly less than earnings which tend to drop by around 42% and are therefore much more volatile.

“While dividends can be cyclical, they do tend to be more stable over time, meaning you are more likely to receive them and less likely to be affected by what is going on in the wider economy,” Mortimer said.

Lastly, he noted that dividends also tend to behave well in times of inflation, with dividend growth broadly tracking the level of inflation thanks to companies’ ability to pass on costs to consumers.

This has been crucial in 2022, as inflation has risen into the double digits, as it can protect investors’ money in real terms.

“Right now, companies are generally surprising to the upside in terms of dividend growth, which means pricing power is being passed through,” he said.