Investors who are trying to adapt to today’s market are likely to have considered expanding their portfolio allocation to include more alternative investments.

Only last week, BlackRock portfolio experts called time on the 60/40 portfolio and said it is now down to investors to be more dynamic and open to new opportunities in a changing market environment.

As the range of asset classes held in portfolios is likely to expand, below, we look into investment companies in the alternative realm that currently trade at a discount and that Numis analysts Ewan Lovett-Turner, Colette Ord, Priyesh Parmar and Andrew Rees believe are worth looking into.

Last week, we covered their recommendations in the UK, Asia and globally.

Private equity

Numis analysts argue that listed private equity deserves more space in investors’ portfolios, given the attractive risk/return opportunities.

“We believe listed private equity funds provide a tried and tested route to access private assets through a selection of high-quality managers with a record of outperforming equity markets,” they said.

“In addition, there is currently an attractive valuation opportunity with wide discounts factoring in significant potential NAV [net asset value] declines, whereas we believe portfolios have been, and will continue to be, more resilient than investors expect.”

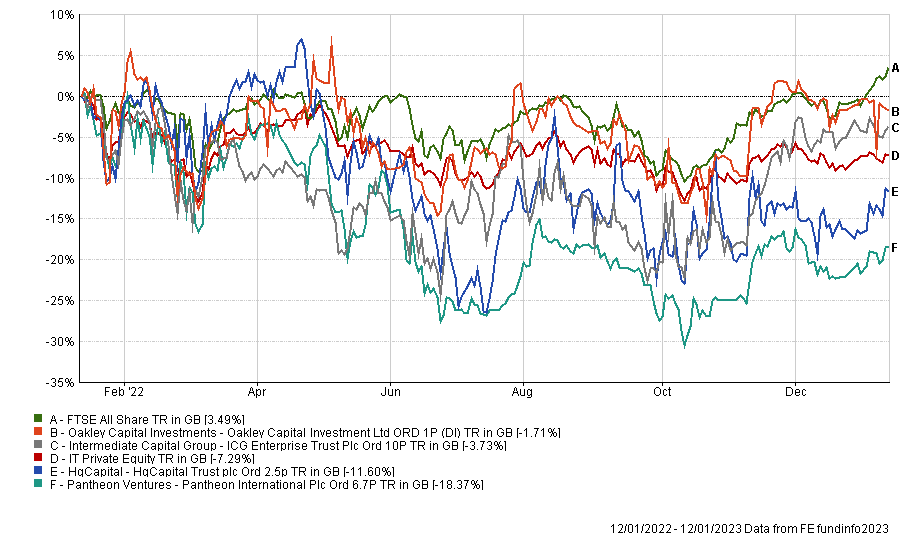

Performance of Numis-recommended trusts over 1yr against sector and index

Source: FE Analytics

One of Numis’ “highest conviction recommendation in the investment companies sector” is HgCapital Trust*, which invests in “mission critical” but “dull” technology that seeks to automate business processes and increase efficiency.

This is far away from the blue-sky technology that investors might be concerned about, which should be in high demand in an environment where labour costs are rising, according to the analysts.

HgCapital Trust is currently at an 18% discount.

Generating “strong net cash flows”, Pantheon International and HarbourVest Global Private Equity (43% and 42% discount, respectively) are both “solid choices” for investors seeking exposure to venture capital growth investments, the analysts continued.

Meanwhile, Chrysalis Investments, which suffered a “torrid” 2022, is a good option for brave investors, said the Numis team.

“We believe the focus on companies with strong unit economics leaves the portfolio relatively well placed as the market shifts from growth to profitability,” they noted.

“In our view, there is an excessive amount of bad news factored into the current share price, and brave buyers at the current discount of 48% will be rewarded over the medium-to-long term, albeit volatility is to be expected.”

Infrastructure

In the infrastructure space, Lovett-Turner's team finds value in those with high-quality cash flows and expects “attractive returns” from a select group of trusts, both in absolute terms and relative to the relevant peer group.

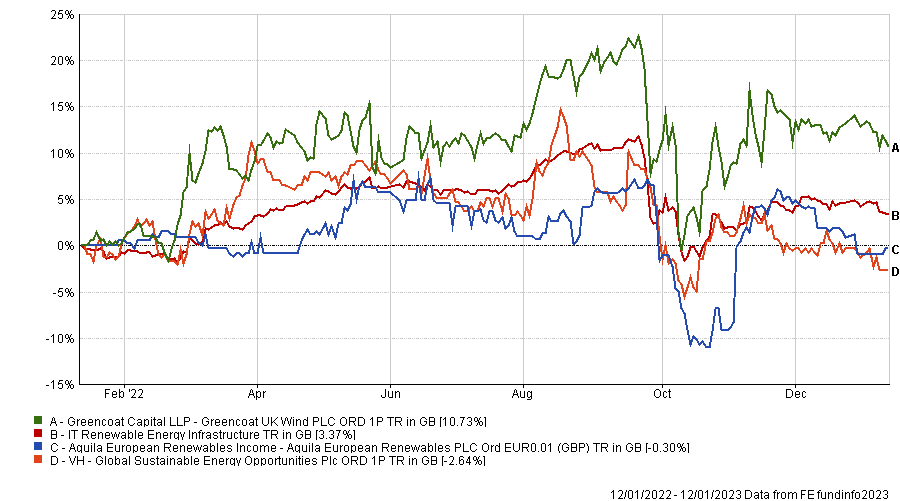

Performance of Numis-recommended trusts over 1yr against sector

Source: FE Analytics

Here, the core recommendation was International Public Partnership, currently trading at a 4% discount and offering a 5.1% yield.

