Cheap prices and policy changes have made Japan one of the best markets for value investors, according to Joe Bauernfreund, manager of the AVI Global Trust.

He holds 19% of his £974m portfolio in Japanese equities, giving him a large overweight to the region, while exposure to more traditional value markets such as the UK stand at a modest 3%.

Japanese companies are currently trading at “valuations you can’t find elsewhere in the world,” according to Bauernfreund, creating favourable conditions for value investors.

He said: “There's just a lot of stars aligning on the fundamental front in Japan that you don't see in other markets.”

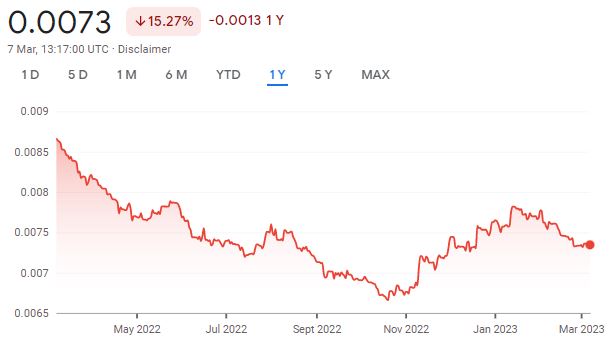

One of the main draws of Japan right now is the cheapness of its assets, which has been largely driven by declines in its currency. The yen dropped 15.3% against the US dollar over the past year as the Bank of Japan maintained its loose monetary policy, even whilst inflation reached a 41-year-high of 4.3% in January.

Japanese Yen to US dollar over the past year

Source: Google Finance

Bauernfreund does not anticipate the yen staying depressed for long, so investors wanting to take advantage of the cheap currency may want to do so soon.

He said: “That's not going to persist forever and the economic fundamentals in Japan, particularly on the inflationary front, suggest that the days of yield curve control and ultra-low interest are numbered. We think that that provides an attractive source of returns.”

Analysts at Lazard Asset Management also noted the opportunities that have arisen from declines in the Japanese currency, stating in a report in January that “the significant weakening of the yen has put Japan in its most cost-competitive position in decades”.

They added: “Valuations remain attractive relative to historic levels and relative to other markets, and underlying core profitability continues to improve”.

Companies in Japan may be cheap at present but many businesses in the region have beneficial traits that Bauernfreund is not finding in other markets.

He said: “When you look at Japanese companies, the features that immediately stand out are the surplus net cash on their balance sheets.

“A lot of those companies have got far too much cash on the balance sheet and don't have any debt, so that provides a very sound bedrock to their to their operations.”

Although the cheapness of Japanese equities has been recognised by value investors for quite some time, now marks a good time to allocate to the region as changes to policy are putting that idle cash to better use.

Bauernfreund said: “Japan has stood out on valuation grounds for the best part of 20 years and many value investors would have dabbled in Japanese equities from time to time full of excitement and anticipation, only to have been disappointed a short while thereafter.

“Nothing ever changes in Japan and what was cheap remains cheap and nothing really happens to them.”

Bauernfreund said that policies introduced by former prime minster Shinzo Abe jumpstarted the stagnant market and set about putting the masses of idle cash held by Japanese companies to good use.

He added: “For the first time in many years, we felt that not only was Japan cheap and attractive on valuation grounds, but it also had a catalyst in the form of the corporate governance code and the stewardship code.”

The manager has noticed a sizable shift in the productivity of Japanese companies since these changes were introduced and this is still ongoing today, generating strong drivers for future returns.

“There's a big push on the activism front in Japan so there's a lot of catalysts brewing. There's a lot of willingness on the part of management to do things to unlock value, and it comes after years of not focusing on shareholder returns and focusing on other interests,” he said.

“Finally, the interests of shareholders are now being promoted and that provides a powerful tailwind to generating returns.”

Despite these positive changes, Bauernfreund said that “Japan still suffers from a perception that it's a bit of a basket case,” and is unappreciated by value investors.

This has led some value investors to move allocations away from the region, but it is worth revisiting now for its attractive opportunities, according to Bauernfreund.

He said: “There are other markets in the world that are far more relevant and a lot of investors prefer to focus on the larger markets, but Japan stands out as being attractive for many professional investors we come across.

“We know from the past that when Japan catches a lot of interest and capital flows into it, it can move quite strongly, so there are an increasing number of international investors focusing their efforts on Japan.”