Last year was a tricky period for those investing in UK equities, with the highest interest rates in decades and political uncertainty dragging share prices down.

However, the FTSE 100 index has started 2023 with a bang, hitting multiple all-time highs so far this year, suggesting that the unloved region could be worth looking at again.

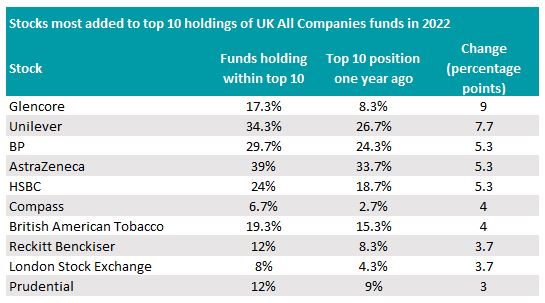

Here, Trustnet looks at the stocks most added to and removed from the top 10 positions of UK All Company fund managers.

Source: FE Analytics

Glencore was the most popular stock among UK managers, with the number of funds in the sector making the mining company a top 10 position in 2022 more than doubling over the course of the year. At the start of 2022 it appeared as a top holding in 8.3% of UK All Companies funds, but this jumped to 17.3% by the end of December.

Shares in the company were up 29.5% over the past year as soaring commodity prices lifted revenues significantly. Glencore’s generous dividend yield of 4.07% may also have appealed to investors seeking income from their assets.

Income may also have played a part in the rise of the second most bought stock, Unilever, which currently has a 3.5% yield. In addition to the dividend, it initiated a €1.5bn share buyback scheme last year.

The consumer goods company, which owns brands such as Dove, Surf and Lipton, was among the top 10 holdings of more than a third (34.3%) of IA UK All Company funds at the end of 2022, compared to 26.7% at the start of the year.

Its share price climbed 7.8% over the past 12 months, but it entered 2023 with a profit warning and a failed takeover of Haleon for £50bn.

Russ Mould, investment director at AJ Bell, said that there are some potential tailwinds coming up now that activist investor Nelson Peltz has joined the board and chief executive Alan Jope is nearing retirement.

Mould added: “Unilever upgraded its underlying sales growth forecast for 2022 alongside its third-quarter results, thanks to the pricing power conferred by its brands, which helped the firm to more than offset declines in volumes as harder-pressed consumers trimmed spending.”

Share price of Glencore and Unilever over the past year

Source: Google Finance

Shares in BP, AstraZeneca and HSBC also filled top 10 positions in UK portfolios last year, with managers increasing their exposure to each by 5.3 percentage points.

Food services company, Compass Group appeared in the top 10 holdings of only 2.7% of UK funds at the start of last year, but it leapt to 6.7% by the end of 2022.

Shares in the company were up 7.5% over the past twelve months, with the return of workers to offices post-Covid providing a boost for the canteen firm, according to Keith Bowman, investment analyst at interactive investor.

He said that forecasts suggest an operating profit growth of more than a fifth in 2023, with sales stripping out acquisitions forecast to rise by around 15%.

“For investors, a desire by its corporate customers to cut costs looks to be playing into its hands. Compass continues to highlight global structural growth opportunities, with just under half the worldwide food services market still self-operated and available to be outsourced,” said Bowman.

UK managers also increased allocations to British American Tobacco (BAT) in 2023, with top 10 positions rising from 15.3% to 19.3% throughout the course of the year.

Its 7.1% yield makes it one the highest payers in the FTSE 100 index and the company paid out £5.7bn in dividends last year. This high yield paired with resilient revenue in an otherwise volatile market, which made it an attractive investment, according to Sophie Lund-Yates, lead equity analyst at Hargreaves Lansdown.

She said: “Investors have turned towards companies that have sticky revenue streams and revenue doesn’t get more reliable than tobacco.

“Of course, there are social risks associated with investing in tobacco, not least that the sector is excluded from some institutional products. The risk of regulators cracking down on new products is also worth being aware of.”

Last year also involved a lot of selling by UK fund managers, with oil company, Shell falling from the most top 10 positions last year.

It was one of the highest allocations with 34% of UK All Companies funds at the start of last year, but that dropped to 12.3% by the end of 2022.

Like BP, the company benefited from rising oil prices, with its share price climbing 17% over the past 12 months, but managers may have eased off buying shares in the company as the oil price started to come down in the second half of 2022.

Indeed, the S&P GSCI Brent Crude Spot index peaked in June and fell 18.9% from its highs by the end of the year – although this was still 53.7% above its price at the start of 2022.

Source: FE Analytics

UK managers also cut their top 10 positions in supermarket chain Tesco by 2.7 percentage points to 1.7%. Its share price dropped 16.2% over the past 12 months, with concerns that the cost-of-living crisis may ignite a price war between the big supermarkets damaging sentiment, according to Lund-Yates.

Nevertheless, she added that Tesco was “doing all it can in very difficult circumstances” and its large size gives it the benefit of pricing power.

“There aren’t significant red flags where Tesco is concerned, the shift in sentiment simply shines a spotlight on the tougher road ahead for the grocers,” Lund-Yates said.

Sentiment towards residential property developer, Bellway also fell, with the number of funds holding it as a top 10 position dropping from 2.7% to 0.7%.

The firm announced a 12.4% dip in weekly reservations back in October’s annual report and rising rates painted a bleak picture for the property market in general.

Indeed, Bowman anticipates much of the same in 2023, which could result in Bellway’s dividend yield dropping from 6.5% to 5.8% over the course of the year.

He said: “The housebuilder highlighted a wider range of potential outcomes for its 2023 underlying operating profit margin compared to 2022 given the backdrop of uncertainty, with build volumes expected to prove similar to 2022.”

Retailer Marks & Spencer, finance software developer Sage and telecommunications giant Vodafone also made the list.