Investments that seemed hopeless in 2022 have experienced a significant comeback over the year to date – including growth, technology and European stocks, Trustnet research has found, leaving investors questioning if the opening months of 2023 are something of a blip.

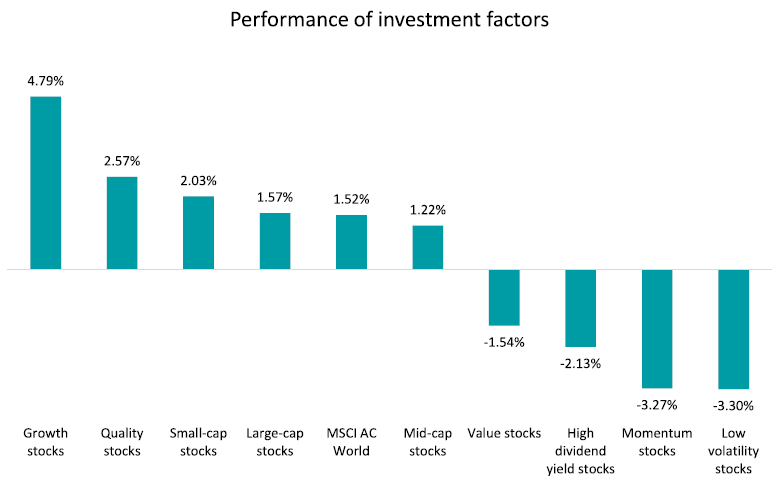

At the same time, other investments that were expected to outperform, such as value, Chinese and healthcare stocks, lost ground instead, as the graph below shows.

Source : FinXL

Experts were taken by surprise by this data, as Andy Merricks, fund manager at 8AM Global, admitted.

“Most of it is contrarian to what people thought was going to happen. I don't think many people forecast these growth and thematic sectors were going to bounce back quite like this,” he said. “Everyone assumed that value was going to continue to outperform.”

When looking for an explanation for this reversal of fortunes, most agree that market expectations around interest rates and bond yields have played a role.

Merricks: “Whenever bond yields rise, growth sectors, which have done well since 2008, get absolutely hammered. When bond yields fall or slow down, which they did in the first couple of months of 2023, they rise. It was all about the anticipation of the market that the Fed was close to stopping raising rates.

“With the banking issues in the past couple of weeks, these sectors have done quite well because it’s less likely that the Fed will continue to raise rates. The Fed and the Bank of England did increase the rates last week, but the market is clearly saying that they’re not going to keep doing that to avoid banking crisis.”

Kamal Warraich, head of equity fund research at Canaccord, agreed, but also identified other reasons for this change and went on to say that the market’s response was mostly irrational.

“People originally thought inflation was transitory, then that it was explosive and that it would stay like that forever and now that it’s tempering down. Whether investors believe that inflation will be sticky and remain higher for longer or not had an impact on these performances,” he said.

“On top of that, investors still have healthy levels of cash and when there’s a sell-off, they buy the dip”.

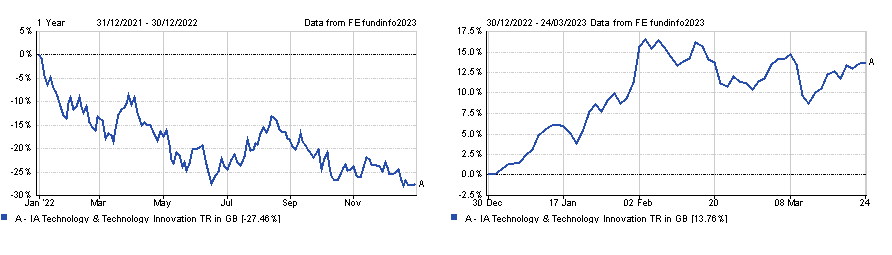

This is what happened, he argued, in the technology sector, whose bounce-back this year (shown in the graph below) has surprised just as much as its crash in 2022.

Performance of sector over 2022 and the year to date

Source: FE Analytics

“Technology companies and especially the FAANGS [Meta owner Facebook, Amazon, Apple, Netflix and Alphabet – parent company of Google] are an enormous part of technology indices these days. Apple and Microsoft collectively make up around 30% of technology indices, so it's a massive active risk for people not to own their shares in a portfolio,” said Warraich.

“Also post-Covid, we've had a very high level of retail participation as well as a massive increase in high-frequency trading and quantitative trading, which have generated a lot of indiscriminate buying and selling”.

Ultimately, he said, these swings in the market are not justified.

“People got carried away in this big rush to tech. Indeed, our own house view is that economic news is going to be a little bit more painful for a bit longer and we're more defensively positioned as a company for our model portfolios,” he concluded.

Merricks was of the opposite view, saying that these movements are “normalising” the market, bringing it back full circle.

“People are starting to invest in what the world wants and needs as opposed to buying things just on valuation,” he said.

“We've had the valuation correction back in the beginning of last year and the sell-off is correcting back in favour of sectors like future mobility, artificial intelligence, robotics and the digital economy, which are performing really well.

“A lot of people are expecting a profit sell-off on the back of the first earnings-to-quarters reporting period, but a lot of these companies have achieved good results. And if they're good in a period of downtime, then you'd expect those profits to continue to be good going forward.”

Richard Clode, co-manager of the Janus Henderson Global Technology Leaders fund, saw these adjustments as a good opportunity to enter the market.

“A combination of more reasonable earnings expectations and rational valuations make us more optimistic on the outlook for the technology sector, in addition to the long-term technology trends that remain intact,” he said.

“Bear markets historically have not tended to last for that long and entering 2023 we were already over a year into that bear market. The next bull market cycle will come and could even have already started.

“However, this time, it will likely reward profitable technology companies and the passing of the baton from the FAANG stocks to new leaders.”

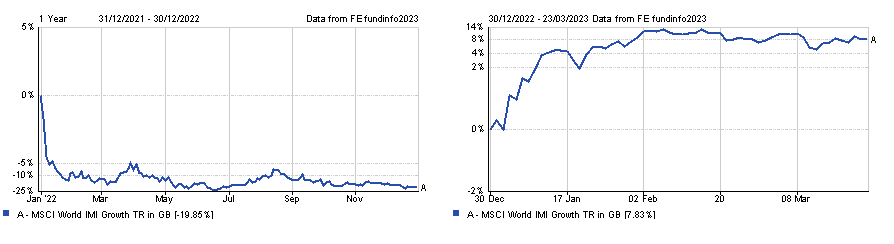

Performance of index over 2022 and the year to date

Source: FE Analytics

Meanwhile, other experts continue to back a value-based investment style, saying that it will regain the lead over growth, despite it being back in red territory in 2023, as the chart above illustrates.

Simon Evan-Cook, multi-asset manager at Downing Fund Managers, noted that in the opening months of 2023 there has already been several market leadership switches and this may change a few more times until the longer-term trend becomes established. Because of this, he advocates staying “on the fence” and not leaning portfolios too heavily into one investment style or another.

“’Is this a blip?’ is the right question to ask, but we’ll only know the right answer in hindsight. There are perfectly good reasons to believe that this year’s rally in growth stocks, Bitcoin and bonds could be a blip. For one, history has plenty of examples of bear markets being punctuated by sharp rallies before they’re finished destroying your wealth,” he said.

“But then you could just as easily argue that this year isn’t the blip; it was 2022 instead. If inflation has been caged, meaning central bankers have achieved their apparent goal of returning us to the conditions we saw last decade, then we may simply have returned to the longer-term trend of the past 10, if not 40, years.”