Technology funds have topped the performance leaderboard in the opening two months of 2023 after last year’s rally in value stocks petered out, FE fundinfo data shows.

The value style wrestled market leadership from growth stocks in 2022 as surging inflation and rising interest rates pushed investors towards companies more likely to pay out now rather than in the far-off future.

However, signs in late 2022 that inflation was starting to peak bolstered hopes central banks were close to finishing their rate-hiking cycles and – when coupled with China scrapping its zero-Covid policy – sparked a market rally.

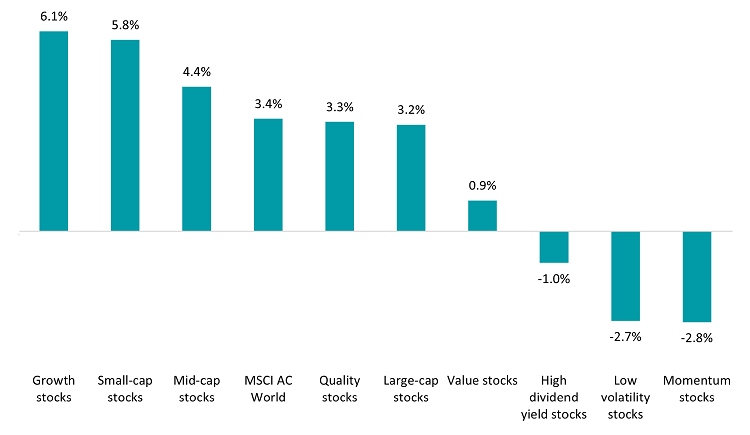

Performance of investment factors in 2023 YTD

Source: FinXL

As the above chart shows, this rally continued into 2023 with the MSCI AC World index gaining 3.4% during January and February. Growth stocks have led the way, returning 6.1% while value stocks are up just 0.9%, as investors pin hopes on a pause in monetary tightening.

However, the year-to-date figures represent something of a pullback from one month ago when the MSCI AC World was up 4.7% and growth stocks had made 7%. Strong economic data in February made investors worry that central banks would need to keep raising interest rates to stem persistent inflation.

That said, growth stocks continued to lead the market last month – the MSCI ACWI Growth index was down 0.9% versus a 1.6% fall in its value counterpart, showing investors continue to favour growth.

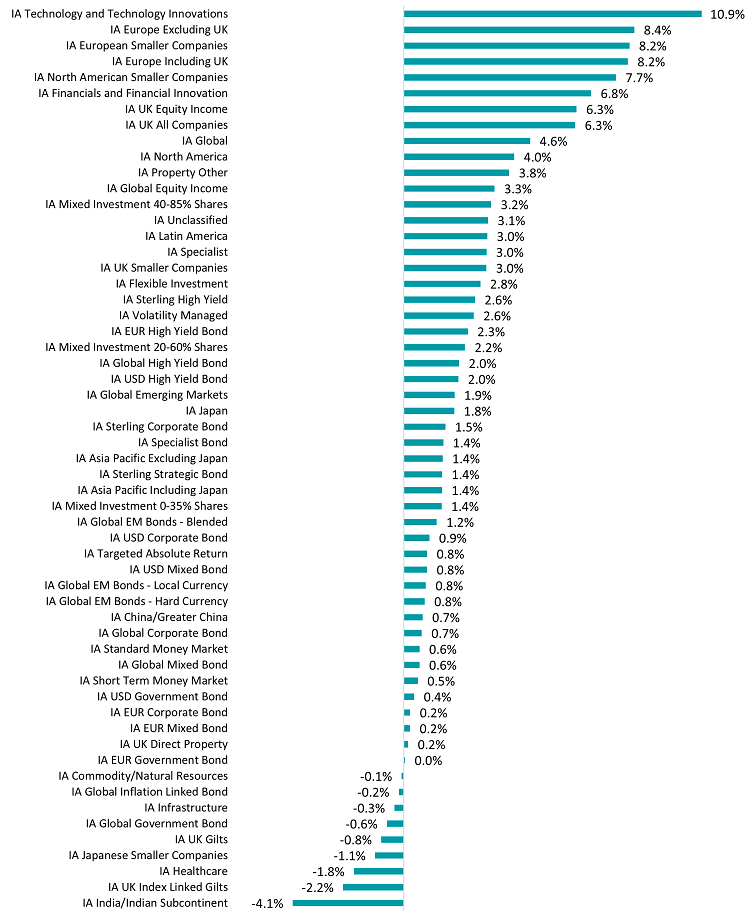

In line with this, the IA Technology and Technology Innovations sector is the best-performing Investment Association peer group over the year so far, with the average fund making close to 11%.

Performance of Investment Association sectors in 2023 YTD

Source: FinXL

Tech stocks – which sit firmly in the growth investing bucket – posted meteoric returns for much of the post-financial crisis bull run but came crashing down last year after higher interest rates caused investors to question their lofty valuations.

While funds in sectors such as IA North American Smaller Companies, IA Global and IA North America tend to have a growth bias and are towards the top of the performance table this year, it’s not been a clear run for the growth style.

