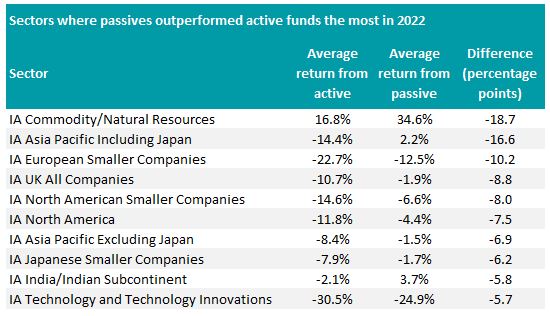

Passive funds beat their active counterparts in more than three-quarters of IA sectors last year as managers struggled to beat their benchmarks.

Trackers outperformed in 29 IA sectors, while actively managed funds only won in nine. The study disregarded sectors where the return difference was less than 1 percentage point.

The greatest passive outperformance last year came in the IA Commodity/Natural Resources sector, where passive funds beat their active counterparts by 18.7 percentage points.

Source: FE Analytics

The nine passive funds in the sector generated an average return of 34.6% in 2022, while the 21 active funds were up 16.8%.

However, returns among the passive funds were varied due to their specialist nature – those tracking energy benefited from a surge in oil & gas prices last year, with the iShares S&P 500 Energy Sector ETF soaring 85.6%.

At the other end of the scale, niche funds such as iShares Global Water and iShares Global Timber & Forestry fell 9.4% and 6% respectively.

The top-performing active funds in the sector were BlackRock BGF World Energy and Guinness Global Energy, climbing 57.3% and 49.9% respectively.

Higher energy prices also made a sizable difference in the IA UK All Companies sector last year, where passives beat active funds by 8.8 percentage points. Managers in this sector typically aim to outperform by taking a higher exposure to companies further down the market cap scale, where there is more opportunity to spot pricing inefficiencies. However, last year two of the main drivers of returns were oil & gas behemoths Shell and BP, which have a combined market cap of £251bn. They made 48.7% and 49.6% respectively.

Performance of Shell and BP in 2022

-2.png)

Source: Google Finance

Passives in the IA UK All Companies sector were still down, with losses of 1.9% in 2022, but active funds fell even further, dropping 10.7%.

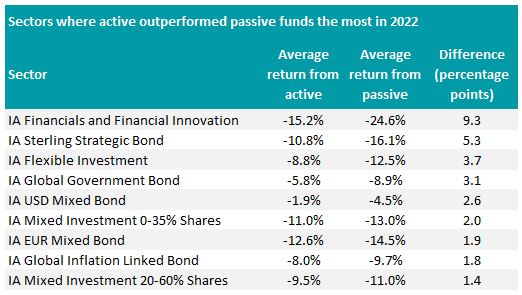

The two passive funds in the IA Asia Pacific including Japan sector are both income focused. This meant they had lower exposure to the more growth-focused Chinese market last year, which suffered from extended Covid lockdowns and geopolitical tensions. The MSCI AC Asia index was up 8.4% overall last year, but the MSCI China index sank 12.1%. The two passive funds in the sector rose 2.2% last year, while actives dropped 14.4%.

Total return of indices in 2022

Source: FE Analytics

The US has the reputation of the hardest market for managers to beat, and so it appeared last year when passive funds in the IA North America sector made 4.4%, 7.5 percentage points ahead of the average active strategy.

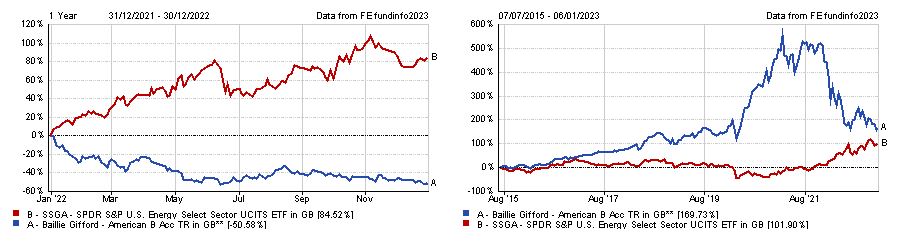

Again, energy trackers topped the sector, with SPDR S&P U.S. Energy Select Sector up 84.5% over the course of the year, while Baillie Gifford American sank to the bottom with a loss of 50.6%.

Baillie Gifford American’s high-conviction growth approach worked in its favour in the decade or so before 2022, but the concentrated portfolio didn’t do so well in the correction. In this environment, the greater diversity in passive funds helped minimise losses.

Total return of funds in 2022 vs the past decade

Source: FE Analytics

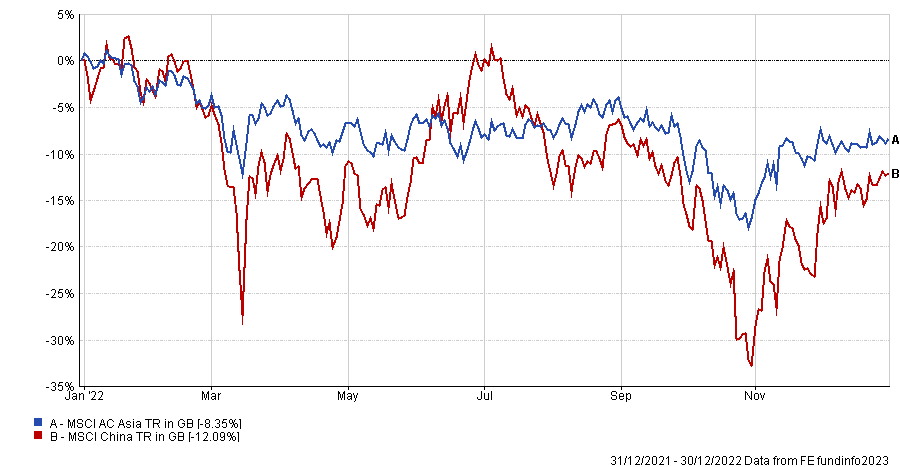

Active management still proved advantageous in some sectors last year, especially in fixed income.

For example, active funds came out on top in IA Sterling Strategic Bond and IA Global Government Bond, beating their passive peers by 5.3 and 3.1 percentage points respectively.

Bond indices have the highest exposure to the biggest borrowers. This means bond trackers invest with no gauge of the risks involved. An active manager in a smaller fund, on the other hand, can inspect bonds individually to access their credibility, which can reduce risk.

Source: FE Analytics

Active funds outperformed by the highest margin in the IA Financials and Financial Innovation sector last year, making 9.3 percentage points more than their passive counterparts.

Only one active fund, Polar Capital Global Insurance, was up over the period, with its 24.2% return boosting the average performance of all actively managed funds in the sector.

Likewise, a 73.4% fall from the HAN ETC Group Digital Assets & Blockchain Equity fund (which tracks cryptocurrencies) dragged down the performance of passives.

Broader trackers such as the Xtrackers MSCI World Financials and Xtrackers MSCI USA Financials were the second- and third-best performing funds over the period.