There is much uncertainty about what 2026 will bring for markets, with tariffs, interest rates, fragile economic growth and the continuation of wars around the world all set to impact stocks.

Yet there are some funds that experts wouldn’t be without heading into next year. Below, five fund selectors share their favourites for the next 12 months.

WS Ardtur Continental European

With much anxiety about the high valuations for US tech giants, many experts chose to look away from the dominant American market.

One example was Ross McKnight, senior investment analyst at City Asset Management, who chose WS Ardtur Continental European as a strong option for 2026.

“This is a pan-European deep value fund, managed by veteran Oliver Kelton, which invests in five key buckets: banks, telecoms, oil & gas, industrial value and general value,” he said.

It has been a standout in the IA Europe Excluding UK sector, sitting in the top 10 of the over 100-strong peer group over one, three, five and 10 years.

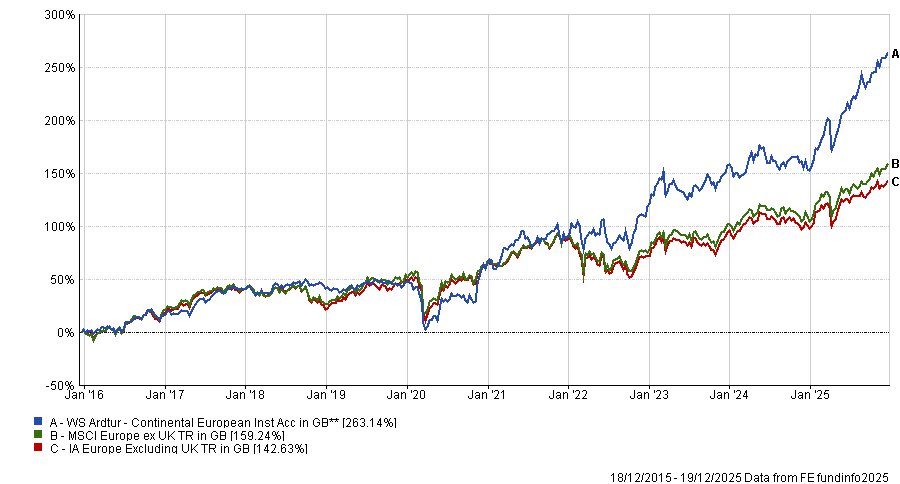

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics

However, there are reasons to believe it can continue this run of form. Europe should benefit from an improving regulatory environment and stimulus from countries such as Germany.

This should benefit the fund, which is 50% geared to the performance of the European economy. The other 50% is not and “is improving through self-help measures such as share buybacks and efficiency gains,” said McKnight.

“A P/E [price-to-earnings ratio] of 12x, a 4% dividend yield (and 1-2% buyback yield) with an expected EPS [earnings per share] growth of 10-15% sets this fund up well.”

WS Raynar UK Smaller Companies

Another eschewing the US was Juliet Schooling Latter, research director at Chelsea Financial Services, who went for a UK smaller companies pick.

“When we look for genuine value going into 2026, what stands out is that most asset classes and global equity markets are no longer cheap. China, Asia, Europe and even UK large-caps are trading at premiums to their own history, leaving little margin for error,” she said.

“UK smaller companies are the clear exception. The sector has endured one of its toughest periods in living memory and remains a long way below its 2021 peak. This is a deeply out-of-favour part of the market, and that is precisely what makes it interesting.”

With so much money leaving the asset class, it doesn’t take much of a shift in sentiment to drive a powerful recovery, she noted.

Her selection, WS Raynar UK Smaller Companies, is managed by Philip Rodrigs, who brings two decades of experience investing in UK smaller companies at Investec and River and Mercantile.

He founded Raynar and launched the fund in July 2024, during which time it has been the best performer in the IA UK Smaller Companies sector.

“As conditions normalise, his disciplined, valuation-aware approach and strong long-term track record leave us confident he is well placed to capture the upside from a long-overdue recovery in the sector,” said Schooling Latter.

Fidelity Global Dividend

For those wanting to take a broader approach, Tom Bigley, fund analyst at interactive investor, suggested a global fund – but one that mitigated exposure to the US.

Given its income focus, Fidelity Global Dividend has just 23.9% allocated to the US, compared with 64.7% for the MSCI ACWI benchmark.

Managed by Daniel Roberts since 2012, it has made a second-quartile return in the IA Global Equity Income sector over one, three and 10 years, slipping to the third quartile over five years.