The trust’s most attractive assets include offshore transmission cables and the Thames Tideway “super-sewer”, both of which with downside protection and no weather or power price risk, the analysts said.

For the “vast majority of time” since launch, the fund has traded on a premium, making this an opportune moment to buy.

In the renewables space, Numis analysts recommended Aquila European Renewables (18% discount), Greencoat UK Wind (13%) and VH Global Energy Opportunities (10%).

Meanwhile, in digital infrastructure, Cordiant Digital Infrastructure (24%) looks “attractively priced”. The performances of these trusts are shown in the graph above.

Property

While rising gilt yields and borrowing costs caused a repricing of commercial properties in 2022, the analysts believe that “a lot of bad news is already priced into share prices and that there will be ample margin for the current average sector discount of 28% to close, especially in the second half of 2023.

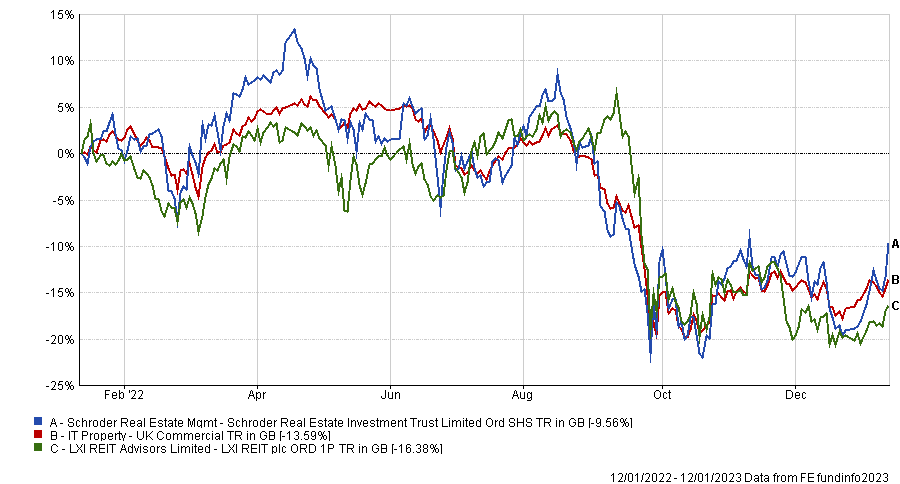

Performance of Numis-recommended trusts over 1yr against sector

Source: FE Analytics

Here, the team highlighted LXi REIT.

“Having historically traded at a premium prior to September’s mini-Budget, we believe the current discount [17%] represents a very attractive entry point,” they said.

“With an aggregate £734m of borrowings due to expire over the course of 2023 and 2024, debt refinancings will be a near-term priority for management. We believe the announcement of successful refinancing that provides clarity on finance costs could be a catalyst for a re-rating.”

Another place to find value, according to Lovett-Turner, is Schroder Real Estate, which is currently on a 27% discount.

The NAV will not be immune from further weakness in the near term, the analyst said, but the portfolio is 49% weighted to industrial assets, which continue to witness favourable occupational markets.

Specialist

There are also opportunities among more specialist trusts that do not necessarily lend themselves to an easy comparison, the Numis analysts highlighted.

First up is Syncona, whose 6% discount, combined with value in the underlying listed assets, makes for a “compelling” buying opportunity. One of the reasons for the recommendation is the trust’s strong life sciences portfolio, which includes Autolus, a company that recently impressed with the release of data on leukaemia treatments. However, its share price remains suppressed given this required it to raise additional capital.

Riverstone Energy had a very strong performance in 2022, when, given its exposure to oil and gas, it benefitted from rising energy prices and distanced its peers by 25 percentage points, as illustrated below.

Performance of trust over 1yr against sector

Source: FE Analytics

While this performance might not continue to be the case in 2023, Lovett-Turner continues to find its current 48% discount attractive.

Finally, the analysts drew attention to music royalty trusts, as they provide “a positive backdrop for revenues, given the continued growth of streaming, price rises from streaming platforms and the US Copyright Royalty Board (CRB) ruling increasing songwriters share of income”.

Trusts in this sector are now trading at wide discounts, including Hipgnosis Songs (40%) and Round Hill Music (34%), which they consider “an attractive starting point for investors, providing a cushion against some of the potential concerns around about whether there has been a ‘land grab’ for assets with insufficient focus on pricing”.

*HgCapital Trust is an investor in FE fundinfo.