There was a dramatic performance difference between listed and private real estate in 2022. While REITs, as measured by the FTSE Nareit All Equity REITs Index, were down 27.9% through September and 21% through November, the NCREIF ODCE index, a measure of private real estate that is calculated quarterly, was up 13% through September on a total return basis.

Based on history, however, we believe this gap in performance will not persist. While private real estate typically lags listed real estate due to its slower-moving price discovery and transactions, the NCREIF ODCE Index suffered its second-greatest deceleration since 1978 – returning 0.5% in the third quarter compared to 7.4% in the first and 4.8% in the second.

We have advised investors to have strategic allocations to both private and listed real estate. Yet, we see the emergence of a backdrop that supports a REIT recovery over the next 12 months as a reason to overweight listed REITs.

Robust fundamentals

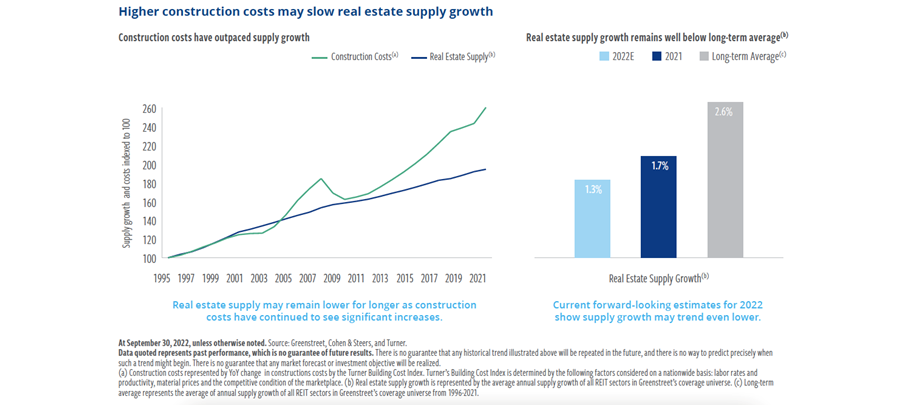

REIT fundamentals are decelerating but will remain resilient. REITs have entered the economic slowdown in a healthy position due to favourable supply-demand dynamics, characterised by tight supply.

A key difference between this cycle and previous downturns is that real estate supply is likely to remain lower for longer. We expect inflation to decline but remain elevated until at least the end of 2023.

Higher costs for land, materials and labour have increased replacement costs, reducing the potential profits of development and raising the economic barriers to new supply, while reducing potential competition for existing properties.

Durable and predictable cash flows may also provide defensiveness relative to other asset classes. REITs offer the potential for relative stable earnings compared to equities, due to limited supply, in-place leases, high operating margins and low labour intensity.

Moving past peak inflation

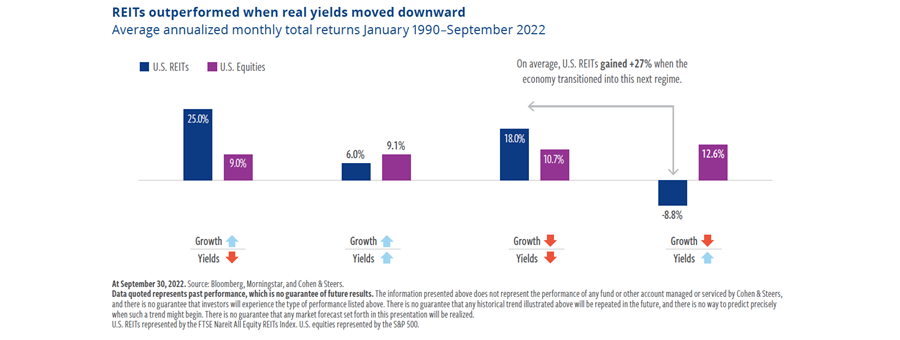

Additionally, listed real estate has historically outperformed in the type of more supportive inflationary backdrop we see on the horizon – when the end of the rate-hiking cycle occurs and both real yields and growth are down.