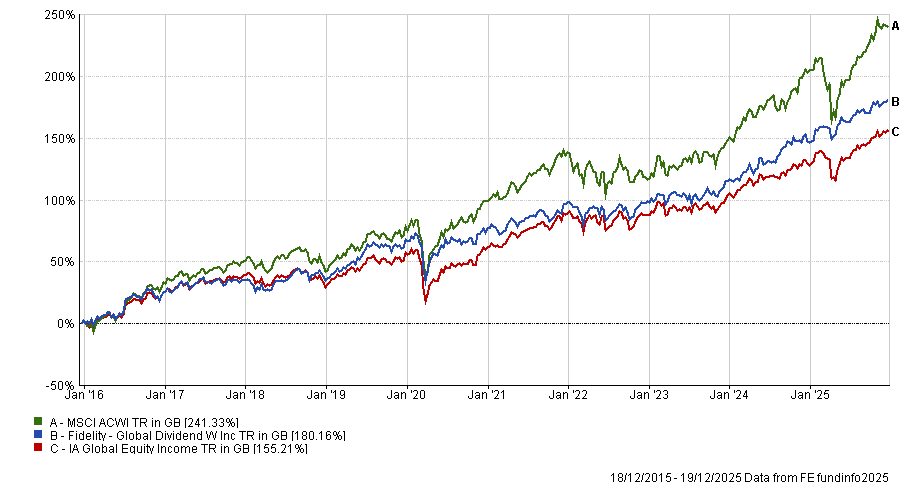

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics

Bigley said this is a fund “designed for a smoother ride through market cycles”, which could be important for investors if next year follows the same pattern as 2025, when markets were strong but “riddled with bouts of volatility and diminished outperformance of growth above value”.

“The focus is on companies that offer a healthy and growing dividend yield, as well as potential for capital growth. Companies which demonstrate pricing power and robust balance sheets are favoured and those holding large amounts of debt are avoided.

“Being value-oriented, globally diversified and without positions in the ‘Magnificent Seven’, it represents a differentiated exposure from many global equity peers,” he said.

“The yield on offer from this fund is modest, however the focus on dividends and dividend growth can enhance stability and play a key role in providing diversification in an uncertain environment.”

Orbis Global Balanced or Orbis Global Cautious

For a multi-asset, one-stop-shop approach, Peter Toogood, founder of Fund Research Centre, said investors should think of their fund selections like their Christmas songs: “The old ones are the best”.

“Specifically, we would continue to favour contrarian yet flexible fund managers and, in this regard, Alec Cutler, manager of the Orbis Global Balanced and Orbis Global Cautious funds, fits the bill perfectly,” he said.

The Balanced fund has been the top performer in the IA Mixed Investment 40-85% Shares sector over one, three, five and 10 years, while the Cautious fund is in the top quartile of the IA Mixed Investment 20-60% Shares sector over one, three and five years.

Part of the recent success has been the funds’ weightings to gold, which Cutler “has been a fan of for a number of years,” Toogood said.

“He was early into defence stocks and utilities, playing the themes of geopolitical unrest and the electrification of the world at large,” he added, while also “staunchly refusing” to hold developed sovereign bonds at the low in yields in 2020, instead favouring US 10-year treasury inflation-protected securities (TIPS).

“The active share is consistently above 90% and the portfolio composition rarely bears much relationship to reference benchmarks,” Toogood concluded, giving investors something different in 2026.

JPM Natural Resources

Jack Roberts, Investment Analyst at IBOSS Asset Management, said commodities and natural resource equities have been two of the best performing areas of the market this year and look set to have another strong run in 2026.

“Years of underinvestment have constrained global commodity supply, while the accelerating energy transition and electrification of transport continue to drive demand for base metals. Inventories remain low and spare capacity is limited, so conditions remain supportive for elevated commodity prices,” he said, meaning the “structural drivers” that have propelled the asset class in 2025 should persist.

The JPM Natural Resources fund provides diversified exposure to this theme as it invests across the market-capitalisation spectrum in commodities and related equities such as miners.

Managed by Christopher Korpan and Veronika Lysogorskaya, the fund has made top-quartile returns in the IA Commodity/Natural Resources sector over the past 12 months, three years and decade.

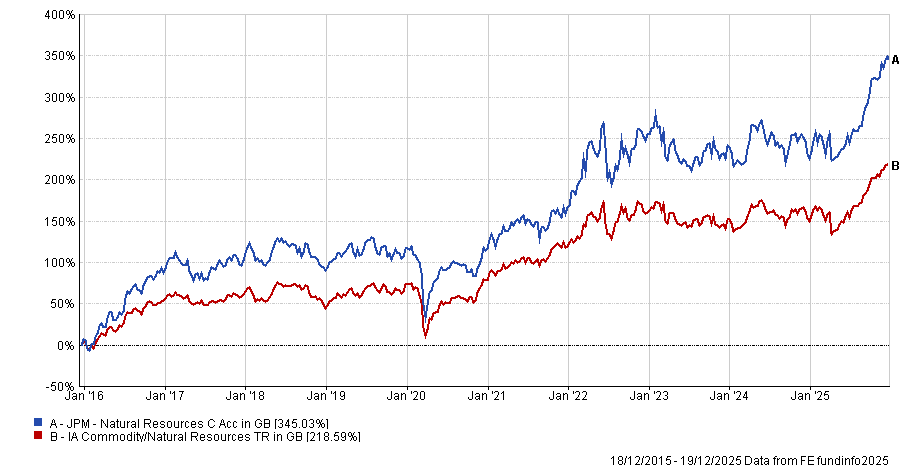

Performance of fund vs sector and benchmark over 10yrs

Source: FE Analytics

Roberts said: “The fund has refined its process to enhance resilience and broadened its potential opportunity set. It capped individual stock allocations to a maximum of 5% to reduce concentration risk while expanding its geographic reach across a wider set of regions, improving diversification.”

It also has “tactical agility”, as proved by its recent rotation from gold miners into oil-related holdings to capture near-term value.

“Historically, commodities and natural-resource equities have offered diversification benefits within multi-asset portfolios. With disciplined risk management and exposure to continuing growth drivers, JPM Natural Resources stands out as a compelling choice for us in 2026,” he said.