Following a decade-long rally, real estate has taken a pummelling as interest rates have been marching upwards and last year’s market turmoil exposed liquidity issues in some property funds.

Commercial real estate (CRE) has, for many years, generated returns in excess of investment grade or high-yield bonds of around 100-400 basis points per year. However, recent interest rate increases have left many CRE assets yielding less than an average high-yield bond. According to research, the entire global CRE sector remains expensive relative to investment grade bond yields and public REITs.

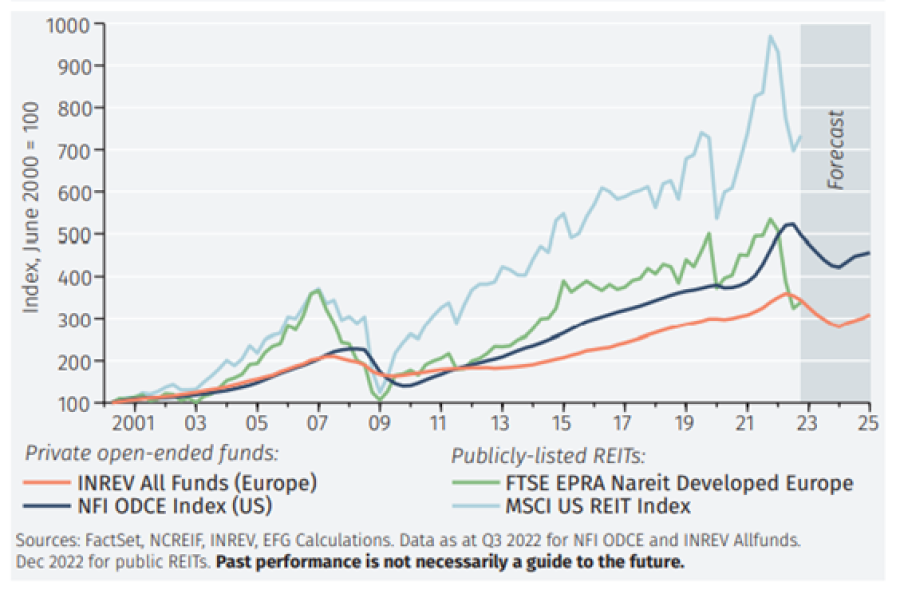

Private CRE funds show the most downside potential in our view (see chart below). We believe there is the possibility of a correction of 10-20% based on our assumptions, fund leverage as well as geographic and sector exposures.

CRE Private open-ended funds and publicly listed REITs

Sector performance

The average drop in property values in Europe and the US was 13% over the past 12 months. Office, industrial and residential sectors suffered the most, though the retail sector, which has struggled to recover from the impact of the pandemic, also dropped significantly. Publicly traded Real Estate Investment Trusts (REITs), which are more volatile vehicles than their private counterparts, fell by at least 25% over the same period.

Secular trends are providing asymmetric opportunities across sub-sectors with winners and losers set to emerge. One way of looking at these asymmetries is from a geographical perspective. Taking the office sector for example, there are asymmetries between regions, with hybrid working being much less of a secular trend in Asia than in the US or UK.

The largest sub-sector within CRE is offices. The UK and US office sector has not rebounded from the Covid-enforced working-from-home culture, despite governments and businesses promoting hybrid working options. However, more densely populated cities and smaller residential apartment sizes have supported a widespread return to office-based work in Asia-Pacific, buoying its CRE sector.

The UK office sector – already facing ageing stock, large volumes of obsolete suburban office space and a high level of new-building supply – is further squeezed by climate-related CapEx requirements for buildings to meet new emissions standards. However, the CapEx forecast varies by region, with the US office sector particularly hit, while the retail CRE sector is harder hit in the Eurozone and UK.

Another way of looking at asymmetries is that current real estate trends point to two, sometimes conflicting, property market trends. Some parts of the industry are expected to normalise or return to pre-Covid patterns, while others appear to have been permanently altered as the pandemic has changed or accelerated how and where we use different types of real estate (hybrid working, last-mile logistics, bricks-and-mortar retail).

Residential is better positioned for the medium to long term. Higher interest rates have reduced the affordability of home purchases, supporting rental demand. While there are signs of a stabilisation in rents, particularly in the US, demographic tailwinds continue to support demand for other areas of the residential sector, such as single-family, senior, affordable and student housing.

Residential is also a potential beneficiary of the working-from-home structural trend, with growth expected in major urban centres, supported by accelerating urbanisation and lower capital expenditure requirements than for offices. The amount of time spent working from home varies widely between countries, regions and sectors. Secondary office space – obsolete peripheral space with high vacancy rates – is becoming a target for "office-to-residential" conversions, helping to improve the low supply of residential projects in large cities, while also allowing new residential projects to adapt to hybrid working and environmental, social and governance (ESG) demands.

So developers, homebuilders or value-add focused investment strategies/funds in general could benefit from these conversions, while new office investment trends would focus on prime assets with strong ESG parameters.

Ongoing trends supporting e-commerce give further boost for CRE sectors such as warehouses, logistics and distribution centres. We believe that while retail and hospitality sectors have not yet recovered from the pandemic, there are long-term growth factors. Retail centres in prime locations with strong grocery anchor tenants remain well supported for long-term growth, as do leisure-oriented hospitality in attractive locations.

Conclusion

Over the longer term, the historically stable and attractive returns profile of CRE means the asset class can play an important role in a balanced portfolio. Transformation of ageing CRE portfolios, capital expenditures to meet new ESG standards, secular trends, accelerating urbanisation and e-commerce growth provide structural support to the long-term growth potential of certain CRE sectors.

While rising inflation and interest rates will continue to pressure the asset class in the short run, exposure to structurally supported sub-sectors through careful selection of fund structures may still be appropriate for clients with a medium-to-long-term investment horizon.

Jaroslav Machalicky is senior Analyst, EFG Asset Management. The views expressed above should not be taken as investment advice.