The Federal Reserve is engaged in one of its most aggressive rate-hiking cycles ever to tackle inflation – and market participants expect it will succeed sooner rather than later. This supports a more favourable backdrop for REITs for two primary reasons.

The first is moving towards lower real yields. Low growth but higher yields – indicating stagflation – present a headwind to real estate, with REITs declining 8.8% on average in these situations.

Periods when both growth and yields are down, indicating a more stagnant environment, have represented a significant tailwind to REITs, which have climbed 18%, on average as a result.

Second, REITs have performed remarkably well when rate-hiking cycles have ended – on average returning 15.8% in the first six months after the Fed has stopped raising rates.

Investors may already be anticipating these two dynamics playing out. REITs gained in October – up 3.4% for the month. Since then, REITs rallied more than 7% on 10 November, on the news that the Consumer Prices Index had fallen to 7.7% in October – and REITs were up 9.6% for the fourth quarter through 13 December.

One risk to our base case, however, is the possibility that the Fed overshoots, continuing more aggressive hikes as it seeks to win back credibility amid criticism it was slow to react to inflation. This would push back the end of the rate-hiking cycle and the magnitude of the slowdown could be worse.

Rise of REITs

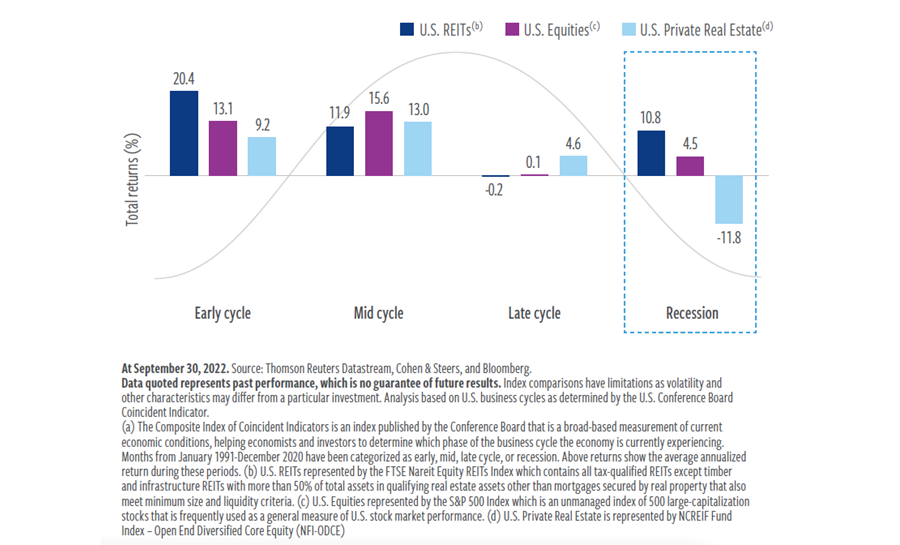

While we think the market has priced in a worse recession than we expect, we believe the current downturn could present a similar arc to recessionary precedent – after which REITs performed remarkably well.

Analysis looking back to 1990 shows the best returns for REITs have been generated during the early cycle. Nevertheless, investing during the recession has generated forward returns on average of 10.8%, which is above long-term averages and outperforms the returns of the equity market of 4.5%.

REIT forward returns turn positive in a recession: Average 12-month forward total returns based on U.S. conference board indicator from January 1990–December 2021

We see even stronger relative outperformance in early cycle recovery periods when comparing private and listed real estate. Private real estate posted negative 12-month forward returns of -11.8% post-recession and positive returns of 9.2% post-early cycle.

By understanding the leading and lagging behaviours of listed and private markets, real estate investors can tactically allocate at different times across the two asset classes.

Jason Yablon is head of US real estate and Rich Hill, head of real estate strategy and research at Cohen & Steers. The views expressed above should not be taken as investment advice.