Specialist funds have been an increasingly growing part of the market as investors have looked outside of traditional bonds and stocks, whether it be portfolios investing in country-specific equities or asset-classes that are not in standard markets, such as infrastructure, specialist lending or thematic bets.

But experts are mixed on whether they should be in investors’ toolkits. Louis Tambe, head of managed portfolio service at City Asset Management, said DIY investors should be wary of using specialist funds to get exposure to a particular theme.

He argued that investors would be better off getting exposure to a specialist area through a broader equity portfolio with exposure to a theme, rather than a fund investing solely in that one sector.

Indeed, one of the main drawbacks that prevents him from investing in specialist funds is their limited pool of assets.

Fund investing in one theme are constrained to a small part of the market, so end up buying “one in every two stocks” available to them, according to Tambe.

Not all the companies in one field will come out as winners, so holding a portfolio full of them means that many will be competing with one another.

Tambe said: “Everything tells us that you want companies with a strong market position, so why do you want to buy all the companies within a sector? Chances are you're going to get some bankruptcies and you're taking a much bigger risk.”

It provides no diversification, he suggested, with the managers of thematic funds restricted in where they can reallocate capital if they sell out of a holding.

Tambe said that “there is no incentive for a specialist fund to ever sell out” of a holding because it would not have the freedom to reinvest that into something else.

For some themes such as technology, financials and healthcare – all of which have dedicated funds and trusts investing solely in the sector – investors can instead look to a global fund as many already have a sizable allocation to these areas. Value funds, for example, tend to be overweight financials, but will have broader market coverage than a specialist portfolio.

This ability to spread risk can lead to higher alpha, as these managers take more concentrated positions in a smaller number of companies, compared with specialist funds that may have many more holdings at smaller sizes in an attempt to dampen risk, Tambe pointed out.

Another reason not to like specialist funds is that, by the time an asset class has enough momentum to warrant its own specialist portfolios, it is often nearing maturity.

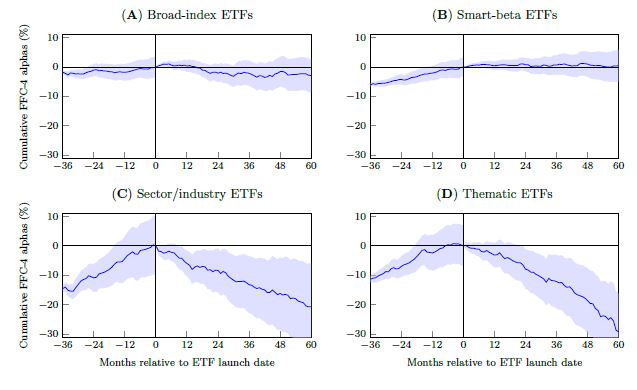

He referred to a study published by the Ohio State University in October last year that suggests the alpha generated by specialised exchange-traded funds (ETFs) goes down by 6% a year in the first five years following their launch.

Performance of the indexes underlying newly launched ETFs

Source: Ohio State University

The report said that “they do not create value for their investors by providing outperforming investment strategies” and “the combination of underperformance, high fees, and lack of diversification of these products remains a puzzle”.

It goes on to say that specialist ETFs are often launched when an investment theme has entered the mainstream, so these funds are “designed to appeal to investors’ irrational beliefs”.

Tambe said that many broad equity funds typically would have allocated to these themes sooner and would have generated a healthy return on them by the time they peak.

He added: “They’d launch at a point where we're already well into a bull market and the big quality growth funds already own these names in the theme, and many of them have even started selling out of those companies."

This paints an unappealing case for specialist funds, but Tambe said that they are still very attractive to general investors as they tell an engaging story.

Tambe said: “If you're a multi-manager fund house, like us, having a biotech fund or an artificial intelligence fund in a portfolio immediately makes it sexy and it becomes much more interesting to the end client.

“But that's not investing – it’s about long-term preservation and growth of wealth, not taking moon-shot bets. If you're someone in my position though, having thematic funds is very easy to sell to clients.”

Not all agreed with Tambe. Kelly Prior, manager in the multi-manager team at Columbia Threadneedle, said that while specialist funds can be risky, “it would be foolish to totally ignore the space”.

She added: “Putting all your faith and hard-earned savings into any one of these offerings can lead to various outcomes as the alpha skill of the manager can be swamped by the beta characteristics of the asset class, driven by factors out of their control.”

Prior said that it might be a good time to look at specialist funds investing in financials, particularly Premier Miton Financial Capital Securities. The £218m portfolio run by FE fundinfo Alpha manager Lloyd Harris, alongside Rob James, is up 7% since launching in October 2020.

Total return of fund vs sector and benchmark since launch

Source: FE Analytics

She said: “With banks having de-risked their businesses at the same time as de-risking their balance sheets, the current value in this space makes it worthy of consideration at the moment in our eyes.”