Tom Slater has dismissed analogies made between the Scottish Mortgage Investment Trust and Woodford Equity Income fund, saying the difference in size of the unlisted stocks held by the two strategies means they are in no way comparable.

Scottish Mortgage recently made the news after non-executive director Amar Bhidé was asked to resign after he questioned, among other issues, the extent of the trust’s investments in private companies.

“In my opinion they do not have the capabilities and governance clout to be able to monitor the illiquid investments on which there is little audited information in the public sphere,” Bhidé told The Financial Times.

This led some investors to question whether Scottish Mortgage could fall foul of the same liquidity issues that caused the eventual wind-up of the Woodford Equity Income fund, which at one point had more than £10bn in assets under management.

However, Slater (pictured) said there were two reasons why this wouldn’t happen.

“The first is the size and geography of the investments,” he said. “The average company the Woodford fund was investing in was based in the UK and roughly valued at £200m.

“We're investing in global companies with an average size of £10bn. We aren't getting into small companies – these are big established investments for the main part.”

He said the second difference is the structure of the two vehicles: while Woodford Equity Income was open-ended, Scottish Mortgage is closed-ended.

“Therefore, we are not a forced seller of these assets,” the manager continued. “Those are two absolutely fundamental differences in approach.”

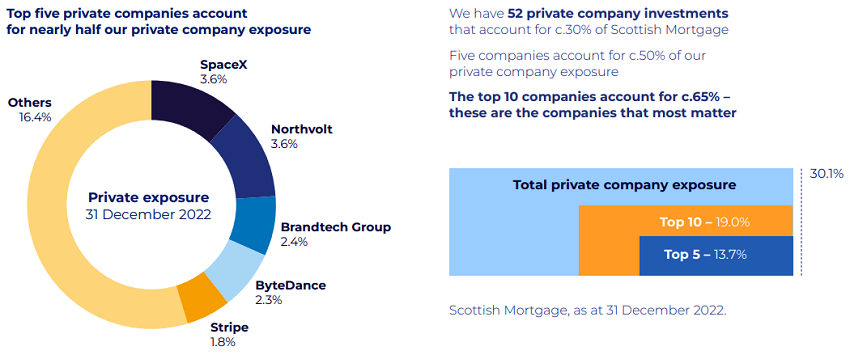

Liquidity is not the only reason why investors have expressed concerns about Scottish Mortgage’s investments in unlisted assets. The trust raised its maximum unlisted exposure from 25 to 30% of assets in 2020, but breached this upper limit for about a third of last year.

There is also some unease about whether the way that the trust values its private holdings is sufficiently transparent. Again though, Slater moved to assuage these concerns.

On the first point, he said that the trust’s private holdings have to some extent been a victim of their own success.

“What we've seen is that the private companies we own generally performed better than their publicly listed peers last year and raised money at higher valuations, despite what was going on in the broader market,” the manager added.

“That pushed that relative weighting in privates up as public markets came down.”

And far from trying to reduce exposure to unlisted companies, Slater’s deputy manager Lawrence Burns said Scottish Mortgage invested a further £260m into them last year.

“We were still able to make private investments for a lot of 2022,” he explained. “There was one investment we would have liked to have made, but we weren't able to because we happened to be at or close to the limit at that point.

“We haven't felt totally constrained yet and it's not something where we've felt we’re not fulfilling our duties as a responsible shareholder. But it's something that we continue to monitor.”

On the second point, Burns was keen to stress that neither he nor Slater are involved in determining the valuation of private companies. “We basically get an email telling us when they've changed,” he said.

Slater said the starting point involves asking a third party, S&P Global, to assess the valuation of a private company. This is then passed on to Baillie Gifford’s private companies valuation committee, made up of five full-time accountants.

“They will provide another layer of challenge to that report and target areas to get the best estimate they can of the value of these private companies if they were to trade today – it's not based on historical prices,” Slater continued.

“Then the output of the valuation committee is reviewed by the audit committee of the board, then the external auditors.”

While this may sound like more trouble than it is worth, Slater said that it is important to remember why the trust began investing in private companies – many of the world’s fastest growing businesses are choosing to stay private for longer.

Slater said there are many reasons for this. One is that the allure of being a listed company declined following the financial crisis. Another is that private companies don’t have “what's seen as the significant administrative burden that goes into being a listed company”.

Perhaps most important is that they get to choose their own shareholders. Slater said this is significant as the intrinsic qualities of the exceptional companies of the past 10 or 20 years “come from the influence of founder managers that allow businesses to take really long-term decisions that aren't too focused on maximising short-term profitability”.

He said another defining characteristic of a truly exceptional business is having a large enough opportunity set, which is perhaps the main reason for investing in private companies. The manager pointed to Scottish Mortgage’s five largest unlisted holdings – SpaceX, ByteDance, Stripe, Northvolt and BrandTech – which together make up about half of the trust’s unlisted portfolio.

“We think they are exposed to growth areas that we can't get exposure to if we invest in public companies, and we think they have some of the biggest growth opportunities in the world,” Slater added.

“We shouldn't think of [private companies] as an asset class. We don't invest in asset classes. We invest in a relatively small number of companies which have got exceptional growth opportunities.

“Sure there are headwinds. We have to make sure we get the valuations right, that sort of thing. But these are some of our best ideas.”