Nick Train has claimed he can turn around the recent poor performance of his Finsbury Growth & Income Trust by simply doing nothing.

Speaking at the trust’s AGM, he thanked shareholders for their patience, admitting his recent performance as manager has not been satisfactory to himself as a shareholder, never mind anyone else.

The trust has yet to regain the peak reached in 2019 and has underperformed its IT UK Equity Income sector and FTSE All Share in both of the past two calendar years.

Performance of trust vs sector and index over 3yrs

Source: FE Analytics

While the manager said he hoped performance would soon take a turn for the better, he didn’t believe any changes were necessary to achieve this, and he made no additions to the portfolio last year.

Instead, he said he would stick to a strategy that, even after recent poor performance, has caused Finsbury Growth & Income to significantly beat its sector and benchmark over the past decade.

“Just to summarise succinctly, it is a perfectly viable approach to construct your portfolio around wonderful businesses and wait,” he said. “If you are prepared to wait, you are prone to find that the result will be a wonderful change to your wealth.

“And the reason why I remain optimistic about the outlook for Finsbury Growth & Income is I’m persuaded that its portfolio constitutes extremely robust businesses. Actually, my personal view is that the vast majority of companies in the portfolio are truly exceptional.”

To illustrate his point, he noted that 90% of portfolio holdings by value increased their dividends last year, while two held them at the same level. There were no cuts.

In addition, 85% of the portfolio by value either bought back shares or paid a special dividend.

“Only strong companies can do both of those things,” Train added. “That fits our proposition that this portfolio is made up of robust businesses.”

Performance of trust vs sector and index over 10yrs

Source: FE Analytics

One of the main reasons for Finsbury Growth & Income’s recent underperformance is the spike in inflation, favouring the sector responsible for driving prices higher – energy – which Train avoids due to the unpredictability of earnings.

Inflation has also led to an increase in interest rates, which has hit the valuations of the quality-growth companies favoured by the manager.

However, he claimed that, over the long term, the brands owned by his portfolio holdings act as a strong hedge against rising prices. For example, co-manager Madeline Wright pointed out that the price of a bottle of Heineken served in a US bar has increased by 18x since 1955, compared with an increase of 11x from the retail price index.

While she only had performance data going back to October 1989, she noted that Heineken has made a return of about 4,400% over this time, compared with about 1,100% from the MSCI World index. UK CPI is up 140%.

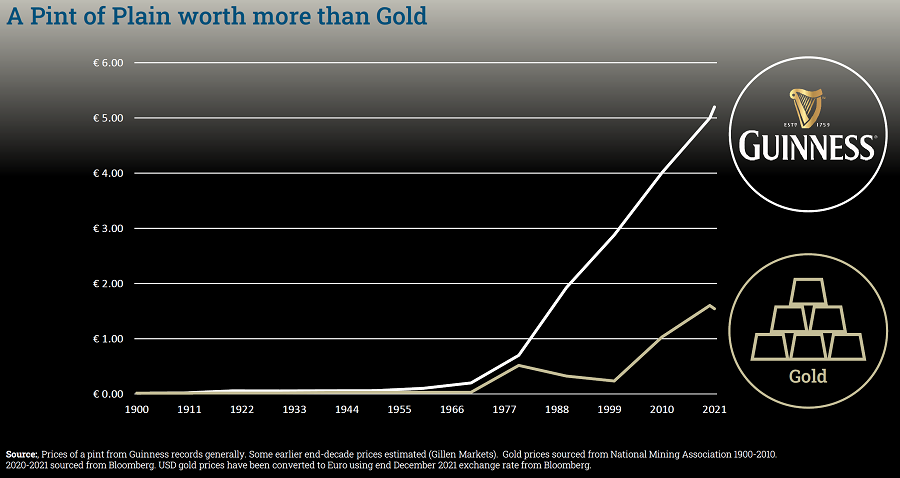

Train also pointed to a graph showing the price of a pint of Guinness – owned by the trust’s second-largest holding, Diageo – which has vastly outperformed the classic inflation hedge, gold, since 1900.

While inflation harms growth companies, it also plays into the hands of value stocks – when everything is growing by double digits, valuations of expensive and cheap companies should in theory converge towards the mean.

Train said that while this wasn’t deliberate, the poor performance of some of his holdings over the past few years meant they have begun to attract the attention of value managers, suggesting the portfolio should do well even if inflation remains high. He cited Burberry as one example.

However, he said he didn’t believe investment value could be measured by simple price-to-earnings ratios.

“Investment value is a combination of price and the value being created by the company over time,” he explained.

“I believe Diageo or Relx or the London Stock Exchange currently offer terrific investment value, even though ostensibly they're not on 10x earnings.

“Guinness is a hugely valuable part of Diageo. And it's not valuable because of its position in Ireland. It's valuable because of growth in the United States, and potentially in Africa over the next 50 years.”

Train’s holdings are not the only companies that have struggled recently, and he said the abysmal performance of the UK market has thrown up more potential ideas than at any time he can remember.

However, returning to his point about doing nothing, he said it was important to remember “the grass isn’t always greener”.

“I’m a true believer in the Warren Buffett proposition that if you own something good and you get a chance to buy more of it, do that,” he added. “That's just as valid a thing to do with new capital as buying a new stock.”