Managers of some of the world’s largest funds were under a great deal of pressure to protect investor’s capital last year as high inflation and interest rates created challenging hurdles, but only one that has assets under management (AUM) of more than £5bn managed to make a positive return in 2022, according to data from FE Analytics.

It comes as the number of equity funds running more than our £5bn cut-off figure slumped from 28 a year ago to 16 today after a year in which most funds made a loss.

The likes of Baillie Gifford American, Polar Capital Global Technology and Morgan Stanley US Advantage have all dropped off the list after a year in which the trio lost 50.6%, 31.7% and 49.4% respectively.

However, there are still big funds that investors are likely to have some exposure to. As such, Trustnet looked at how the investment association’s biggest funds fared last year.

Source: FE Analytics

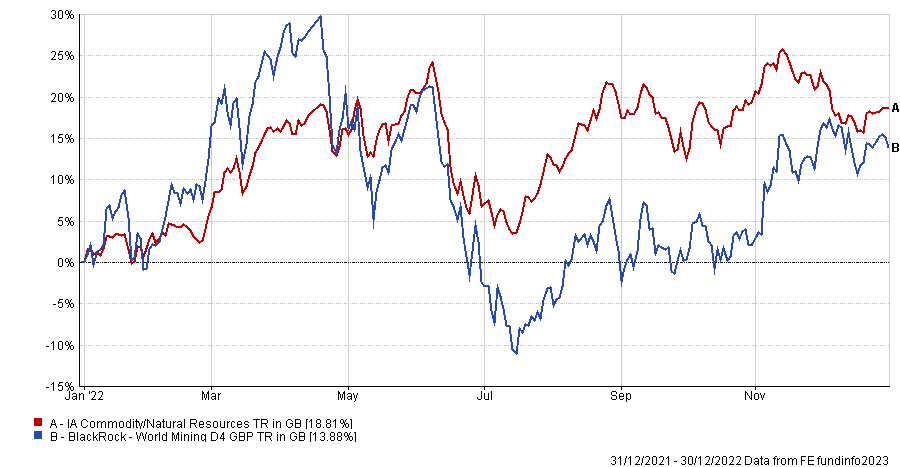

The £5.1bn BlackRock World Mining fund was the best performing giant of 2022, climbing 13.9%. indeed, it was the only one to make a positive return on year.

The unstable market conditions including the war in Ukraine and the continued supply chain disruption from the pandemic – both of which led to inflation and rising interest rates – allowed the commodities sector to thrive last year, with funds in the IA Commodities/Natural Resources group up 18.8% on average in 2022.

BlackRock World Mining was well poised to benefit from the uncertainty of last year, but its cyclical nature also made it among the most volatile funds in the Investment Association universe at 30.7.

Indeed, it had both the largest max gain of 21% as well as the biggest max drawdown at 30.7%, meaning investors who held the fund had bumpy ride last year.

Total return of fund vs sector in 2022

Source: FE Analytics

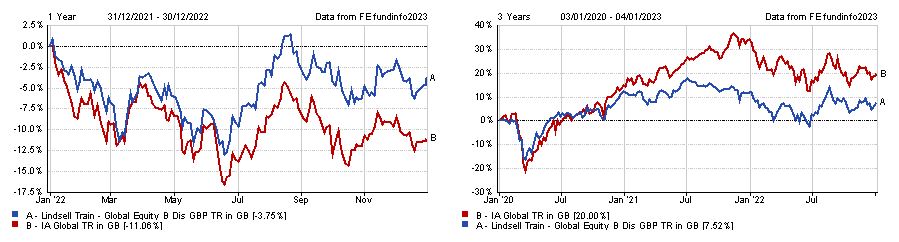

All 15 of the remaining funds that run more than £5bn failed to make a positive return last year, even Lindsell Train Global Equity, which had the second best performance on the list.

It fell 3.8% in 2022, but still managed to beat its average peer in IA Global sector, which was down 11.1% over the period.

Nick Train’s £5.5bn portfolio is still a top-quartile performer over the long term, rising 280% over the past decade, but volatility since Covid struck in 2020 has dragged it to the bottom quartile over the past three years.