UK and European sectors including IA UK All Companies, IA UK Equity Income and IA Europe Excluding UK also made some of the highest returns over the past two months and they tend to be more value orientated.

Both regions may be attracting investors because they look cheap when compared with the US and companies in industries such energy and banking have just posted some strong results.

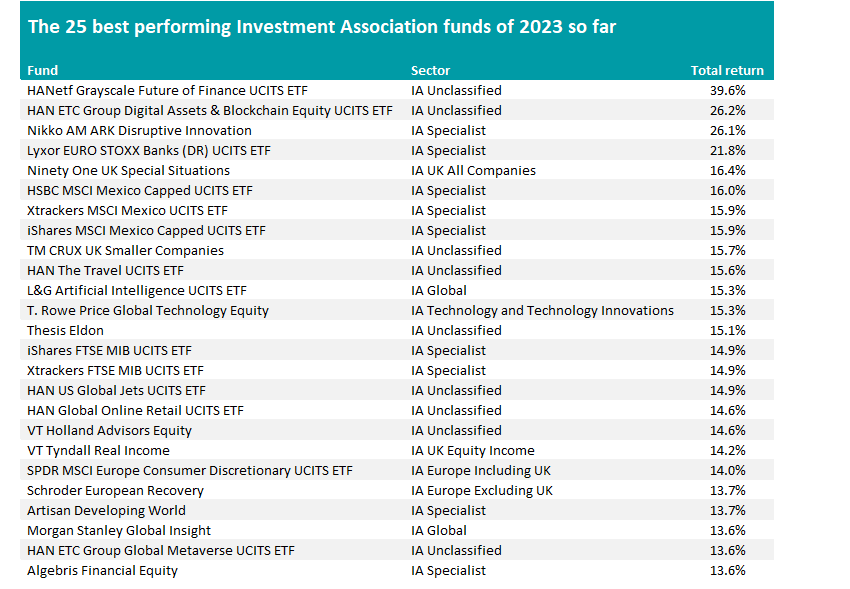

A look at the funds with the highest returns over 2023 to date reflects the dominance of growth and tech stocks with examples of outperformance from select value funds.

Source: FinXL

HANetf Grayscale Future of Finance UCITS ETF is up almost 40% in two months, while HAN ETC Group Digital Assets & Blockchain Equity UCITS ETF has made more than 25%.

Both of these funds fell hard in 2022 when investors were fleeing tech stocks, especially those on the frontier of the industry. But these stocks are back in favour in 2023 – blockchain economy and the digital economy companies have been some of the best performing thematic stocks of the past two months.

Funds such as Nikko AM ARK Disruptive Innovation, L&G Artificial Intelligence UCITS ETF and T. Rowe Price Global Technology Equity are also sitting at the top of the Investment Association performance tables this year thanks to their growth approach.

On the other hand, the table above features a handful of value strategies such as Ninety One UK Special Situations, VT Tyndall Real Income and Schroder European Recovery.

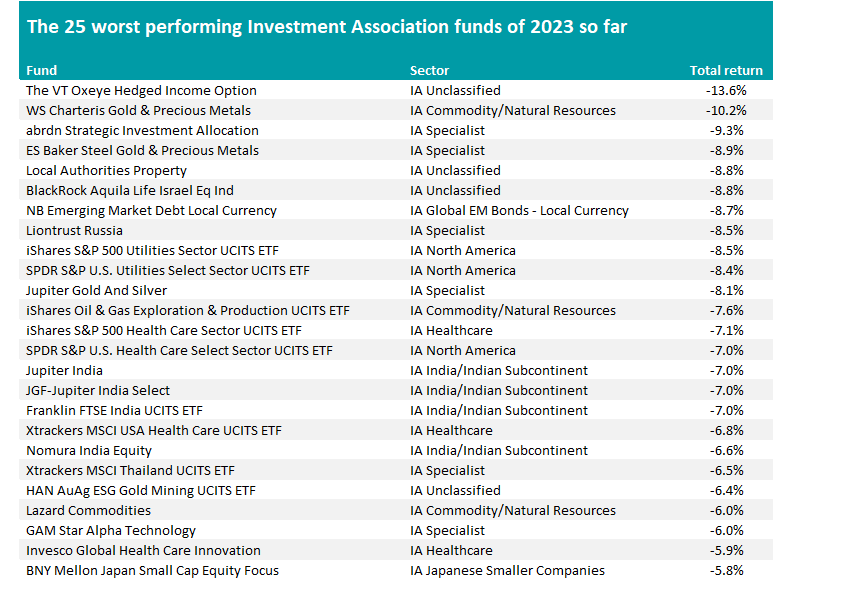

Source: FinXL

A few themes can also be seen among the funds suffering the heaviest losses in 2023 to date – the most obvious of which is the weak performance of commodities strategies after their strong run in 2022.

While most commodity prices surged last year due to supply bottlenecks and the war in Ukraine, they have fallen in 2023 as demand weakens and investors are wary of an economic slowdown.

Indian equity funds (Jupiter India, Franklin FTSE India UCITS ETF, Nomura India Equity) and healthcare strategies (Xtrackers MSCI USA Health Care UCITS ETF, Invesco Global Health Care Innovation) are also found among the recent laggards.