“Dull” companies with low levels of volatility greatly outperformed their riskier counterparts in 2022, according to a new study by RBC Brewin Dolphin.

Although low-volatility businesses have generally been seen as dull in the past, those invested in them this year have been rewarded for playing it safe.

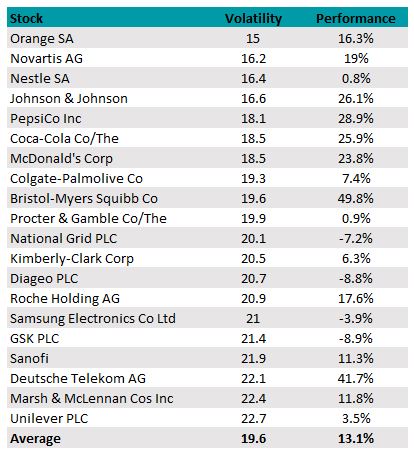

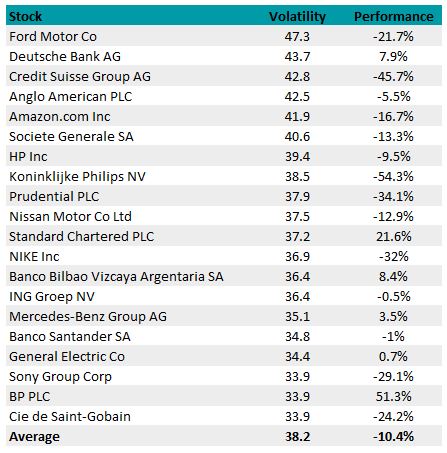

The 20 least volatile stocks in the S&P Global 100 index outperformed the wider index by 13.2 percentage points this year up until 28 October, with the 20 most volatile underperforming by 10.4 percentage points.

The overall index made a loss of 2.3% in sterling terms (this was much worse in dollar terms), meaning the average low-volatility stock has made a double-digit profit, while the riskier options have, on average, made double-digit losses.

Performance of the least volatile S&P Global 100 stocks relative to the index in 2022

Source: Brewin Dolphin

Volatile companies’ share prices can move up and down rapidly in a short space of time, which can lead to periods of significant outperformance if held at the right time.

However, Rob Burgeman, senior investment manager at Brewin Dolphin, said that the survey highlights how lower volatility companies “offer investors greater security and certainty”.

The top 20 list was dominated by names in the consumer staples, pharmaceuticals and utilities sectors, with Burgeman pointing out medical company, Johnson & Johnson as a key example of a safer stock that has rewarded investors in 2022.

He said: “Johnson & Johnson’s activities span consumer products, pharmaceuticals and medical devices, providing a good degree of diversification. The shares yield around 2.6% too, which definitely makes this a ‘no more tears’ product.”

It was the index’s fourth least volatile company (with volatility of 16.6%) and the pharmaceuticals giant has outperformed the index average by 26.1 percentage points since the start of the year.

Meanwhile, the S&P Global 100’s least volatile player, French telecoms company Orange, outperformed the index wider index by 16.3 percentage points in 2022.

Burgeman highlighted the iShares Edge World Minimum Volatility ETF, which risk-averse unwilling to buy individual stocks can use to track the market’s least volatile companies.

He said: “In times of boom, these tend to underperform, as the shiny lights of the latest fad attracts investors looking for a quick buck.

“All of this underlines the importance of a well-diversified set of investments, taking in a broad spread of assets that will perform at different times.”

However, not all highly volatile companies underperformed throughout the year – oil and gas supplier, BP had a volatility ranking of 33.9% yet the highest outperformance on both lists, soaring 51.3 percentage points ahead of the index since the start of the year.

Performance of the most volatile S&P Global 100 stocks relative to the index in 2022

Source: Brewin Dolphin

Burgeman said: “Companies in cyclical sectors – such as oil – or operating in areas of the economy prone to political intervention may experience heightened volatility, but it does not make them bad businesses by any measure. It is a case of accepting increased uncertainty if you choose to participate in these sectors.”

The greatest underperformance of the most volatile stocks came from healthcare technology company, Koninklijke Philips (often shortened to ‘Philips’). It had higher volatility than BP at 38.5%, with its share price dropping 54.3 percentage points below the index average since the start of the year.

Meanwhile banks were among the most volatile companies this year, with more than a quarter of the names on the list in the financials sector._