Total return of fund vs sector in 2022 and over the past three years

Source: FE Analytics

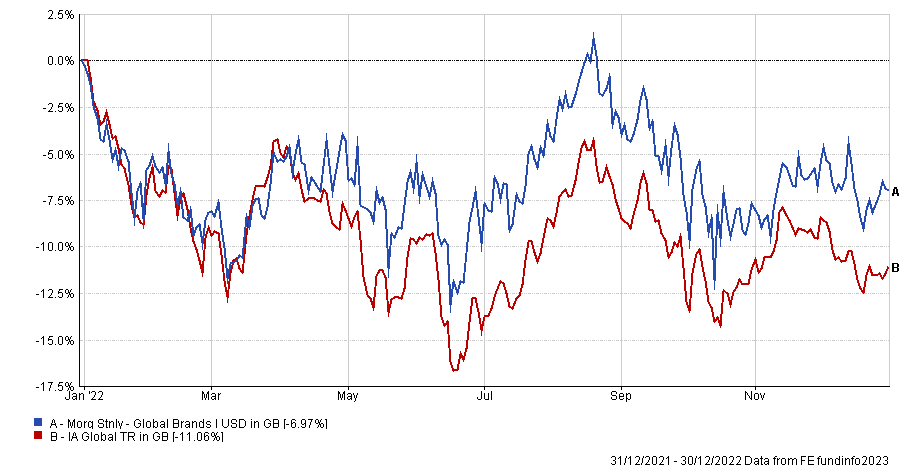

Other growth managers had a difficult time navigating a value-oriented market last year, such as Morgan Stanley Global Brands. The £17.2bn portfolio dropped 7% in 2022 but was still able to beat its peers in the IA Global sector by 4.1 percentage points over the period.

Although it beat the sector average, William Lock’s overweight allocations to high-growth names, such as top holding Microsoft, are likely to have detracted from performance last year.

Total return of fund vs sector in 2022

Source: FE Analytics

Most other IA Global names on the list appeared at the bottom of the pile, such as Morgan Stanley Global Opportunity, which had the worst return in 2022 among the behemoths.

Kristian Heugh’s £8.8bn portfolio is highly exposed to rate sensitive sectors such as information technology and consumer discretionary, which account for 58.3% of all asset allocations.

These areas had a turbulent journey in 2022, and the fund’s top holding in Uber (which makes up 8.6% of the portfolio) is likely to have dragged returns down, with the share price falling 40.1% over the past year.

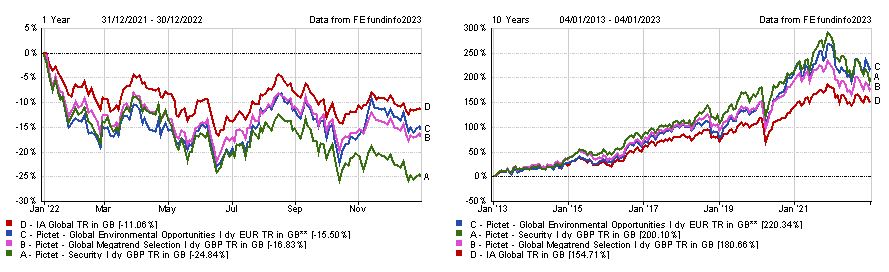

Several IA Global funds run by Pictet also dropped significantly in 2022 – Pictet Security, Pictet Global Megatrend Selection and Pictet Global Environmental Opportunities fell 24.8%, 16.8% and 15.5% throughout the course of the year.

Investors holding these funds, which are jointly worth $21.3bn (£17.8bn), may be comforted to know that all three outperformed their sector over the past 10 years.

Total return of funds vs sector in 2022 and over the past decade

Source: FE Analytics

Likewise, the fund that delivered the best performance among the group over the past decade – Fidelity Global Technology – has not been as successful in the short-term.

It climbed 573.5% over the past 10 years, climbing well above other giant funds on the list, but returns sunk 13.5% last year. This £11.5bn portfolio was also the second most volatile on the list behind BlackRock World Mining at 21.2.

Technology funds were some of the best performers of the 2010s when there was an abundance of free cash in the market, but a tighter monetary environment has been a struggle.

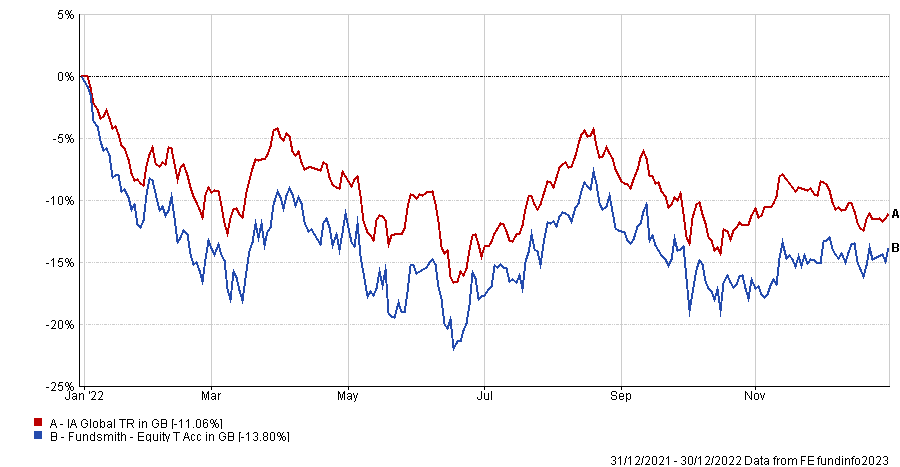

The same can be said for many quality-growth funds such as Fundsmith Equity, which dropped 13.8% in 2022.

Total return of fund vs sector in 2022

Source: FE Analytics

Its high allocations to quality names assets struggled during last year’s downturn as investors who had used these stocks as “bond proxies” were able to move back to the relative safety of fixed income.