Over the last 10 years, a passive fund tracking the S&P 500 would have delivered stellar returns, beating all other major markets by a wide margin in the process.

The technology sector in particular has propelled the US market with the so-called FAANGs – Meta (formerly known as Facebook), Amazon, Apple, Netflix and Alphabet (formerly known as Google) – leading the charge.

But due to the outperformance of the US market, there is now a gap in valuation between US stocks and the other developed markets even after the tech-led sell-off in 2022.

Lorenzo La Posta, fund manager at Momentum Global Investment Management, said: “Some of that was Europe's fault: we’ve had Brexit and fragmentation risks within the European Union. As for Japan, it has been struggling with low growth and deflation for almost two decades.

“In that environment, the US was the only bright light and investors quite unsurprisingly poured their money into that market and it was a great choice.”

Performance of indices over 10 years

Source: FE Analytics

However, Momentum’s view is that the tide has turned with a market rotation from growth to value and the end of the near zero interest rate environment that favoured growth stocks.

Laposta said: “This market rotation has been benefiting European, Japanese and UK stocks against the US, because those markets have a higher portion of value stocks.

“Interest rates will eventually come down in the coming few years, but we still think we're not going to go back to 0% interest rate as we had in the past. A reasonable expectation of environment over the next three to five years is that rates will stay higher than what we've seen over the last decade, which should put an end to the US dominance of market returns.”

Another headwind for US equities is the US dollar weakening after a strong rise in 2022, while sterling has been one of the best performing major currencies so far this year, gaining 4.5% on the greenback.

Jason Hollands, managing director at Bestinvest, said: “If the pound continues to strengthen against the dollar, this will partly offset any share prices gains or deepen losses if US equities pullback in the second half.”

A market rotation and a weakening currency are not the only headwinds the US market is facing, as the largest economy in the world still has to solve the issues around its debt ceiling and regional banks.

As a result, Momentum prefers to have an underweight exposure to the US and a more balanced allocation across many regions, investment styles and asset classes.

Laposta said: “We have been underweight for some years, because the US was too expensive in our valuation models. It's not been always the best position to be in, but it's definitely benefited us recently.

“However, we have been relatively overweight UK and Japan within equities. Both markets have been unloved for a long time and when something is unloved, valuations get very cheap.”

Quilter Cheviot is also “modestly underweight” the US stock market. This stance has been taken principally on relative valuation grounds. Since the latter stages of 2022, the discretionary investment management firm has maintained an overweight to the UK, Asia-Pacific ex-Japan and emerging markets equities.

Simon Doherty, head of managed portfolio services at Quilter Cheviot, said: “Broadly speaking, this is a reversal of our preference to overweight the US stock market in recent years.

“Given how many moving parts there are to the current global economic picture, and the elevated degree of short-term uncertainty that exists, we believe it sensible to avoid making an aggressive call on the prospects of any one investment ‘style’ or sector.”

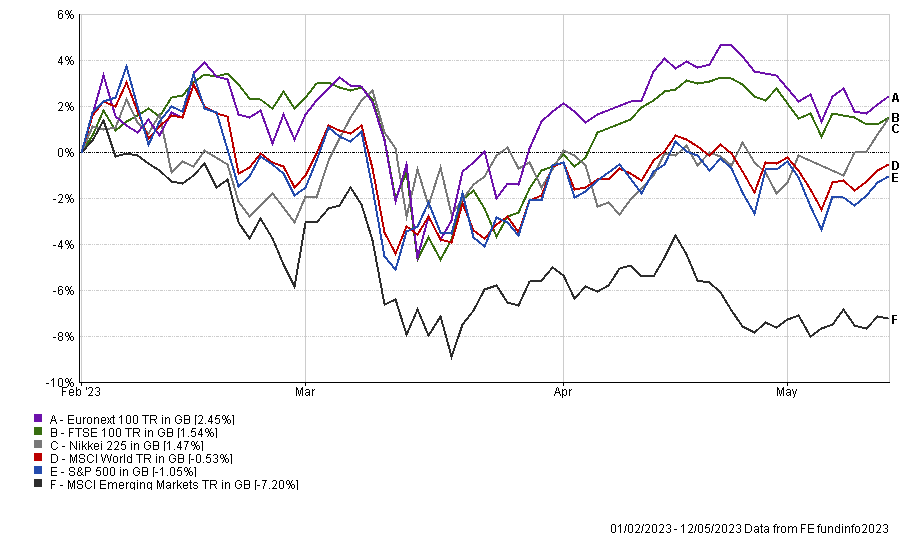

Performance of indices since the beginning of the year

Source: FE Analytics

However, Doherty added that the US market continues to offer a “superb” breadth and quality of companies from which to select.

Wealth management firm Saltus also sees promising opportunities within US equities.

Charles Ambler, partner at Saltus, said: “Looking forward there is a significant amount of pro-cyclical fiscal spending coming in the US such as the IRA and the Chips Act which will help to propel the reshoring narrative and support middle American manufacturing jobs.

“In addition, the US has a far better demographic outlook compared to many other developed market economies with meaningful inbound migration forecast, a key determinant to a healthy and functioning bond market.”

As a result, Saltus does not see any reason to divest from the US market.

Ambler concluded: “We believe that having a defined set of tramlines for regional equity allocations is not the best way to manage a portfolio. This does not mean that we are agnostic to total portfolio risk, however we are agnostic to having restrictions which prevent us from owning or not owning areas of the equity market we like or dislike at differing points in time. After all, why would you employ a racing driver only to set a maximum speed limit?

“That said, given the dominance of US equities within world equities there is typically a higher bar for adding or trimming US equites in a meaningful way from the MSCI World index.”